3 ASX Growth Companies With High Insider Ownership And Up To 60% Earnings Growth

Reviewed by Simply Wall St

As the ASX200 edges up by approximately 0.6% to 8,198 points amidst mixed sector performances and lower trading volumes due to the Labour Day holiday in some states, investors are closely monitoring global events such as the conflict in the Middle East. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those who know the company best and may offer robust earnings potential even amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17% | 54.5% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 71.5% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Pointerra (ASX:3DP) | 20.1% | 126.4% |

| Liontown Resources (ASX:LTR) | 14.7% | 49.8% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Here we highlight a subset of our preferred stocks from the screener.

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

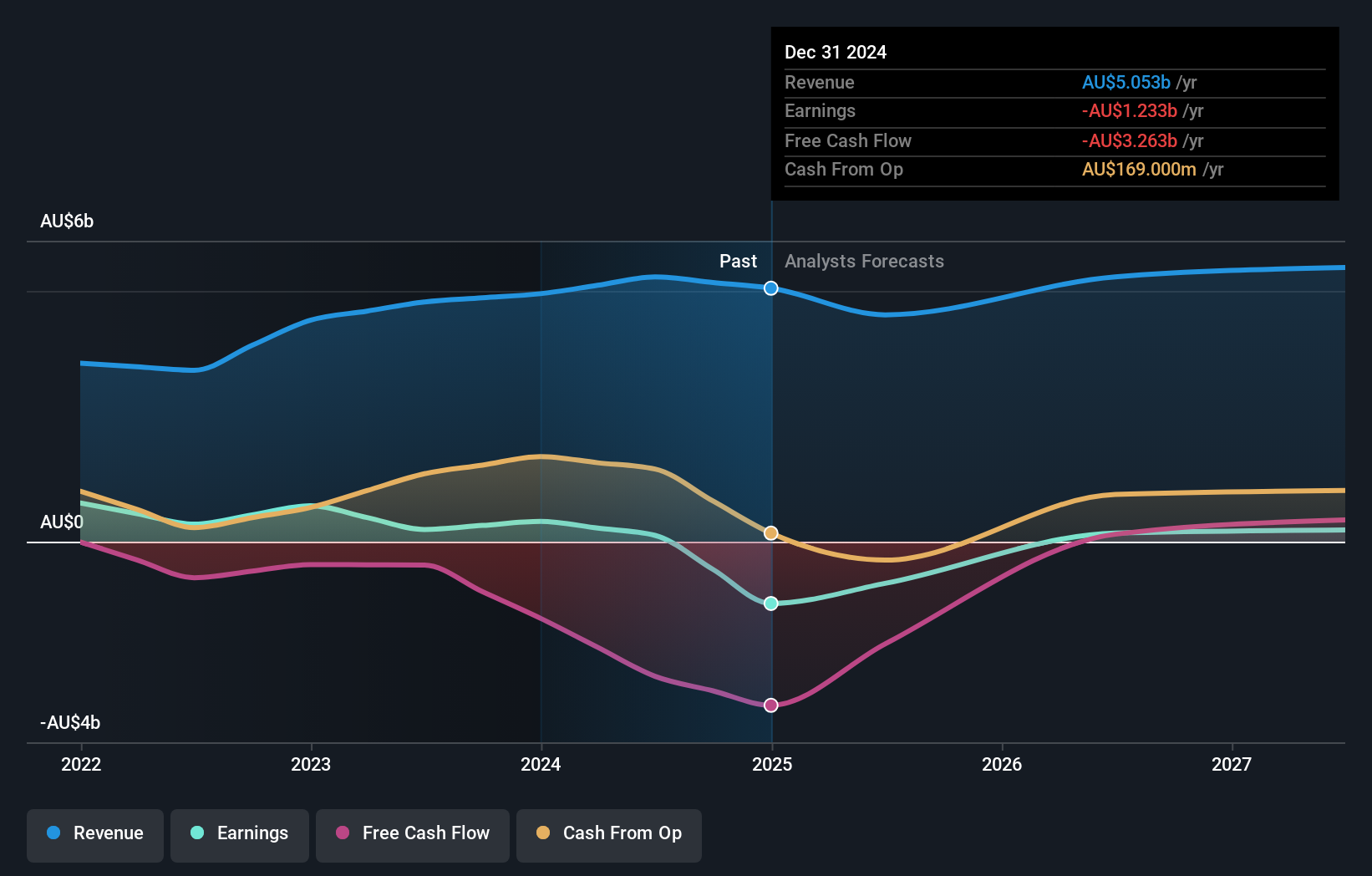

Overview: Mineral Resources Limited operates as a mining services company with operations in Australia, Asia, and internationally, and has a market cap of approximately A$9.94 billion.

Operations: The company's revenue segments consist of A$0.02 million from Energy, A$1.41 billion from Lithium, A$2.58 billion from Iron Ore, and A$3.38 billion from Mining Services, along with A$0.02 million from Other Commodities.

Insider Ownership: 11.7%

Earnings Growth Forecast: 38.3% p.a.

Mineral Resources, with substantial insider ownership, is navigating financial challenges while pursuing growth. Recent M&A discussions for its Perth Basin assets aim to bolster its balance sheet, following a significant A$1.3 billion asset sale in June. Despite net income decline to A$125 million and increased debt pressures, the company forecasts earnings growth of 38.3% annually over three years, outpacing the Australian market's average. Insider buying activity suggests confidence in future prospects amidst strategic asset evaluations.

- Take a closer look at Mineral Resources' potential here in our earnings growth report.

- Our expertly prepared valuation report Mineral Resources implies its share price may be too high.

Mesoblast (ASX:MSB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mesoblast Limited is involved in the development of regenerative medicine products across Australia, the United States, Singapore, and Switzerland, with a market cap of A$1.70 billion.

Operations: The company's revenue segment primarily focuses on the development of a cell technology platform for commercialization, generating $5.90 million.

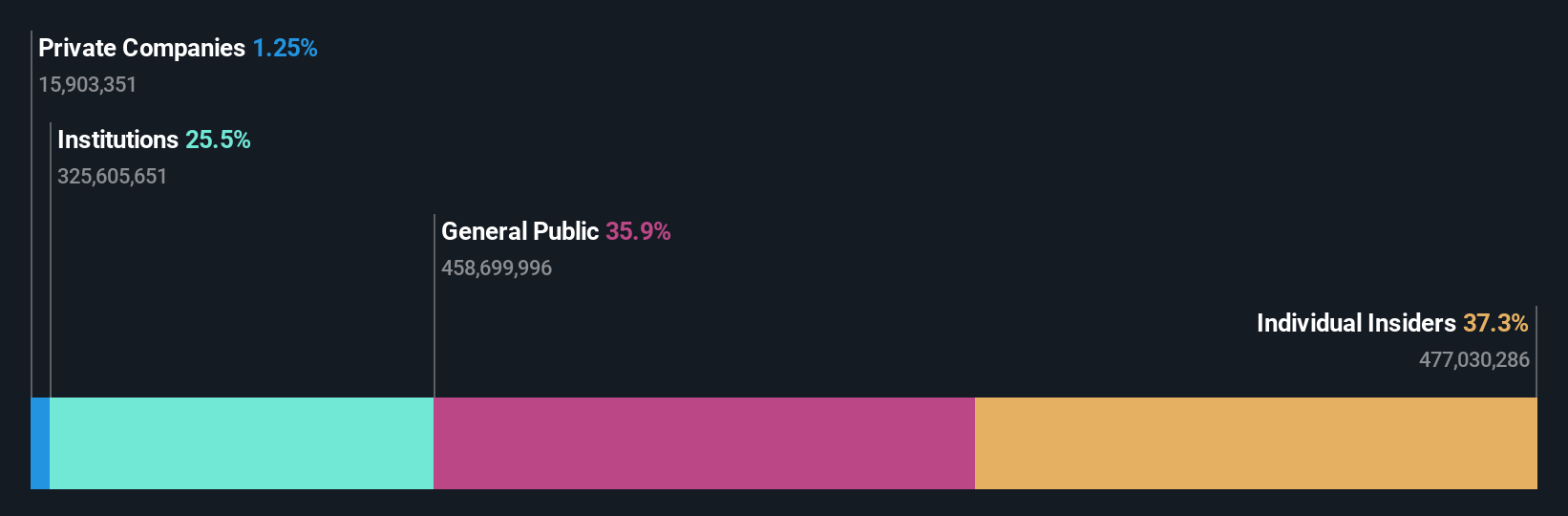

Insider Ownership: 22.2%

Earnings Growth Forecast: 60.8% p.a.

Mesoblast, with significant insider ownership and recent buying activity, is poised for growth despite financial hurdles. The company forecasts high revenue growth of 45.8% annually, surpassing market averages, and aims for profitability within three years. Recent FDA acceptance of its resubmitted Biologics License Application for Ryoncil in treating pediatric SR-aGVHD highlights potential product advancements. However, challenges include a net loss of US$87.96 million last year and limited cash runway under one year.

- Navigate through the intricacies of Mesoblast with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Mesoblast's share price might be on the cheaper side.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions both in Australia and internationally with a market cap of A$7.90 billion.

Operations: The company's revenue is derived from three primary segments: Software (A$317.24 million), Corporate (A$83.83 million), and Consulting (A$68.13 million).

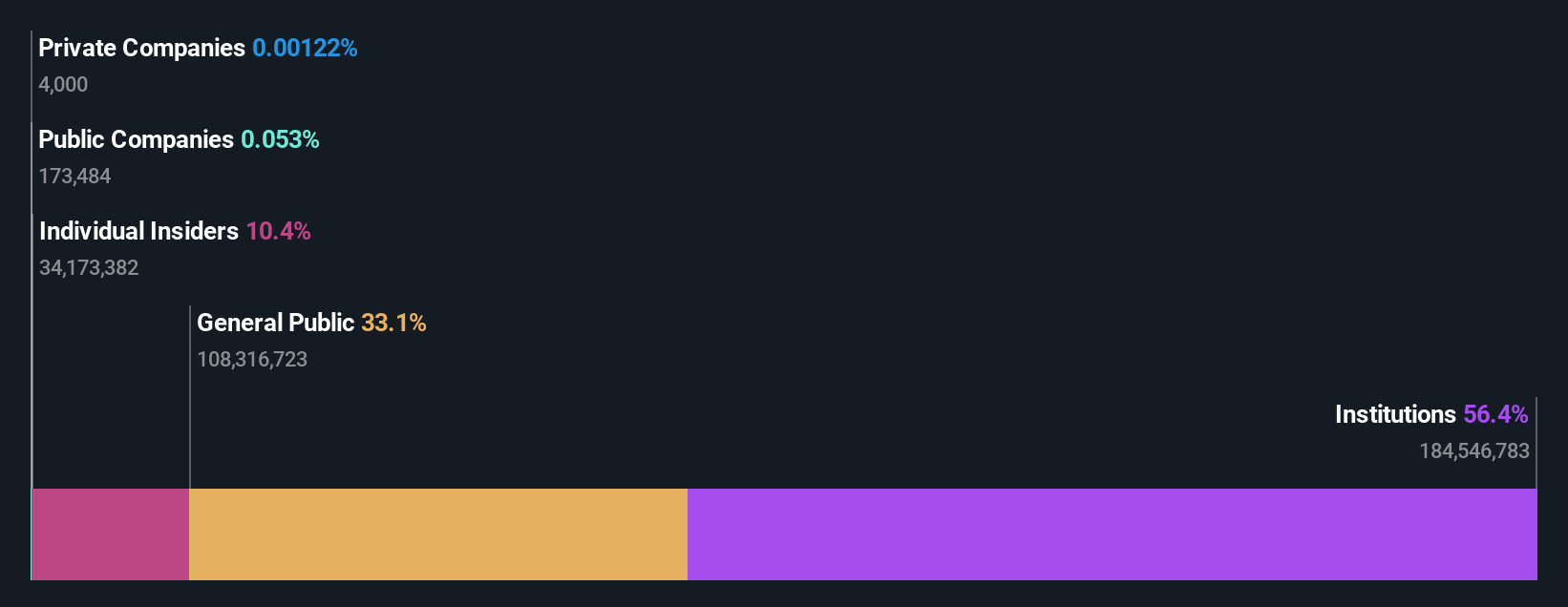

Insider Ownership: 12.3%

Earnings Growth Forecast: 13.6% p.a.

Technology One, with substantial insider ownership, is trading below its estimated fair value by 3.7%, indicating potential investment appeal. The company forecasts earnings growth of 13.6% annually, outpacing the Australian market's average of 12.2%. Revenue growth is also expected at 10.8% per year, higher than the market's 5.5%. Despite no significant recent insider trading activity, Technology One's high forecasted return on equity of 32.7% in three years underscores its robust financial outlook.

- Get an in-depth perspective on Technology One's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Technology One's shares may be trading at a premium.

Key Takeaways

- Delve into our full catalog of 98 Fast Growing ASX Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Technology One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TNE

Technology One

Develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally.

Flawless balance sheet with reasonable growth potential.