Audinate Group And 2 Other ASX Penny Stocks To Watch Closely

Reviewed by Simply Wall St

As the Australian market anticipates a modest rise, buoyed by Wall Street's optimism despite mixed economic signals, investors are keenly observing how local conditions might influence future opportunities. In this context, penny stocks—though an older term—remain relevant as they often spotlight smaller or emerging companies with potential for growth. By focusing on those with strong financials and a clear path forward, investors can uncover valuable prospects in these lesser-known stocks.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.43 | A$123.23M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.835 | A$51.99M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.76 | A$424.18M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.68 | A$271.82M | ✅ 4 ⚠️ 2 View Analysis > |

| Veris (ASX:VRS) | A$0.068 | A$35.82M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.14B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.24 | A$1.37B | ✅ 3 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.56 | A$237.01M | ✅ 3 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.34 | A$129.97M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.46 | A$645.5M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 412 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Audinate Group (ASX:AD8)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Audinate Group Limited develops and sells digital audio visual (AV) networking solutions in Australia and internationally, with a market cap of A$360.93 million.

Operations: The company's revenue is primarily generated from its Contract Electronics Manufacturing Services, which amounts to A$62.07 million.

Market Cap: A$360.93M

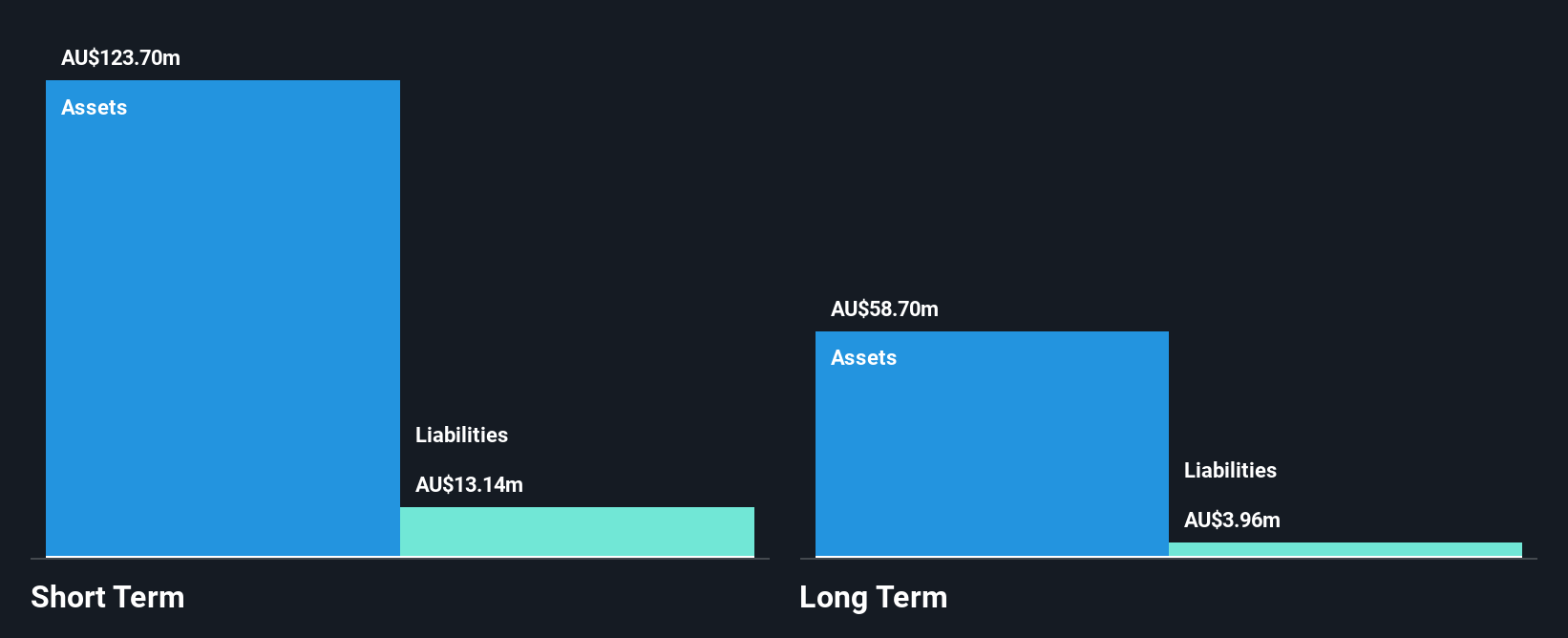

Audinate Group, with a market cap of A$360.93 million, is currently unprofitable and not expected to achieve profitability in the next three years. Despite this, it has demonstrated resilience by reducing losses at a notable rate over the past five years. The company’s revenue from its Contract Electronics Manufacturing Services stands at A$62.07 million, indicating substantial operations beyond pre-revenue status. Audinate's financial stability is supported by short-term assets of A$123.7 million exceeding both short-term and long-term liabilities significantly. Additionally, the company remains debt-free with no meaningful shareholder dilution recently observed.

- Unlock comprehensive insights into our analysis of Audinate Group stock in this financial health report.

- Examine Audinate Group's earnings growth report to understand how analysts expect it to perform.

Judo Capital Holdings (ASX:JDO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Judo Capital Holdings Limited, with a market cap of A$1.69 billion, operates through its subsidiaries to offer a range of banking products and services tailored for small and medium businesses in Australia.

Operations: The company generates revenue primarily from its Small and Medium Enterprises (SMEs) Lending segment, amounting to A$347.4 million.

Market Cap: A$1.69B

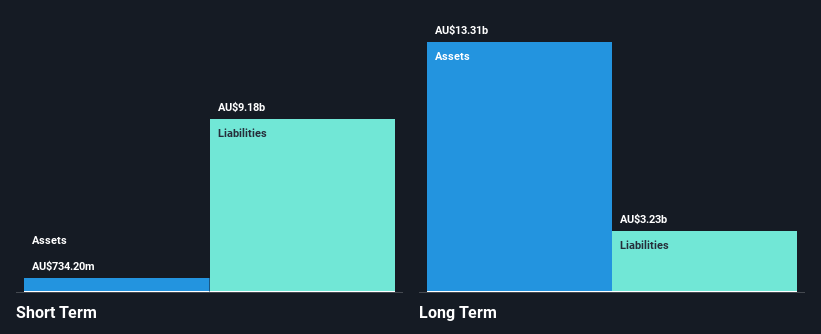

Judo Capital Holdings, with a market cap of A$1.69 billion, focuses on SME lending, generating A$347.4 million in revenue. Its net profit margins have improved to 24.9%, and it trades at 38.4% below estimated fair value, suggesting potential undervaluation. However, the company faces challenges with a high bad loans ratio of 3.4% and a low return on equity at 5.1%. The management team is experienced with an average tenure of 3.8 years, while the board averages 4.3 years in tenure, indicating seasoned leadership amidst recent board changes following Ms. Mette Schepers' retirement announcement.

- Take a closer look at Judo Capital Holdings' potential here in our financial health report.

- Gain insights into Judo Capital Holdings' outlook and expected performance with our report on the company's earnings estimates.

Macmahon Holdings (ASX:MAH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Macmahon Holdings Limited offers surface and underground mining, mining support, and civil infrastructure services to companies in Australia and Southeast Asia, with a market cap of A$1.26 billion.

Operations: The company's revenue is primarily derived from its Mining segment, which accounts for A$1.97 billion, followed by the Civil segment at A$436.97 million.

