It is not uncommon to see companies perform well in the years after insiders buy shares. Unfortunately, there are also plenty of examples of share prices declining precipitously after insiders have sold shares. So before you buy or sell Medusa Mining Limited (ASX:MML), you may well want to know whether insiders have been buying or selling.

Do Insider Transactions Matter?

It is perfectly legal for company insiders, including board members, to buy and sell stock in a company. However, most countries require that the company discloses such transactions to the market.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

See our latest analysis for Medusa Mining

The Last 12 Months Of Insider Transactions At Medusa Mining

In the last twelve months, the biggest single purchase by an insider was when Independent Non-Executive Director Roy Daniel bought AU$160k worth of shares at a price of AU$0.87 per share. That means that an insider was happy to buy shares at above the current price of AU$0.77. It's very possible they regret the purchase, but it's more likely they are bullish about the company. In our view, the price an insider pays for shares is very important. It is generally more encouraging if they paid above the current price, as it suggests they saw value, even at higher levels.

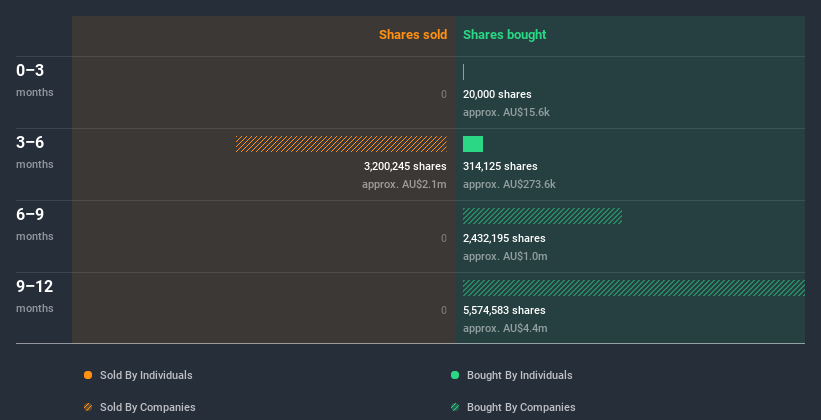

While Medusa Mining insiders bought shares during the last year, they didn't sell. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

There are always plenty of stocks that insiders are buying. So if that suits your style you could check each stock one by one or you could take a look at this free list of companies. (Hint: insiders have been buying them).

Insiders at Medusa Mining Have Bought Stock Recently

Over the last three months, we've seen a bit of insider buying at Medusa Mining. Independent Non Executive Chairman & Interim CEO Boon Teo purchased AU$16k worth of shares in that period. It's great to see that insiders are only buying, not selling. But in this case the amount purchased means the recent transaction may not be very meaningful on its own.

Insider Ownership of Medusa Mining

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Insiders own 5.1% of Medusa Mining shares, worth about AU$8.2m, according to our data. However, it's possible that insiders might have an indirect interest through a more complex structure. Overall, this level of ownership isn't that impressive, but it's certainly better than nothing!

So What Do The Medusa Mining Insider Transactions Indicate?

Our data shows a little insider buying, but no selling, in the last three months. That said, the purchases were not large. However, our analysis of transactions over the last year is heartening. While we have no worries about the insider transactions, we'd be more comfortable if they owned more Medusa Mining stock. I like to dive deeper into how a company has performed in the past. You can find historic revenue and earnings in this detailed graph.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Medusa Mining or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Ten Sixty Four might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:X64

Ten Sixty Four

Engages in the exploration, evaluation, development, production, and sale of mineral properties in the Asia Pacific.

Flawless balance sheet medium.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success