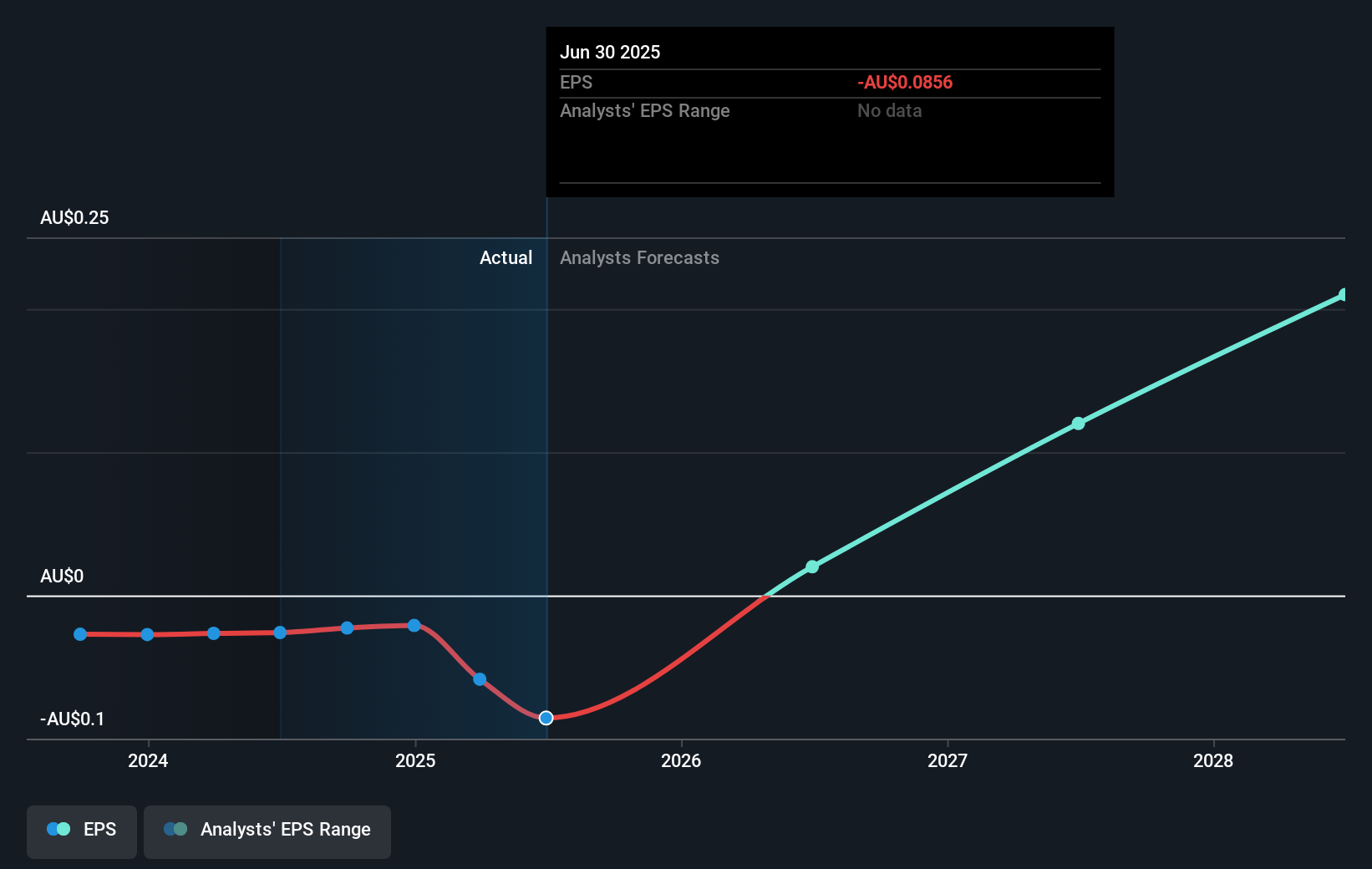

Metallium Limited (ASX:MTM) is possibly approaching a major achievement in its business, so we would like to shine some light on the company. Metallium Limited, through its subsidiaries, explores for mineral tenements in Western Australia and Québec, Canada. On 30 June 2025, the AU$593m market-cap company posted a loss of AU$33m for its most recent financial year. The most pressing concern for investors is Metallium's path to profitability – when will it breakeven? In this article, we will touch on the expectations for the company's growth and when analysts expect it to become profitable.

According to some industry analysts covering Metallium, breakeven is near. They anticipate the company to incur a final loss in 2025, before generating positive profits of AU$9.3m in 2026. Therefore, the company is expected to breakeven roughly a year from now or less! We calculated the rate at which the company must grow to meet the consensus forecasts predicting breakeven within 12 months. It turns out an average annual growth rate of 90% is expected, which signals high confidence from analysts. Should the business grow at a slower rate, it will become profitable at a later date than expected.

Underlying developments driving Metallium's growth isn’t the focus of this broad overview, though, keep in mind that generally a metal and mining business has lumpy cash flows which are contingent on the natural resource mined and stage at which the company is operating. This means that a high growth rate is not unusual, especially if the company is currently in an investment period.

View our latest analysis for Metallium

Before we wrap up, there’s one aspect worth mentioning. The company has managed its capital judiciously, with debt making up 0.0003% of equity. This means that it has predominantly funded its operations from equity capital, and its low debt obligation reduces the risk around investing in the loss-making company.

Next Steps:

There are too many aspects of Metallium to cover in one brief article, but the key fundamentals for the company can all be found in one place – Metallium's company page on Simply Wall St. We've also compiled a list of key aspects you should further research:

- Valuation: What is Metallium worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Metallium is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Metallium’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MTM

Metallium

Through its subsidiaries, explores for mineral tenements in Western Australia and Québec, Canada.

High growth potential with moderate risk.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success