- Australia

- /

- Metals and Mining

- /

- ASX:MIN

A Look at Mineral Resources (ASX:MIN) Valuation After Record Iron Ore Output and $200m Project Payment

Reviewed by Simply Wall St

Mineral Resources (ASX:MIN) hit record iron ore output in the September quarter as its Onslow project reached full capacity. This triggered a $200 million payment and helped strengthen sentiment around the company.

See our latest analysis for Mineral Resources.

After a rocky first half of the year, Mineral Resources is now riding a clear wave of positive momentum. Strong operational results and record iron ore output have propelled the stock to a 22.3% 1-month share price return, while its total shareholder return over the past year sits at an impressive 19%. That renewed confidence is drawing attention, especially as the recent quarterly update has shifted the conversation toward growth potential.

If this turnaround has you thinking about where momentum is building next, it might be worth broadening your search and discovering fast growing stocks with high insider ownership

The question now is whether Mineral Resources’ recent momentum has created an undervalued opportunity or if the market has already priced in its growth story, which could make further upside limited for new investors.

Most Popular Narrative: 29% Overvalued

Mineral Resources’ current share price of A$48.40 stands well above the narrative's estimated fair value, suggesting sentiment is running hotter than what analysts’ models support. The narrative here hinges on future growth and recovery, but cautions that the current valuation leaves little room for disappointment and relies on ambitious performance improvements.

Ongoing investments in infrastructure, logistics (haul roads, transshippers), and automation are already driving operational efficiencies and enabling margin expansion in Mining Services. Future benefits are expected to accrue as volumes increase and cost per tonne decreases, supporting earnings and net margin growth.

What undisclosed financial assumptions are powering this bold valuation stance? One number could flip the whole growth story upside down. Intrigued which profit and efficiency projections are behind this debate? Dive in for the details that shape this hotly contested fair value.

Result: Fair Value of $37.51 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy capital spending and volatile commodity prices remain key risks that could quickly alter the bullish outlook for Mineral Resources.

Find out about the key risks to this Mineral Resources narrative.

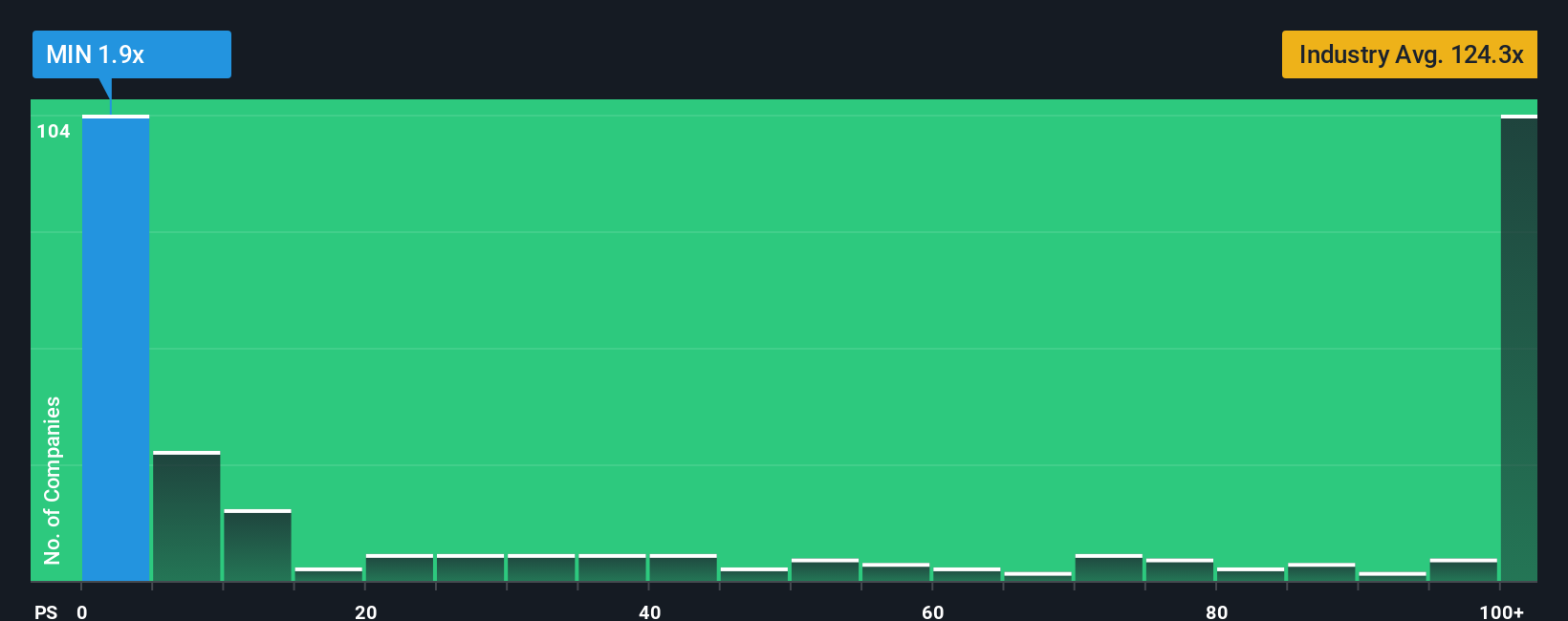

Another View: Market Multiples Tell a Different Story

While the analyst consensus points to Mineral Resources trading above its estimated fair value, our look at its price-to-sales ratio offers a twist. At 2.1x, it is much lower than peers (6.1x) and the industry norm (121.3x). The fair ratio sits even higher at 23.4x, which could mean the market is underestimating the company's near-term potential or overlooking key risks. So, are the multiples signalling a hidden opportunity, or could future shifts push the ratio closer to consensus fair value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mineral Resources Narrative

If you see things differently or want to dig into the numbers yourself, it only takes a few minutes to frame your own perspective. Do it your way

A great starting point for your Mineral Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Don’t let the market race ahead while you miss out on other bold ways to diversify and grow your wealth. See what could be next for your portfolio, and take action while top market trends are still unfolding.

- Spot long-term winners by checking out these 24 dividend stocks with yields > 3%, featuring stable yields greater than 3% for reliable returns in any market.

- Uncover the most promising breakthroughs in medicine when you browse these 34 healthcare AI stocks, a resource highlighting companies transforming the healthcare landscape with next-gen artificial intelligence.

- Capitalize on new trends by exploring these 3574 penny stocks with strong financials, where under-the-radar companies could offer outsized growth potential before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MIN

Mineral Resources

Together with subsidiaries, provides mining services in Australia, Asia, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives