- Australia

- /

- Capital Markets

- /

- ASX:PNI

3 Growth Companies On The ASX With Up To 31% Insider Ownership

Reviewed by Simply Wall St

In the last week, the Australian market has stayed flat, with notable gains in the Real Estate sector at 3.3%. As the market is up 11% over the past year and earnings are forecast to grow by 12% annually, identifying growth companies with high insider ownership can be a promising strategy for investors looking to capitalize on these trends.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Emerald Resources (ASX:EMR) | 18.4% | 30.1% |

| Catalyst Metals (ASX:CYL) | 17% | 61.8% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Pointerra (ASX:3DP) | 18.7% | 126.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 69.7% |

| Acrux (ASX:ACR) | 14.6% | 91.6% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.5% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Underneath we present a selection of stocks filtered out by our screen.

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mineral Resources Limited, with a market cap of A$7.41 billion, operates as a mining services company in Australia, Asia, and internationally through its subsidiaries.

Operations: Mineral Resources Limited generates revenue primarily from Mining Services (A$3.38 billion), Iron Ore (A$2.58 billion), Lithium (A$1.41 billion), Energy (A$16 million), and Other Commodities (A$19 million).

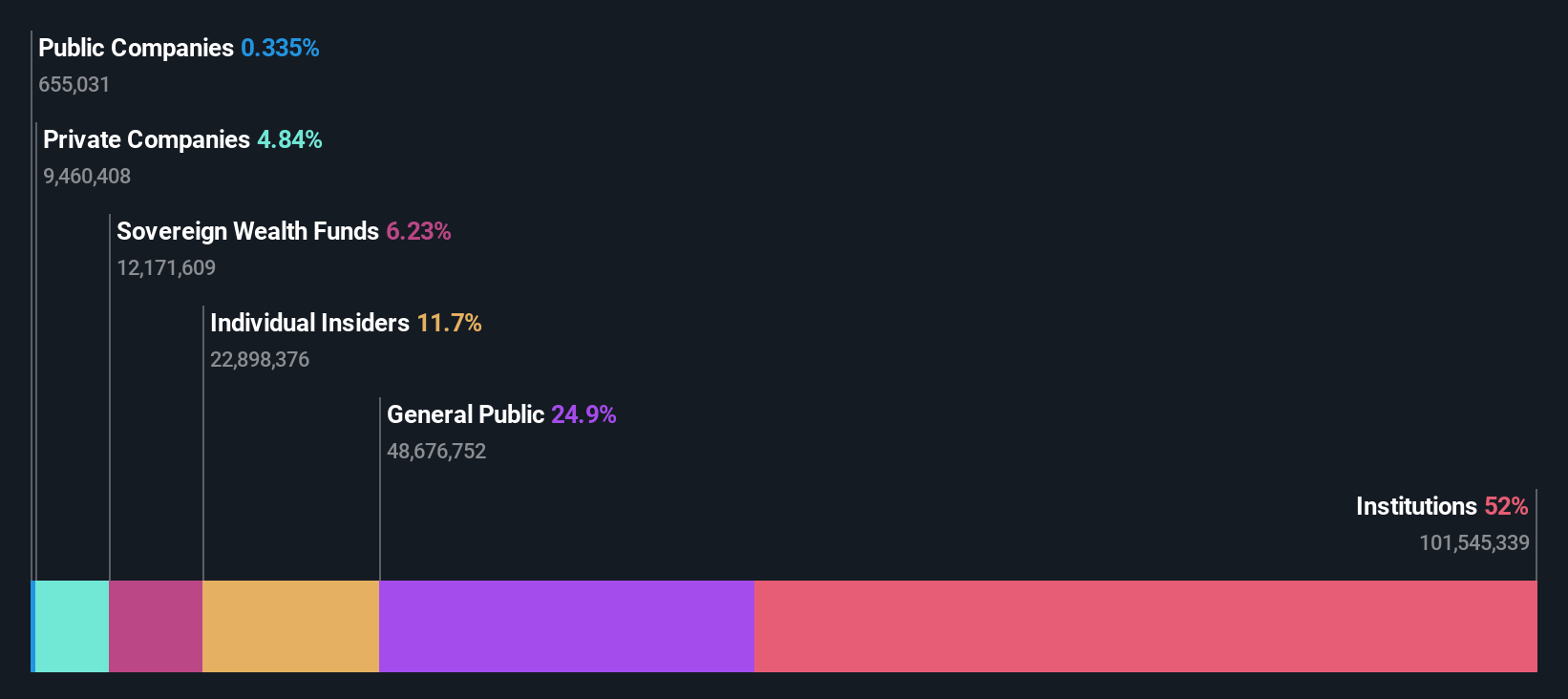

Insider Ownership: 11.7%

Mineral Resources Limited shows strong growth potential with insider ownership remaining stable. Despite a dip in net income to A$125 million for FY2024, earnings are forecasted to grow significantly at 38.7% annually over the next three years. Revenue is expected to increase by 7.3% per year, outpacing the Australian market's 5.3%. However, profit margins have declined from 5.1% to 2.4%, and interest payments are not well covered by earnings, indicating some financial challenges ahead.

- Click to explore a detailed breakdown of our findings in Mineral Resources' earnings growth report.

- The valuation report we've compiled suggests that Mineral Resources' current price could be inflated.

Pinnacle Investment Management Group (ASX:PNI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pinnacle Investment Management Group Limited is an Australian investment management company with a market cap of A$3.36 billion.

Operations: Pinnacle generates revenue primarily from its Funds Management Operations, amounting to A$48.99 million.

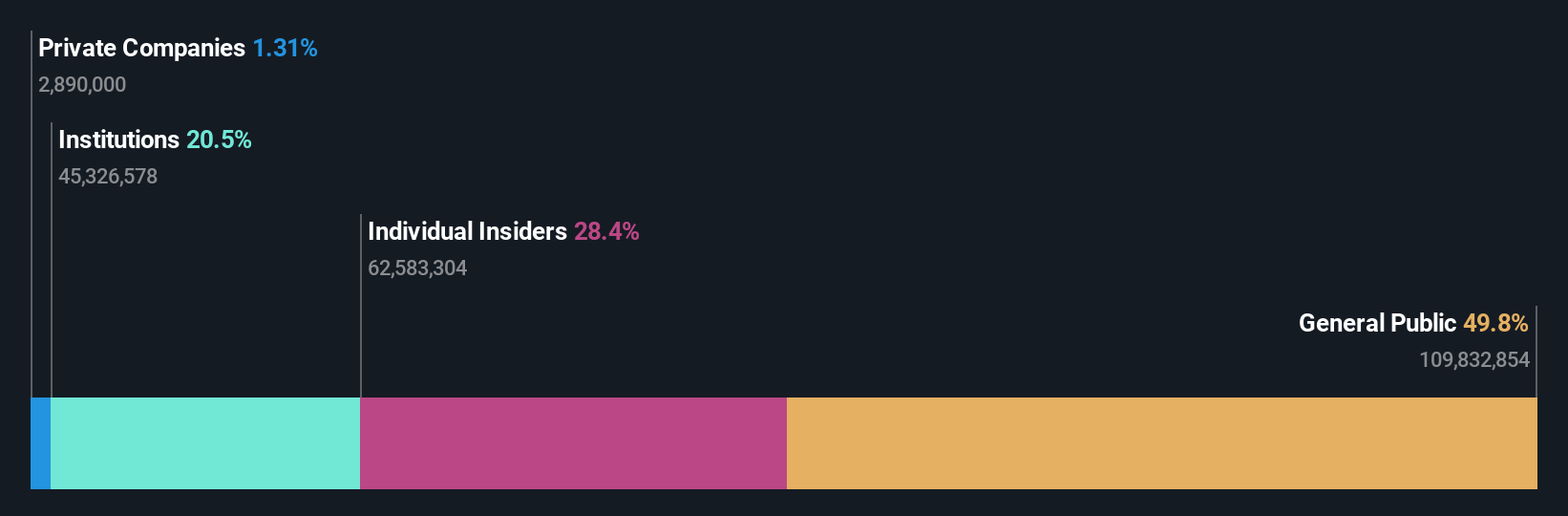

Insider Ownership: 31.5%

Pinnacle Investment Management Group's revenue is forecast to grow at 13.7% per year, faster than the Australian market's 5.3%. Earnings are expected to increase by 14.4% annually, outpacing the market's 12.2%. The company reported a net income rise from A$76.47 million to A$90.35 million for FY2024 and appointed Christina Lenard as Director in August 2024, reflecting strategic leadership changes amidst steady growth prospects and high insider ownership.

- Get an in-depth perspective on Pinnacle Investment Management Group's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Pinnacle Investment Management Group is priced higher than what may be justified by its financials.

PolyNovo (ASX:PNV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices in the United States, Australia, New Zealand, and internationally with a market cap of A$1.75 billion.

