- Australia

- /

- Metals and Mining

- /

- ASX:JMS

Aims Property Securities Fund And 2 Other ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian market has recently faced a challenging period, with the ASX200 experiencing declines amid negative sentiment from the US and domestic economic concerns. Despite these broader market conditions, there are still opportunities for investors willing to explore beyond well-known stocks. Penny stocks, often associated with smaller or newer companies, continue to offer intriguing prospects for growth at lower price points. In this article, we examine three penny stocks that stand out due to their financial strength and potential for long-term growth.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.48 | A$137.56M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.895 | A$55.73M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.95 | A$453.39M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.61 | A$266.44M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.875 | A$418.62M | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.19 | A$1.34B | ✅ 3 ⚠️ 1 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.89 | A$267.56M | ✅ 3 ⚠️ 2 View Analysis > |

| Perenti (ASX:PRN) | A$2.56 | A$2.41B | ✅ 3 ⚠️ 3 View Analysis > |

| GWA Group (ASX:GWA) | A$2.34 | A$614.87M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 419 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Aims Property Securities Fund (ASX:APW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aims Property Securities Fund, with a market cap of A$155.82 million, is a close-ended fund of funds launched by MacArthurCook Ltd.

Operations: The fund's revenue is primarily derived from its investments in the AIMS Growth Investment Fund (A$48.03 million), AIMS Real Estate Opportunity Fund (A$4.61 million), and AIMS Total Return Fund (A$2.29 million), with additional contributions from AIMS APAC REIT (A$1.68 million) and Blackwall Limited (A$0.07 million).

Market Cap: A$155.82M

Aims Property Securities Fund, with a market cap of A$155.82 million, has demonstrated strong financial performance and stability. It is debt-free and maintains a high Return on Equity at 24.2%. The fund's earnings growth of 119.2% over the past year significantly outpaced the broader REITs industry, indicating robust operational efficiency. Its net profit margin improved to 96.2%, reflecting effective cost management and revenue generation strategies, with annual revenue rising to A$54.74 million from A$25.36 million last year. The experienced board enhances governance quality while its low Price-To-Earnings ratio suggests potential value compared to the broader Australian market.

- Dive into the specifics of Aims Property Securities Fund here with our thorough balance sheet health report.

- Examine Aims Property Securities Fund's past performance report to understand how it has performed in prior years.

Jupiter Mines (ASX:JMS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jupiter Mines Limited is an independent mining company based in Australia, with a market capitalization of A$530.50 million.

Operations: The company generates revenue from its manganese operations in South Africa, amounting to A$9.43 million.

Market Cap: A$530.5M

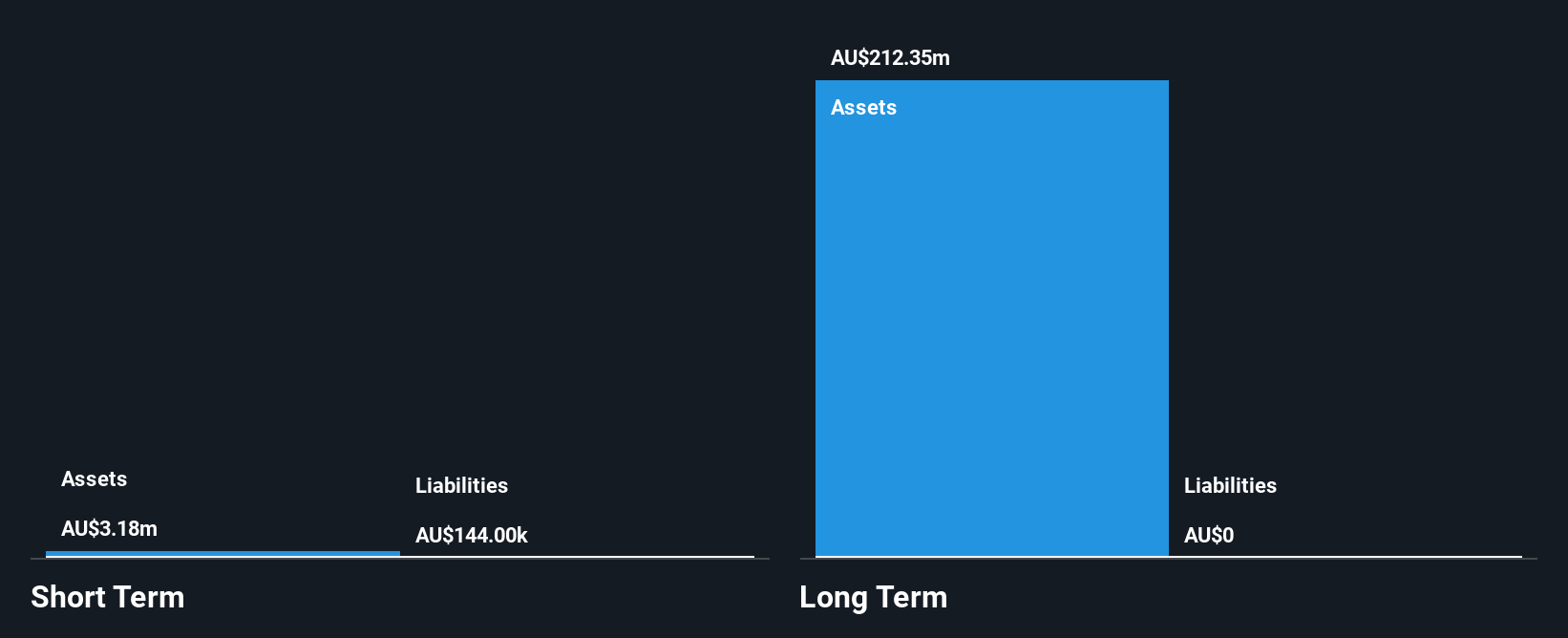

Jupiter Mines Limited, with a market cap of A$530.50 million, has shown stable financial health by remaining debt-free and maintaining short-term assets exceeding liabilities. Despite its earnings growth of 2.8% over the past year not matching the industry average, it surpasses its five-year decline rate of -9.9%. The Price-To-Earnings ratio of 13.3x suggests potential value against the broader Australian market average. However, its Return on Equity is low at 7.1%, and dividends are not well covered by free cash flow, raising concerns about sustainability despite recent dividend increases and consistent earnings reports from manganese operations in South Africa.

- Navigate through the intricacies of Jupiter Mines with our comprehensive balance sheet health report here.

- Learn about Jupiter Mines' historical performance here.

Verbrec (ASX:VBC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Verbrec Limited offers engineering, asset management, training, mining technology software, and operations and maintenance services to industries such as mining, energy, defense, and infrastructure across Australia, New Zealand, Papua New Guinea, and the Pacific Islands with a market cap of A$43.83 million.

Operations: The company's revenue is derived from its Engineering segment, which generated A$77.86 million, and its Training segment, contributing A$7.76 million.

Market Cap: A$43.83M

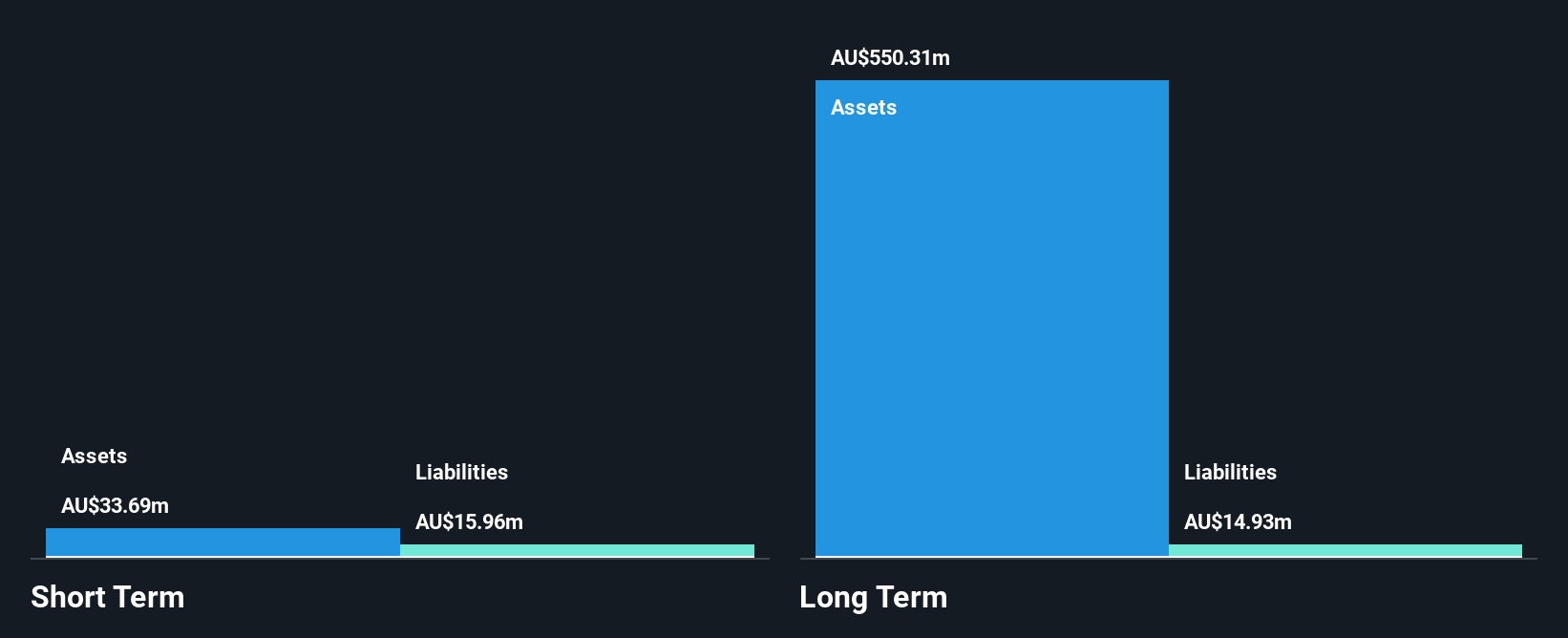

Verbrec Limited, with a market cap of A$43.83 million, has demonstrated financial resilience by achieving profitability over the past five years and maintaining stable profit margins. The company’s debt is well covered by operating cash flow, and its short-term assets exceed both short- and long-term liabilities. Despite a decline in earnings growth last year, Verbrec's strategic focus on acquisitions aims to bolster revenue streams as external trends ease in 2026. While trading below fair value estimates offers potential upside for investors, the company's recent dividend announcement highlights its commitment to returning value amidst ongoing strategic expansion efforts.

- Click to explore a detailed breakdown of our findings in Verbrec's financial health report.

- Examine Verbrec's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Take a closer look at our ASX Penny Stocks list of 419 companies by clicking here.

- Ready For A Different Approach? The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:JMS

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives