- Australia

- /

- Paper and Forestry Products

- /

- ASX:MWY

Can You Imagine How Midway's (ASX:MWY) Shareholders Feel About The 52% Share Price Increase?

The simplest way to invest in stocks is to buy exchange traded funds. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Midway Limited (ASX:MWY) share price is 52% higher than it was a year ago, much better than the market return of around 4.7% (not including dividends) in the same period. That's a solid performance by our standards! We'll need to follow Midway for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for Midway

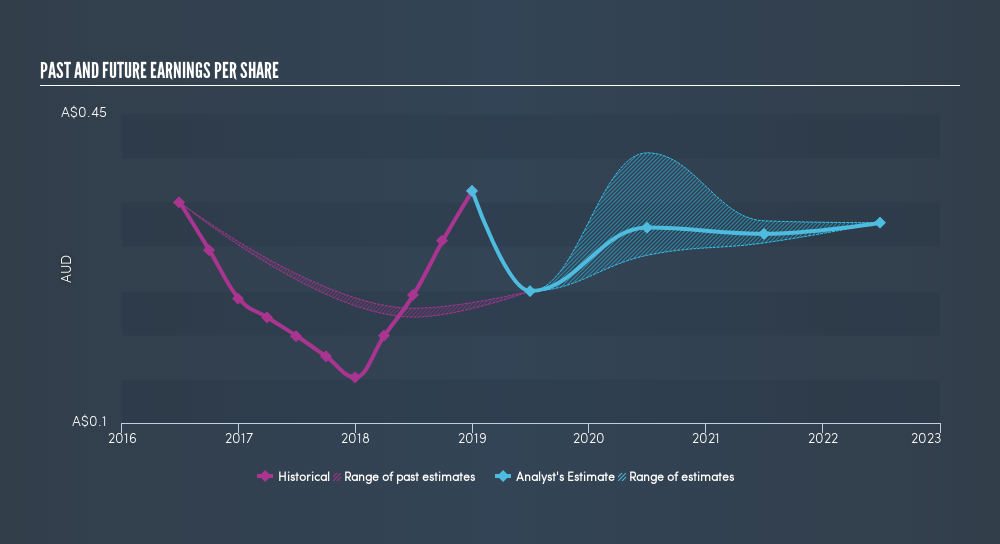

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Midway was able to grow EPS by 139% in the last twelve months. It's fair to say that the share price gain of 52% did not keep pace with the EPS growth. Therefore, it seems the market isn't as excited about Midway as it was before. This could be an opportunity. The caution is also evident in the lowish P/E ratio of 9.92.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Midway has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Midway will grow revenue in the future.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Midway's TSR for the last year was 60%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Midway boasts a total shareholder return of 60% for the last year(that includes the dividends). The more recent returns haven't been as impressive as the longer term returns, coming in at just 0.6%. Having said that, we doubt shareholders would be concerned. It seems the market is simply waiting on more information, because if the business delivers so will the share price (eventually). Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:MWY

Midway

Engages in the production, processing, marketing, and export of woodfibre in Australia, China, Japan, and Southeast Asia.

Flawless balance sheet low.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026