- Australia

- /

- Metals and Mining

- /

- ASX:MAT

What Can We Learn About Matsa Resources' (ASX:MAT) CEO Compensation?

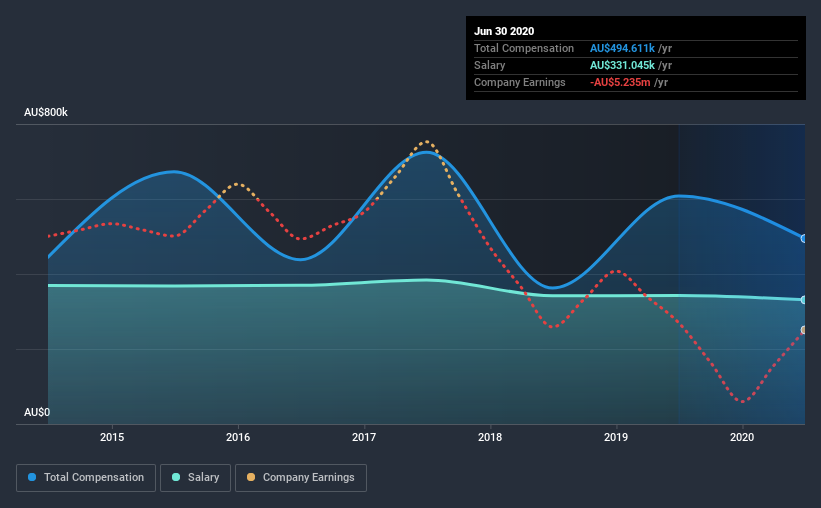

The CEO of Matsa Resources Limited (ASX:MAT) is Paul Poli, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Matsa Resources pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Matsa Resources

How Does Total Compensation For Paul Poli Compare With Other Companies In The Industry?

According to our data, Matsa Resources Limited has a market capitalization of AU$27m, and paid its CEO total annual compensation worth AU$495k over the year to June 2020. We note that's a decrease of 19% compared to last year. Notably, the salary which is AU$331.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below AU$259m, we found that the median total CEO compensation was AU$308k. Accordingly, our analysis reveals that Matsa Resources Limited pays Paul Poli north of the industry median. Furthermore, Paul Poli directly owns AU$1.2m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$331k | AU$342k | 67% |

| Other | AU$164k | AU$266k | 33% |

| Total Compensation | AU$495k | AU$608k | 100% |

Talking in terms of the industry, salary represented approximately 69% of total compensation out of all the companies we analyzed, while other remuneration made up 31% of the pie. There isn't a significant difference between Matsa Resources and the broader market, in terms of salary allocation in the overall compensation package. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Matsa Resources Limited's Growth Numbers

Matsa Resources Limited has reduced its earnings per share by 52% a year over the last three years. Its revenue is down 5.9% over the previous year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Matsa Resources Limited Been A Good Investment?

Since shareholders would have lost about 52% over three years, some Matsa Resources Limited investors would surely be feeling negative emotions. So shareholders would probably want the company to be lessto generous with CEO compensation.

To Conclude...

As we noted earlier, Matsa Resources pays its CEO higher than the norm for similar-sized companies belonging to the same industry. This doesn't look good against shareholder returns, which have been negative for the past three years. Arguably worse, we've been waiting for positive EPS growth for the last three years. Overall, with such poor performance, shareholder's would probably have questions if the company decided to give the CEO a raise.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 4 warning signs (and 1 which doesn't sit too well with us) in Matsa Resources we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Matsa Resources, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:MAT

Matsa Resources

Engages in the exploration of mineral resources in Australia and Thailand.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026