- Australia

- /

- Metals and Mining

- /

- ASX:LTR

Kathleen Valley Launch and LG Investment Might Change the Case for Investing in Liontown Resources (ASX:LTR)

Reviewed by Sasha Jovanovic

- Earlier this month, Liontown Resources commenced production at its Kathleen Valley Lithium Project and announced a US$250 million investment from LG Energy Solution through convertible notes, alongside updated offtake agreements with Ford Motor Company and the launch of digital lithium auctions.

- This combination of operational and funding milestones positions Liontown Resources for greater commercial flexibility and highlights global interest in its lithium expansion efforts.

- With production at Kathleen Valley now underway, we'll explore how strengthened liquidity from LG Energy Solution reshapes Liontown’s investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Liontown Resources Investment Narrative Recap

To invest in Liontown Resources, you need to believe in continued lithium demand and the company's ability to efficiently ramp up production at Kathleen Valley. The recent production start and US$250 million LG Energy Solution funding boost address liquidity questions in the short term, which is arguably the biggest immediate catalyst, but do not completely eliminate exposure to fluctuating lithium prices, the most significant risk facing cash flow and future operations.

Liontown’s updated offtake agreement with Ford, which reduces delivery requirements from 2027, is especially relevant in the context of marketing flexibility and the timing of revenue recognition as production scales. This move, while increasing commercial options, could also alter the expected sales profile and make the company more sensitive to future price changes, an aspect closely tied to its short-term outlook.

In contrast, even with recent operational wins, investors should be aware that the risk of weaker lithium prices remains very much in play...

Read the full narrative on Liontown Resources (it's free!)

Liontown Resources' outlook anticipates A$725.1 million in revenue and A$62.7 million in earnings by 2028. This projection involves a 93.1% annual revenue growth rate and a A$111.8 million increase in earnings from the current A$-49.1 million.

Uncover how Liontown Resources' forecasts yield a A$0.781 fair value, a 47% downside to its current price.

Exploring Other Perspectives

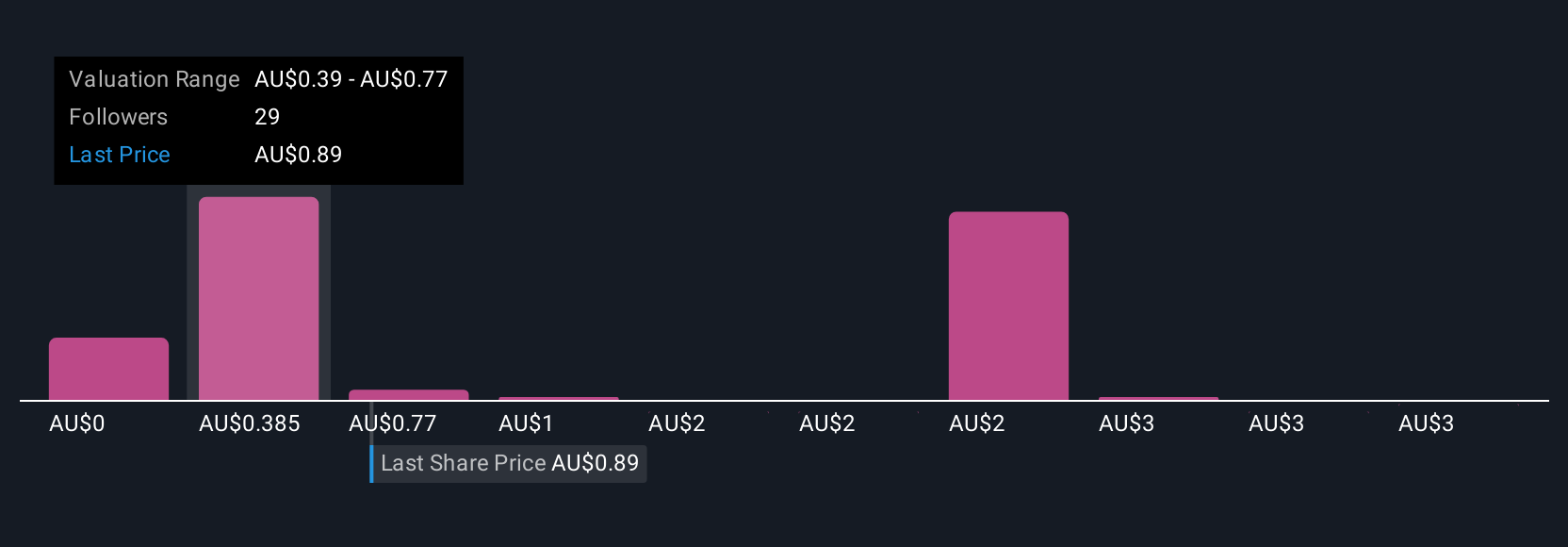

Fifteen unique Simply Wall St Community fair value estimates for Liontown Resources span from A$0.15 to A$5.65, showing a significant range of individual viewpoints. While many see upside potential, the persistent risk of lower lithium prices could still weigh on performance, so explore how these varied opinions could influence your assessment.

Explore 15 other fair value estimates on Liontown Resources - why the stock might be worth over 3x more than the current price!

Build Your Own Liontown Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Liontown Resources research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Liontown Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Liontown Resources' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LTR

Liontown Resources

Engages in the exploration, evaluation, and development of mineral properties in Australia.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives