- Australia

- /

- Metals and Mining

- /

- ASX:JRV

Investors Don't See Light At End Of Jervois Global Limited's (ASX:JRV) Tunnel And Push Stock Down 36%

Jervois Global Limited (ASX:JRV) shareholders that were waiting for something to happen have been dealt a blow with a 36% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 85% loss during that time.

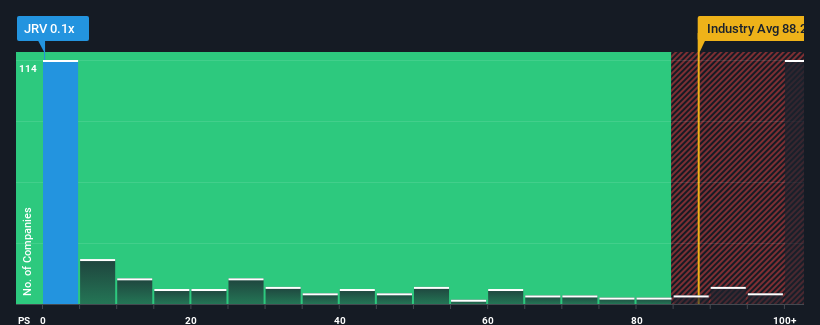

After such a large drop in price, Jervois Global may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Metals and Mining industry in Australia have P/S ratios greater than 88.2x and even P/S higher than 547x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Jervois Global

What Does Jervois Global's Recent Performance Look Like?

Jervois Global hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Jervois Global.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Jervois Global would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 45% decrease to the company's top line. In spite of this, the company still managed to deliver immense revenue growth over the last three years. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Shifting to the future, estimates from the one analyst covering the company suggest revenue growth is heading into negative territory, declining 7.6% over the next year. That's not great when the rest of the industry is expected to grow by 93%.

With this in consideration, we find it intriguing that Jervois Global's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Jervois Global's P/S

Shares in Jervois Global have plummeted and its P/S has followed suit. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Jervois Global's P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Jervois Global that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:JRV

Jervois Global

Engages in the exploration, development, and production of mineral properties.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives