This article will reflect on the compensation paid to Mark Caruso who has served as CEO of Mineral Commodities Ltd (ASX:MRC) since 2014. This analysis will also assess whether Mineral Commodities pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Mineral Commodities

Comparing Mineral Commodities Ltd's CEO Compensation With the industry

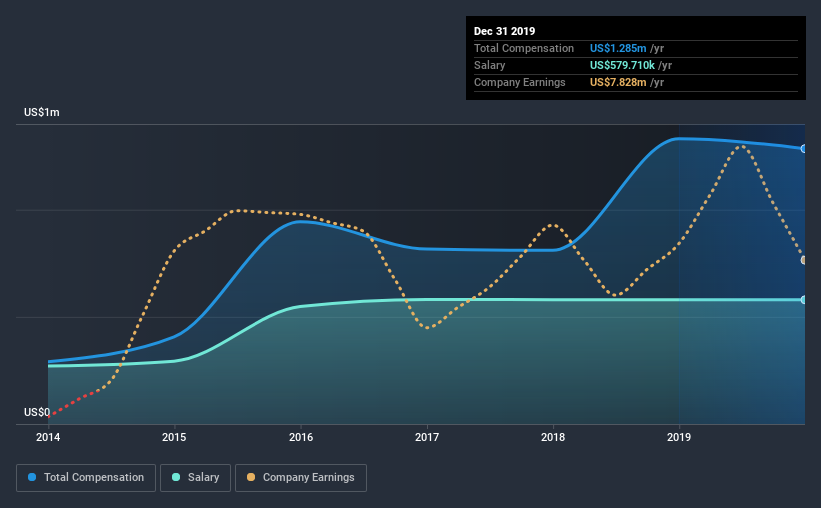

According to our data, Mineral Commodities Ltd has a market capitalization of AU$114m, and paid its CEO total annual compensation worth AU$1.3m over the year to December 2019. That's a slightly lower by 3.5% over the previous year. We think total compensation is more important but our data shows that the CEO salary is lower, at AU$580k.

On comparing similar-sized companies in the industry with market capitalizations below AU$279m, we found that the median total CEO compensation was AU$307k. Hence, we can conclude that Mark Caruso is remunerated higher than the industry median. What's more, Mark Caruso holds AU$391k worth of shares in the company in their own name.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | AU$580k | AU$580k | 45% |

| Other | AU$705k | AU$751k | 55% |

| Total Compensation | AU$1.3m | AU$1.3m | 100% |

Talking in terms of the industry, salary represented approximately 70% of total compensation out of all the companies we analyzed, while other remuneration made up 30% of the pie. Mineral Commodities pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Mineral Commodities Ltd's Growth Numbers

Mineral Commodities Ltd has seen its earnings per share (EPS) increase by 26% a year over the past three years. It achieved revenue growth of 12% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Mineral Commodities Ltd Been A Good Investment?

Most shareholders would probably be pleased with Mineral Commodities Ltd for providing a total return of 131% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

As previously discussed, Mark is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. But earnings growth and shareholder returns have been top-notch for the past three years. As a result of the excellent all-round performance of the company, we believe CEO compensation is fair. Given the strong history of shareholder returns, the shareholders are probably very happy with Mark's performance.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 2 warning signs for Mineral Commodities that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Mineral Commodities or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:MRC

Mineral Commodities

Operates as a mining and development company with a primary focus on the development of mineral deposits within the industrial and battery minerals sectors.

Moderate with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion