- Australia

- /

- Metals and Mining

- /

- ASX:MI6

A Look at Minerals 260 (ASX:MI6) Valuation Following Bullabulling Gold Drilling Results and Share Price Surge

Reviewed by Kshitija Bhandaru

Minerals 260 (ASX:MI6) has released strong drilling results at its Bullabulling Gold Project, hinting at a potential resource upgrade. These findings have sparked renewed investor interest and have driven the company’s share price higher over the past month.

See our latest analysis for Minerals 260.

This surge in investor confidence has translated into remarkable share price momentum for Minerals 260, with a 178% share price return so far this year and a 128% total shareholder return over the past twelve months. While recent drilling updates are a clear catalyst, the long-term track record remains modest. However, momentum is clearly building as the company advances its key gold project.

If you’re curious about what other fast-moving companies are catching investor attention this year, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares already up more than 170% this year and a new resource update on the horizon, investors may be wondering if this is the start of a bigger re-rating or if future growth is already fully priced in.

Price-to-Book of 3.1x: Is it justified?

Minerals 260 trades at a price-to-book ratio of 3.1x, placing its valuation above much of its local industry. As of the last close at A$0.32, this signals investors have priced in notably higher expectations than the typical Australian Metals and Mining company.

The price-to-book ratio compares the company’s market value to the value of its net assets on the balance sheet. In mining, this multiple is important because it can reveal how much investors are willing to pay for each dollar of resource potential, real assets, or potential discoveries before profitability arrives.

Paying a premium multiple can indicate that the market believes the company is positioned for significant asset growth or operational improvements. However, it can also signal an overvaluation if these expectations do not materialize.

Minerals 260’s current level far exceeds the industry average of 2.2x, making its premium status clear. In contrast, it appears undervalued versus its peer average of 21.2x, adding a layer of complexity to the valuation picture. Understanding what justifies these differences is key for investors considering long-term exposure.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 3.1x (OVERVALUED)

However, continued momentum depends on successful resource upgrades and the ability to overcome operational losses. Both factors could quickly shift investor sentiment going forward.

Find out about the key risks to this Minerals 260 narrative.

Another View: Discounted Cash Flow Tells a Different Story

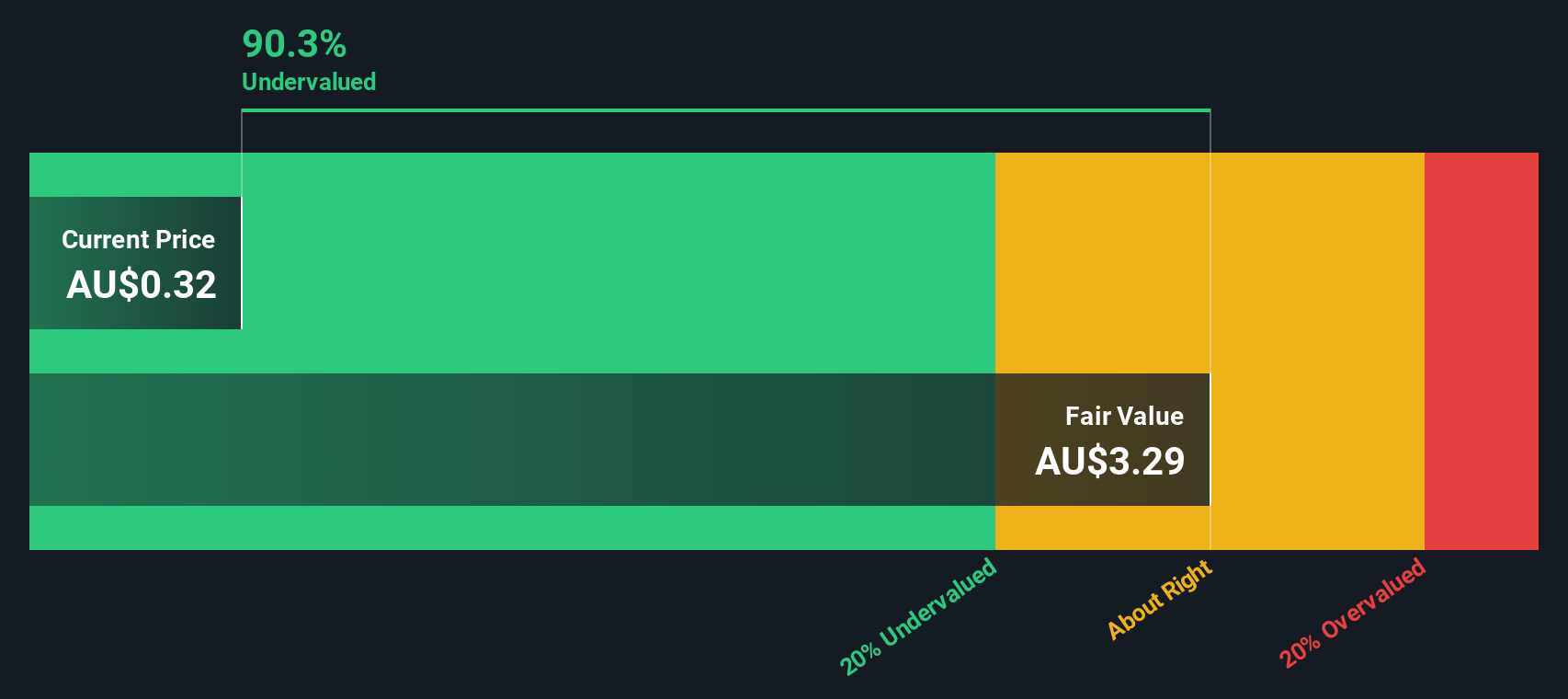

While the market sees Minerals 260 as richly valued based on its price-to-book ratio, our DCF model suggests something strikingly different. The SWS DCF model estimates fair value at A$3.27, which is over 900% above the current price. This implies the stock could be heavily undervalued on long-term fundamentals. Could the market be missing something vital?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Minerals 260 for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Minerals 260 Narrative

If you’re keen to dig deeper and shape your own perspective, it’s quick and easy to explore the numbers yourself and develop a personal take on Minerals 260, all in just a few minutes. Do it your way

A great starting point for your Minerals 260 research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Ready to uncover tomorrow’s winners? Take action and expand your portfolio by exploring handpicked investment opportunities that could put you ahead of the curve.

- Boost your returns by tapping into these 19 dividend stocks with yields > 3% offering high yields and reliable income streams for your portfolio.

- Ride the wave of artificial intelligence breakthroughs through these 24 AI penny stocks and find companies transforming industries with cutting-edge AI solutions.

- Seize opportunities among these 898 undervalued stocks based on cash flows and spot stocks trading at compelling valuations before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MI6

Minerals 260

Engages in the exploration and evaluation of mineral resources in Australia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success