- Australia

- /

- Metals and Mining

- /

- ASX:MGL

3 ASX Penny Stocks With Market Caps Under A$300M To Consider

Reviewed by Simply Wall St

The ASX 200 index is poised to open higher, marking a potential fourth consecutive day of gains, despite challenges in the iron ore sector and mixed signals from global markets. In such a fluctuating market landscape, investors may find opportunities in lesser-known stocks that offer unique value propositions. Penny stocks, often representing smaller or newer companies with strong financial foundations, can present intriguing investment opportunities.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.54 | A$334.88M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$1.96 | A$109.9M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.09 | A$340.29M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.88 | A$238.78M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$226.38M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.285 | A$109.71M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.68 | A$823.33M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.98 | A$491.35M | ★★★★☆☆ |

Click here to see the full list of 1,050 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Magontec (ASX:MGL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Magontec Limited researches, develops, manufactures, and sells generic and specialist magnesium alloys across Europe, China, North America, and internationally with a market cap of A$17.52 million.

Operations: No specific revenue segments have been reported for the company.

Market Cap: A$17.52M

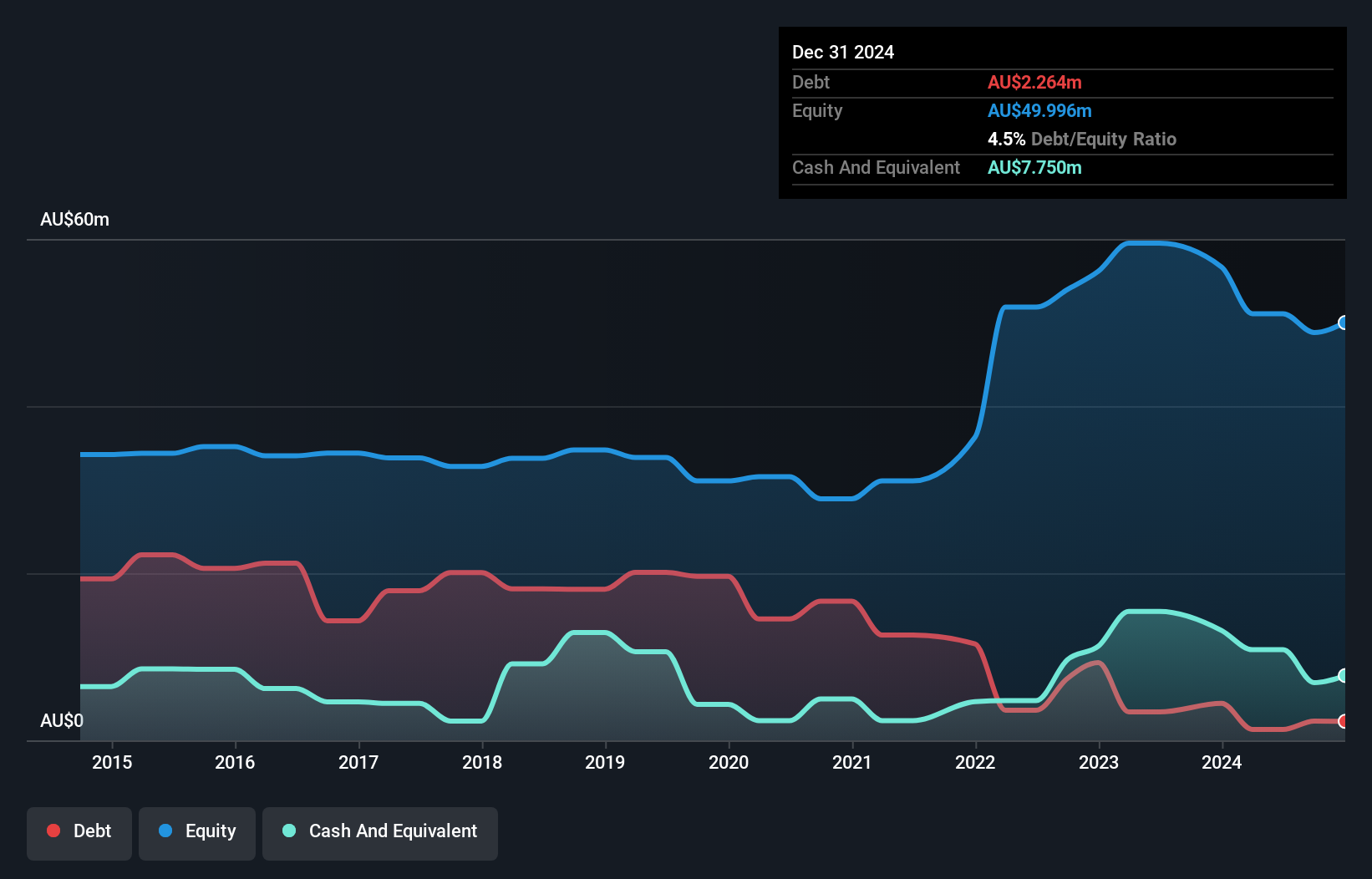

Magontec Limited, with a market cap of A$17.52 million, has announced a significant share buyback program, aiming to repurchase up to 28.48% of its issued share capital, pending shareholder approval. Despite being unprofitable and reporting a net loss of A$7.47 million for the first nine months of 2024, the company maintains strong liquidity with short-term assets far exceeding liabilities and debt well covered by operating cash flow. The management team is experienced with an average tenure of 8.8 years, and while volatility remains high, earnings are forecasted to grow significantly at over 100% annually.

- Jump into the full analysis health report here for a deeper understanding of Magontec.

- Assess Magontec's future earnings estimates with our detailed growth reports.

Paradigm Biopharmaceuticals (ASX:PAR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Paradigm Biopharmaceuticals Limited is an Australian company focused on the research and development of therapeutic products for human use, with a market cap of A$139.77 million.

Operations: Paradigm Biopharmaceuticals Limited does not report any revenue segments.

Market Cap: A$139.77M

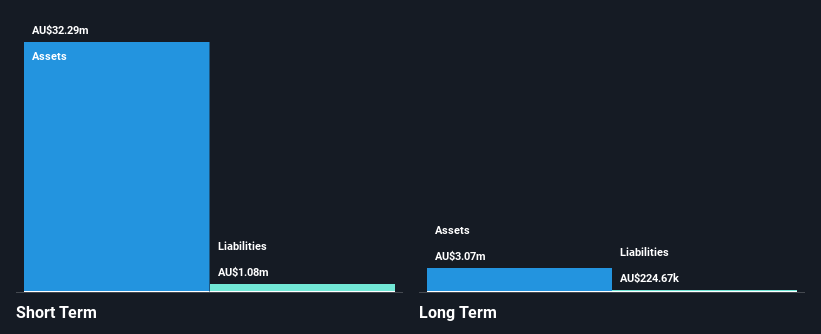

Paradigm Biopharmaceuticals, with a market cap of A$139.77 million, remains pre-revenue and unprofitable but is actively advancing its Phase 3 clinical trial for a key therapeutic product. The company recently raised A$16 million through a follow-on equity offering to bolster its cash runway, addressing short-term financial needs despite ongoing cash flow challenges. Paradigm is debt-free and has sufficient short-term assets to cover liabilities. Recent board changes include Dr. Donna Skerrett stepping down as Executive Director to focus on her role as Chief Medical Officer, crucial for the trial's progress towards potential FDA approval.

- Dive into the specifics of Paradigm Biopharmaceuticals here with our thorough balance sheet health report.

- Gain insights into Paradigm Biopharmaceuticals' outlook and expected performance with our report on the company's earnings estimates.

SKS Technologies Group (ASX:SKS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SKS Technologies Group Limited operates in Australia, focusing on the design, supply, and installation of audio visual, electrical, and communication products and services with a market capitalization of A$226.38 million.

Operations: The company generates revenue of A$136.31 million from its operations in the lighting and audio-visual markets.

Market Cap: A$226.38M

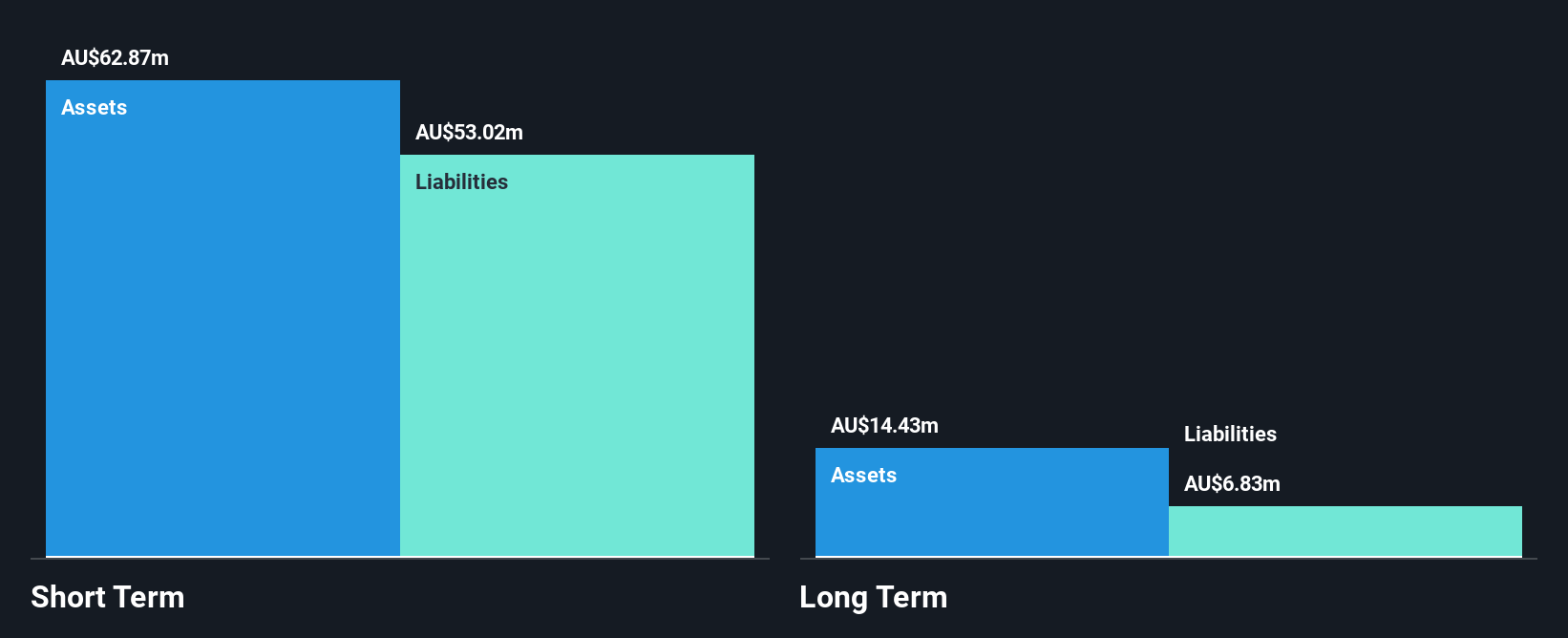

SKS Technologies Group, with a market cap of A$226.38 million, has demonstrated remarkable financial growth, achieving a 948% earnings increase over the past year. The company operates debt-free and maintains strong liquidity with short-term assets of A$46.1 million exceeding both its short-term (A$41.0M) and long-term liabilities (A$6.6M). Despite recent shareholder dilution, SKS trades at 46.9% below estimated fair value, suggesting potential upside for investors cautious about volatility and insider selling concerns. The seasoned management team and board provide stability as SKS continues to capitalize on opportunities in the audio-visual market segment.

- Click to explore a detailed breakdown of our findings in SKS Technologies Group's financial health report.

- Explore SKS Technologies Group's analyst forecasts in our growth report.

Where To Now?

- Investigate our full lineup of 1,050 ASX Penny Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MGL

Magontec

Researches, develops, manufactures, and sells generic and specialist magnesium alloys in Australia, Europe, China, North America, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives