- Australia

- /

- Metals and Mining

- /

- ASX:MRR

MinRex Resources Limited (ASX:MRR) Insiders Increased Their Holdings

We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So shareholders might well want to know whether insiders have been buying or selling shares in MinRex Resources Limited (ASX:MRR).

What Is Insider Selling?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, such insiders must disclose their trading activities, and not trade on inside information.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But it is perfectly logical to keep tabs on what insiders are doing. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

See our latest analysis for MinRex Resources

The Last 12 Months Of Insider Transactions At MinRex Resources

The insider Adam Blumenthal made the biggest insider purchase in the last 12 months. That single transaction was for AU$1.5m worth of shares at a price of AU$0.10 each. That means that even when the share price was higher than AU$0.021 (the recent price), an insider wanted to purchase shares. It's very possible they regret the purchase, but it's more likely they are bullish about the company. To us, it's very important to consider the price insiders pay for shares. It is generally more encouraging if they paid above the current price, as it suggests they saw value, even at higher levels.

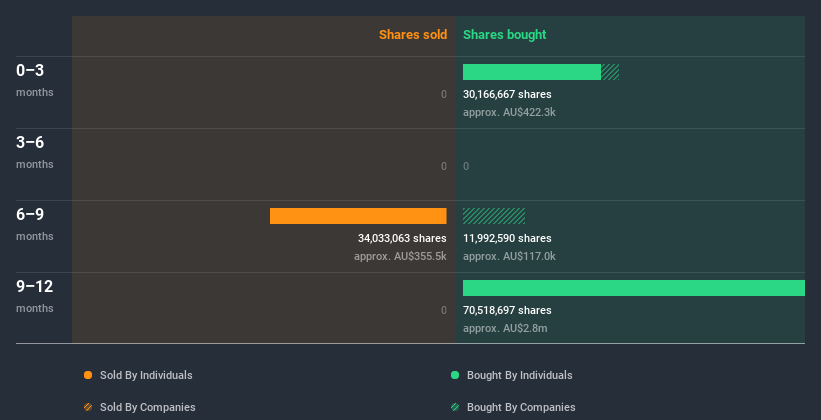

Over the last year, we can see that insiders have bought 97.34m shares worth AU$2.4m. But they sold 34.03m shares for AU$367k. Overall, MinRex Resources insiders were net buyers during the last year. They paid about AU$0.025 on average. This is nice to see since it implies that insiders might see value around current prices. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

MinRex Resources is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

MinRex Resources Insiders Bought Stock Recently

It's good to see that MinRex Resources insiders have made notable investments in the company's shares. Not only was there no selling that we can see, but they collectively bought AU$320k worth of shares. This is a positive in our book as it implies some confidence.

Insider Ownership

Many investors like to check how much of a company is owned by insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. It appears that MinRex Resources insiders own 27% of the company, worth about AU$2.6m. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

What Might The Insider Transactions At MinRex Resources Tell Us?

It's certainly positive to see the recent insider purchases. We also take confidence from the longer term picture of insider transactions. However, we note that the company didn't make a profit over the last twelve months, which makes us cautious. Given that insiders also own a fair bit of MinRex Resources we think they are probably pretty confident of a bright future. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing MinRex Resources. Every company has risks, and we've spotted 5 warning signs for MinRex Resources (of which 4 don't sit too well with us!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading MinRex Resources or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:MRR

MinRex Resources

Engages in the exploration and development of mineral properties.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026