- Australia

- /

- Metals and Mining

- /

- ASX:MI6

Cardno Leads The Pack Of 3 ASX Penny Stocks To Consider

Reviewed by Simply Wall St

The Australian stock market has recently seen a mixed performance, with the ASX200 down 1% at 8,084 points. While sectors like Discretionary and Financials have struggled, Utilities and Energy have shown resilience, highlighting the complex dynamics investors face today. In this context, penny stocks—often smaller or newer companies—can still present unique opportunities for growth when backed by strong financials. We'll explore three such stocks that stand out for their financial strength and potential to offer both stability and upside in a challenging market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.79 | A$99.02M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.84 | A$235.47M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.92 | A$312.61M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.495 | A$306.97M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.575 | A$771.88M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.92 | A$134.78M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$190.52M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.78 | A$99.85M | ★★★★★★ |

Click here to see the full list of 1,052 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Cardno (ASX:CDD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cardno Limited (ASX:CDD) is a professional environmental services company focused on developing and improving social infrastructure in Ecuador and Peru, with a market cap of A$7.81 million.

Operations: Cardno's revenue segment in Latin America amounts to A$15.13 million.

Market Cap: A$7.81M

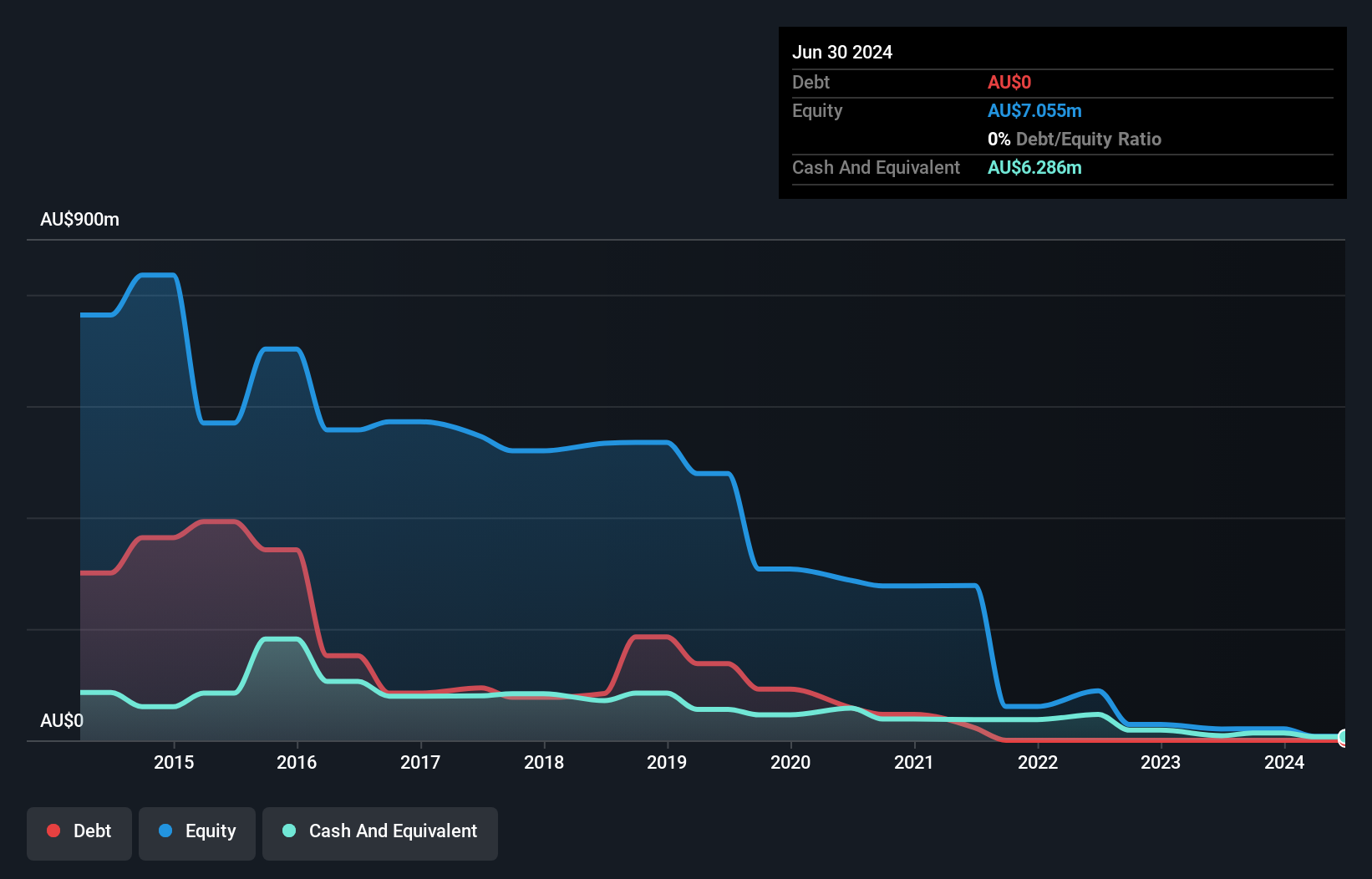

Cardno Limited, with a market cap of A$7.81 million, has become profitable in the past year and boasts an outstanding Return on Equity at 106.9%. The company's short-term assets of A$8.8 million comfortably cover both its short-term liabilities of A$1.8 million and long-term liabilities of A$451,000, while it operates debt-free. Despite its high level of non-cash earnings and stable weekly volatility over the past year, Cardno's share price has been highly volatile recently. Trading significantly below estimated fair value suggests potential for revaluation if financial stability continues to improve. Recent events include an AGM discussing potential delisting from ASX.

- Navigate through the intricacies of Cardno with our comprehensive balance sheet health report here.

- Learn about Cardno's historical performance here.

Central Petroleum (ASX:CTP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Central Petroleum Limited is an Australian company involved in the development, production, processing, and marketing of hydrocarbons with a market cap of A$38.75 million.

Operations: Central Petroleum's revenue is primarily generated from its producing assets, amounting to A$37.15 million.

Market Cap: A$38.75M

Central Petroleum Limited, with a market cap of A$38.75 million, has recently achieved profitability and demonstrates strong financial attributes for a penny stock. It trades significantly below its estimated fair value and maintains a high Return on Equity at 38.2%. The company's short-term assets (A$34.2M) surpass its short-term liabilities (A$18.2M), though they fall short of covering long-term liabilities (A$52.9M). Despite this, Central Petroleum's debt is well-covered by operating cash flow, and it holds more cash than total debt. The experienced management team further supports stability as the company prepares to report Q1 2025 results shortly.

- Take a closer look at Central Petroleum's potential here in our financial health report.

- Assess Central Petroleum's future earnings estimates with our detailed growth reports.

Minerals 260 (ASX:MI6)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Minerals 260 Limited focuses on the exploration and evaluation of mineral resources in Australia, with a market cap of A$30.42 million.

Operations: Minerals 260 Limited has not reported any revenue segments.

Market Cap: A$30.42M

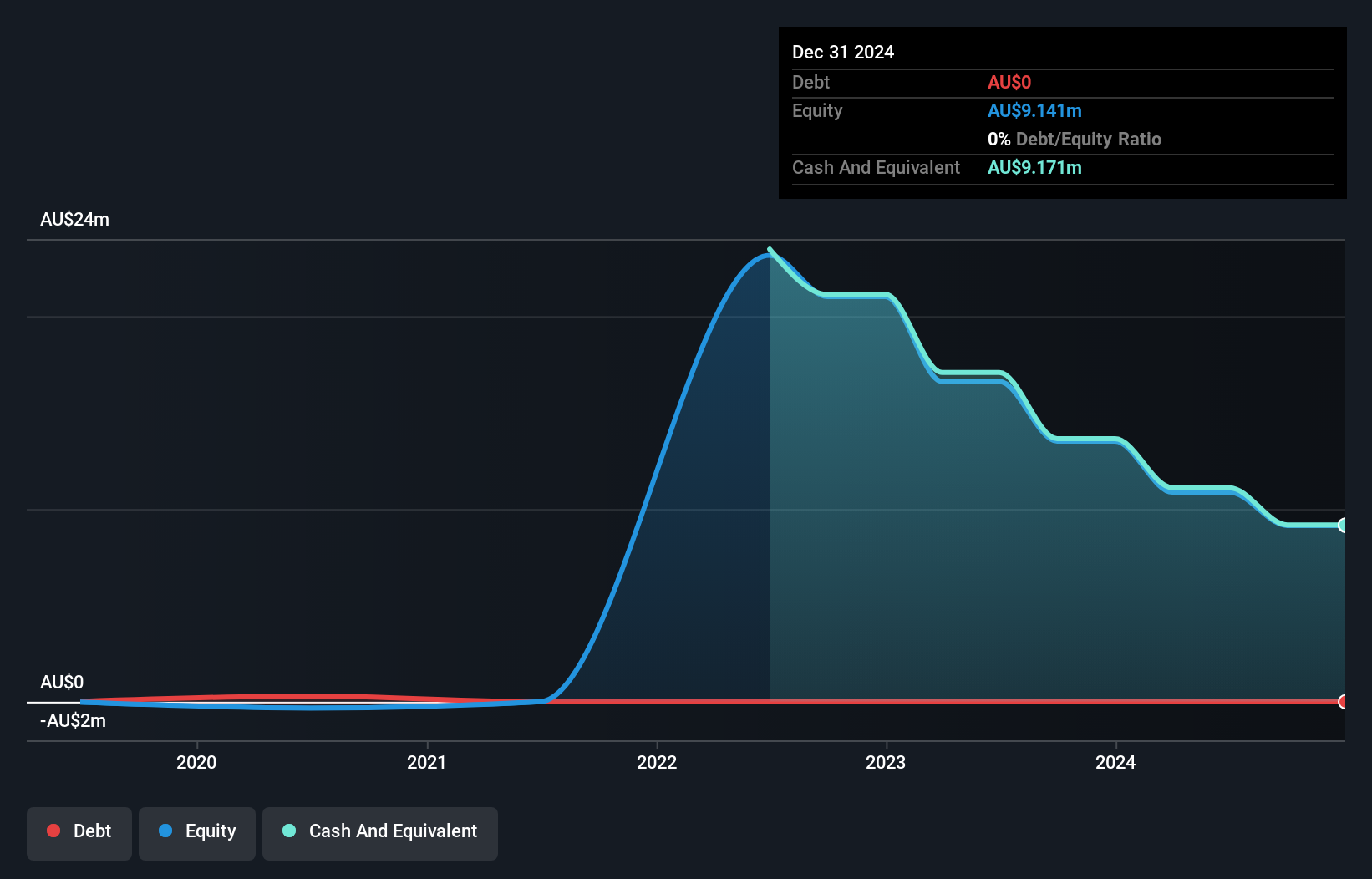

Minerals 260 Limited, with a market cap of A$30.42 million, is pre-revenue and currently unprofitable, reporting a net loss of A$7.71 million for the year ended June 2024. The company remains debt-free and has sufficient cash runway for over a year based on current free cash flow trends. Recent executive changes include the appointment of Mr. Jamie Armes as CFO and Company Secretary, alongside Ms Stacey Apostolou joining as Non-Executive Director, enhancing leadership with extensive industry experience. Despite challenges in profitability, Minerals 260's short-term assets significantly exceed both its short-term and long-term liabilities.

- Get an in-depth perspective on Minerals 260's performance by reading our balance sheet health report here.

- Evaluate Minerals 260's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Click here to access our complete index of 1,052 ASX Penny Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MI6

Minerals 260

Engages in the exploration and evaluation of mineral resources in Australia.

Flawless balance sheet low.

Market Insights

Community Narratives