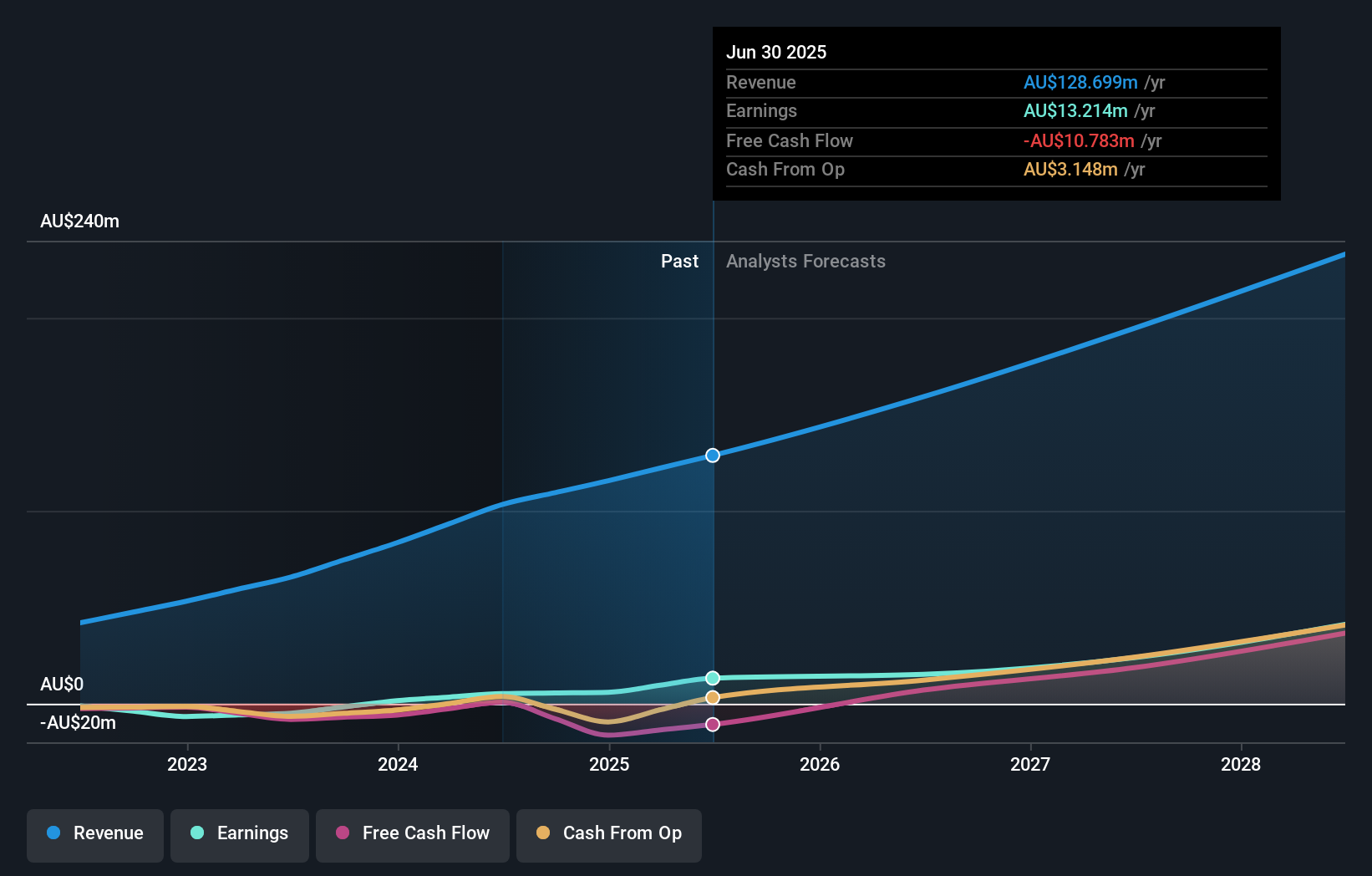

Operations: The company's revenue from the development, manufacturing, and commercialization of the NovoSorb technology is A$103.23 million.

Insider Ownership: 10.3%

PolyNovo's revenue is forecast to grow at 17.5% annually, faster than the Australian market's 5.3%. Earnings are expected to rise by 38.3% per year, significantly outpacing the market's 12.2%. The company reported FY2024 revenue of A$104.76 million and net income of A$5.26 million, marking a turnaround from a loss last year, reflecting strong growth potential and substantial insider ownership amidst strategic expansions like the collaboration with Spectral AI for burn treatments in Australia.

- Unlock comprehensive insights into our analysis of PolyNovo stock in this growth report.

- Our valuation report here indicates PolyNovo may be overvalued.

Next Steps

- Investigate our full lineup of 96 Fast Growing ASX Companies With High Insider Ownership right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PNI

Pinnacle Investment Management Group

Operates as an investment management company in Australia.

Solid track record with reasonable growth potential.