Market Cap: A$1.26B

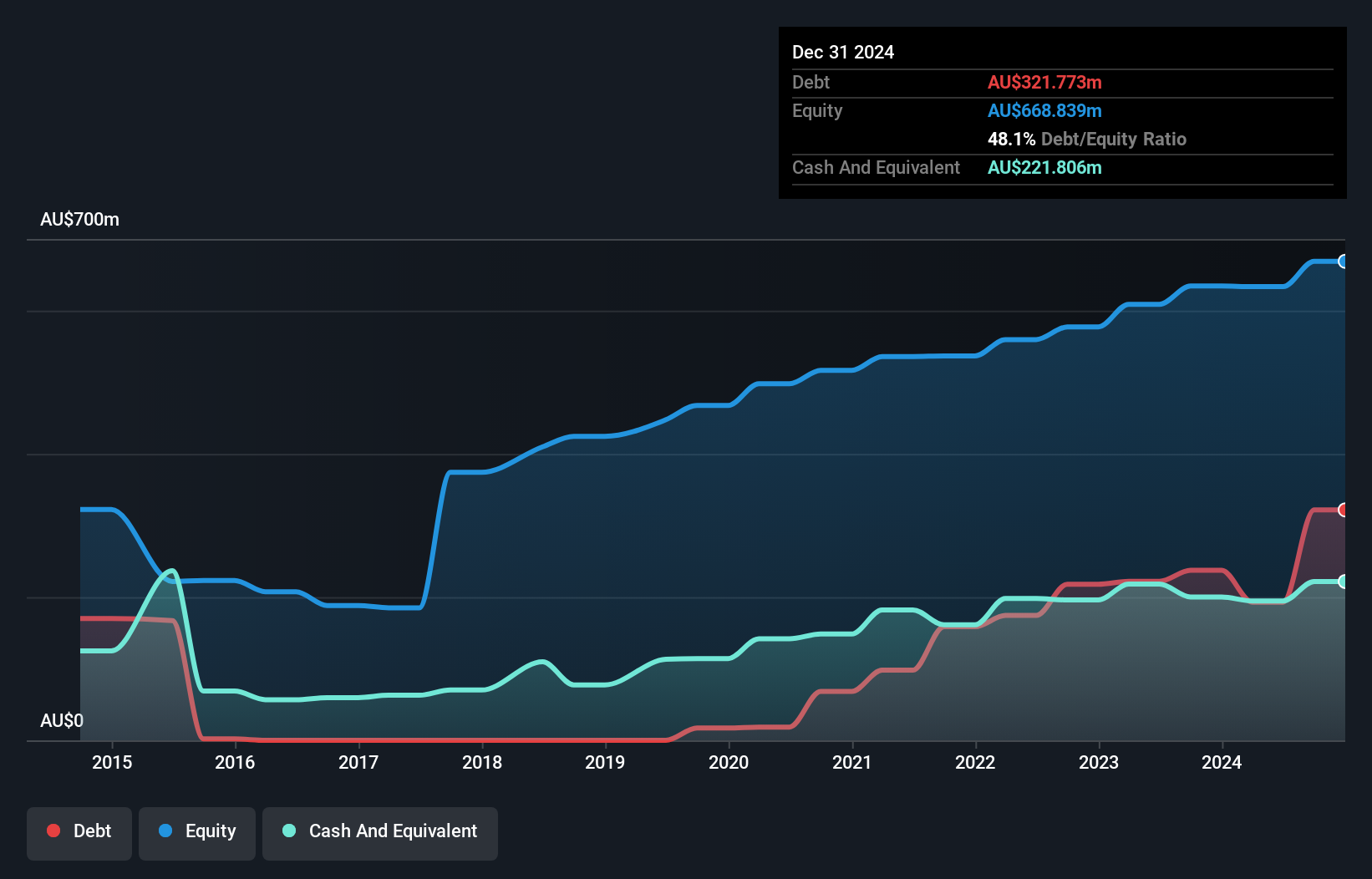

Macmahon Holdings, with a market cap of A$1.26 billion, derives significant revenue from its Mining segment (A$1.97 billion) and Civil segment (A$436.97 million). The company trades at 26.7% below its estimated fair value, suggesting potential undervaluation among peers. Earnings have shown robust growth of 38.9% over the past year, outpacing industry averages, though long-term earnings have declined by 2.3% annually over five years. Debt levels are satisfactory with strong cash flow coverage and interest payments well covered by EBIT (4.4x). Recent board changes include the appointment of Ms Suzan Pervan as an Independent Non-Executive Director in November 2025.

- Click here and access our complete financial health analysis report to understand the dynamics of Macmahon Holdings.

- Gain insights into Macmahon Holdings' future direction by reviewing our growth report.

Key Takeaways

- Click this link to deep-dive into the 412 companies within our ASX Penny Stocks screener.

- Want To Explore Some Alternatives? We've found 15 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AD8

Audinate Group

Engages in develops and sells digital audio visual (AV) networking solutions Australia and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success