- Australia

- /

- Metals and Mining

- /

- ASX:MLG

Investors Still Aren't Entirely Convinced By MLG Oz Limited's (ASX:MLG) Earnings Despite 26% Price Jump

MLG Oz Limited (ASX:MLG) shareholders have had their patience rewarded with a 26% share price jump in the last month. Taking a wider view, although not as strong as the last month, the full year gain of 14% is also fairly reasonable.

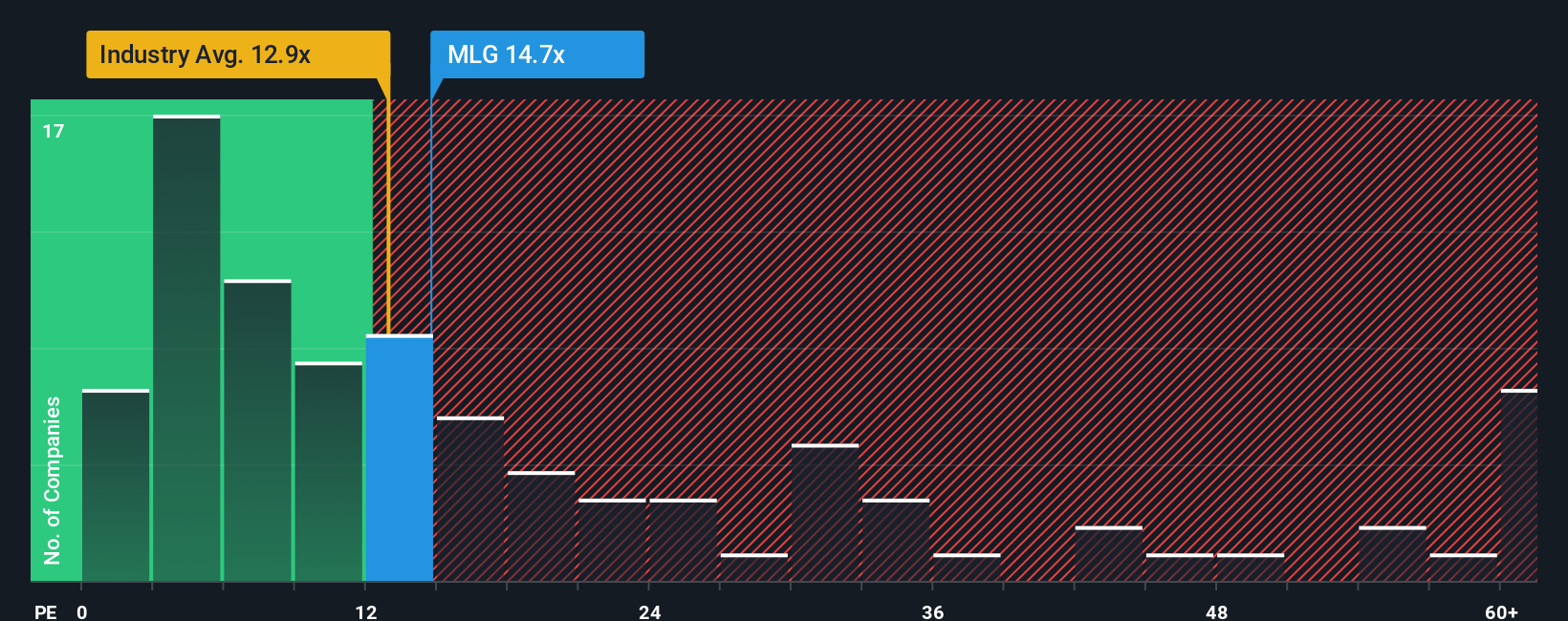

In spite of the firm bounce in price, MLG Oz may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 14.7x, since almost half of all companies in Australia have P/E ratios greater than 18x and even P/E's higher than 34x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been advantageous for MLG Oz as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for MLG Oz

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as MLG Oz's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 47% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 3.6% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 44% each year during the coming three years according to the lone analyst following the company. That's shaping up to be materially higher than the 15% per annum growth forecast for the broader market.

With this information, we find it odd that MLG Oz is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

The latest share price surge wasn't enough to lift MLG Oz's P/E close to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that MLG Oz currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Having said that, be aware MLG Oz is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MLG

MLG Oz

Provides mine site and supply chain solutions in Western Australia and the Northern Territory.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success