- Australia

- /

- Metals and Mining

- /

- ASX:MGL

It Looks Like Magontec Limited's (ASX:MGL) CEO May Expect Their Salary To Be Put Under The Microscope

Shareholders will probably not be too impressed with the underwhelming results at Magontec Limited (ASX:MGL) recently. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 25 May 2021. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. From our analysis, we think CEO compensation may need a review in light of the recent performance.

View our latest analysis for Magontec

How Does Total Compensation For Nick Andrews Compare With Other Companies In The Industry?

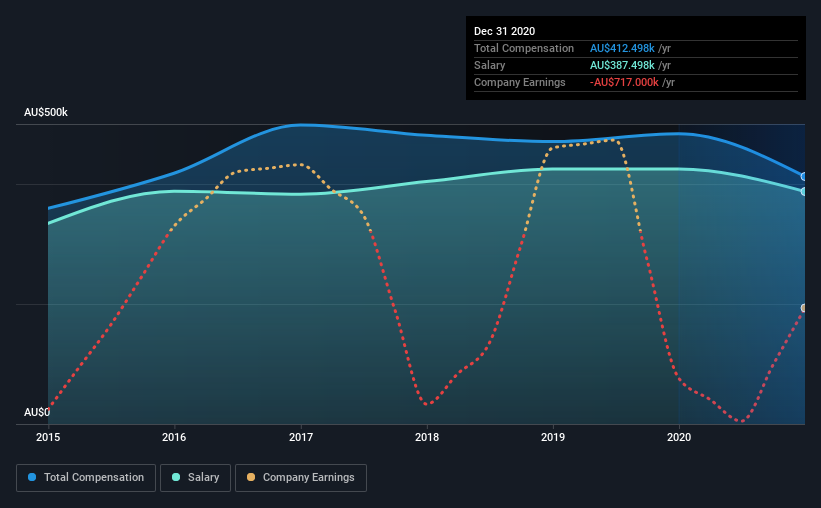

At the time of writing, our data shows that Magontec Limited has a market capitalization of AU$23m, and reported total annual CEO compensation of AU$412k for the year to December 2020. Notably, that's a decrease of 15% over the year before. We note that the salary portion, which stands at AU$387.5k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below AU$258m, we found that the median total CEO compensation was AU$305k. This suggests that Nick Andrews is paid more than the median for the industry. What's more, Nick Andrews holds AU$448k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$387k | AU$425k | 94% |

| Other | AU$25k | AU$59k | 6% |

| Total Compensation | AU$412k | AU$484k | 100% |

Speaking on an industry level, nearly 69% of total compensation represents salary, while the remainder of 31% is other remuneration. Magontec is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Magontec Limited's Growth

Over the last three years, Magontec Limited has shrunk its earnings per share by 14% per year. It saw its revenue drop 27% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Magontec Limited Been A Good Investment?

Given the total shareholder loss of 29% over three years, many shareholders in Magontec Limited are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 3 warning signs for Magontec (1 is a bit concerning!) that you should be aware of before investing here.

Switching gears from Magontec, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Magontec, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:MGL

Magontec

Researches, develops, manufactures, and sells generic and specialist magnesium alloys in Australia, Europe, China, North America, and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026