- Australia

- /

- Metals and Mining

- /

- ASX:MRC

Returns On Capital At Mineral Commodities (ASX:MRC) Paint An Interesting Picture

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. However, after investigating Mineral Commodities (ASX:MRC), we don't think it's current trends fit the mold of a multi-bagger.

Return On Capital Employed (ROCE): What is it?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Mineral Commodities is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.19 = US$10m ÷ (US$92m - US$38m) (Based on the trailing twelve months to June 2020).

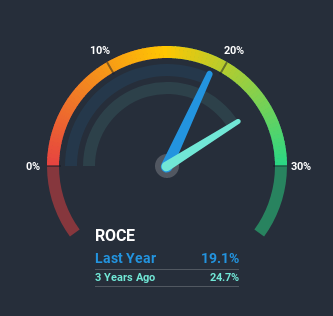

So, Mineral Commodities has an ROCE of 19%. In absolute terms, that's a satisfactory return, but compared to the Metals and Mining industry average of 11% it's much better.

See our latest analysis for Mineral Commodities

In the above chart we have measured Mineral Commodities' prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Mineral Commodities here for free.

What Can We Tell From Mineral Commodities' ROCE Trend?

The trend of ROCE doesn't look fantastic because it's fallen from 25% five years ago, while the business's capital employed increased by 58%. That being said, Mineral Commodities raised some capital prior to their latest results being released, so that could partly explain the increase in capital employed. The funds raised likely haven't been put to work yet so it's worth watching what happens in the future with Mineral Commodities' earnings and if they change as a result from the capital raise.

While on the subject, we noticed that the ratio of current liabilities to total assets has risen to 41%, which has impacted the ROCE. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. And with current liabilities at these levels, suppliers or short-term creditors are effectively funding a large part of the business, which can introduce some risks.What We Can Learn From Mineral Commodities' ROCE

We're a bit apprehensive about Mineral Commodities because despite more capital being deployed in the business, returns on that capital and sales have both fallen. Since the stock has skyrocketed 237% over the last five years, it looks like investors have high expectations of the stock. In any case, the current underlying trends don't bode well for long term performance so unless they reverse, we'd start looking elsewhere.

If you want to know some of the risks facing Mineral Commodities we've found 5 warning signs (2 make us uncomfortable!) that you should be aware of before investing here.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you’re looking to trade Mineral Commodities, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:MRC

Mineral Commodities

Operates as a mining and development company with a primary focus on the development of mineral deposits within the industrial and battery minerals sectors.

Moderate with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026