- Australia

- /

- Metals and Mining

- /

- ASX:LYC

Lynas Rare Earths (ASX:LYC) Valuation: Assessing Market Potential as New Hydrogen Peroxide Tech Pilot Launches

Reviewed by Simply Wall St

Lynas Rare Earths (ASX:LYC) has formed a new partnership with Solidec, launching a pilot project at its Australian facility to test hydrogen peroxide generation technology for cleaner, more efficient rare earth processing. This move could bolster Lynas’s sustainability credentials while supporting global demand growth.

See our latest analysis for Lynas Rare Earths.

Lynas Rare Earths’ push for cleaner processing arrives as the company’s momentum keeps investors on their toes. Despite a sharp 30-day share price return of -30.84%, the stock remains up 107% year-to-date and has delivered a total shareholder return of 67% over the past year. This signals that long-term optimism remains strong even as short-term volatility picks up.

If this kind of industry innovation interests you, now’s the perfect moment to explore fast growing stocks with high insider ownership.

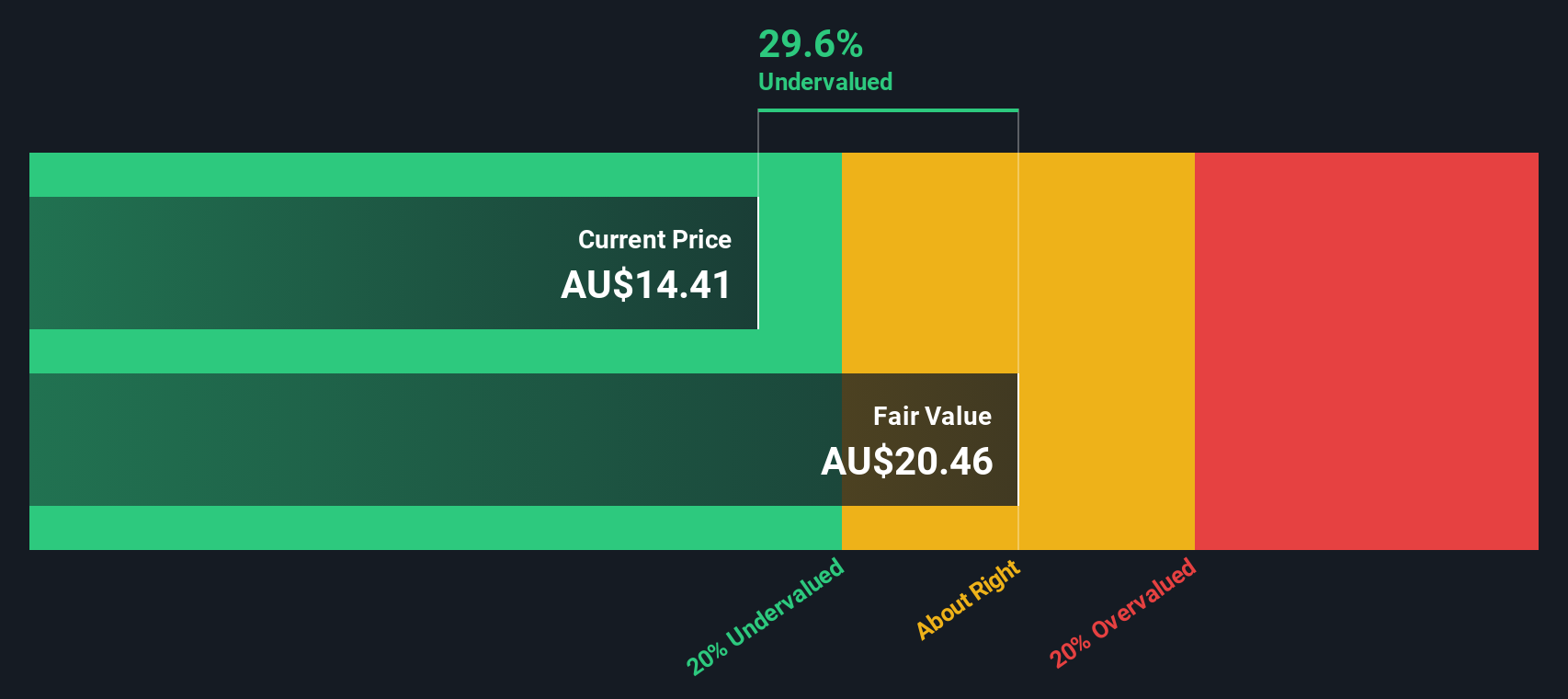

With the stock trading at a notable discount to analyst targets despite its technology push and solid returns, the question remains: Is Lynas still undervalued, or has the market already priced in its next leg of growth?

Most Popular Narrative: 13.8% Undervalued

With Lynas Rare Earths closing at A$13.52 and the most popular narrative setting fair value at A$15.69, analyst expectations outpace today’s trading level. How could such a gap emerge? The following highlights a crucial catalyst underpinning these high expectations.

The market seems to be pricing in flawless execution of Lynas's aggressive expansion into downstream processing and magnet manufacturing, including successful ramp-up of the new Kalgoorlie and Malaysian facilities, as well as anticipated revenue from potential magnet JV/partnerships. This projects significant margin and earnings growth.

What exactly is fueling this bullish stance? The blueprint features a bold leap in future profits, rapid expansion, and assumptions about sector leadership rarely seen outside hyper-growth tech. Which numbers are shaping this future, and how do they justify the valuation premium? Find out what the narrative sees that others might be missing.

Result: Fair Value of $15.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory challenges in Malaysia and heavy reliance on a narrow set of rare earth products could still disrupt Lynas's positive outlook.

Find out about the key risks to this Lynas Rare Earths narrative.

Another View: Discounted Cash Flow Perspective

While the most common valuation focuses on multiples compared to analyst targets, our SWS DCF model offers a fresh angle. According to this approach, Lynas shares are trading at a 39.6% discount to fair value. This suggests much more upside than the market’s consensus implies. Could this gap reveal hidden opportunity, or is it a trap?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Lynas Rare Earths Narrative

If you’d rather draw your own conclusions or see the numbers in a different light, you can build a customized Lynas story in just a few minutes. Do it your way.

A great starting point for your Lynas Rare Earths research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that opportunity rarely knocks twice. If you want to keep your strategy ahead of the curve, check these out before the market moves.

- Boost your passive income potential by tapping into these 17 dividend stocks with yields > 3% with strong yields and a reliable track record.

- Ride the AI wave and seize early-mover advantage through these 25 AI penny stocks in the fast-evolving world of artificial intelligence.

- Capitalize on deep value opportunities by targeting these 861 undervalued stocks based on cash flows that analysts believe are trading below intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LYC

Lynas Rare Earths

Engages in the exploration, development, mining, extraction, and processing of rare earth minerals in Australia and Malaysia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives