- Australia

- /

- Basic Materials

- /

- ASX:JHX

James Hardie Industries (ASX:JHX): Evaluating Valuation Following Board Changes and Strategic Growth Updates

Reviewed by Simply Wall St

James Hardie Industries (ASX:JHX) has just wrapped up its 2025 Annual General Meeting, ushering in new board members as long-standing directors stepped down. The company also highlighted its ongoing strategic push following the AZEK combination.

See our latest analysis for James Hardie Industries.

James Hardie’s year has been a wild ride for investors, with recent boardroom changes and a high-profile lawsuit adding new chapters to the story. After a steep drop in August tied to weaker-than-expected North American sales, momentum has started to rebound. October’s 17% climb in share price shows sentiment is stabilizing. But taking a step back, long-term total shareholder returns remain in negative territory, so it’s a stock where risk perception is still adjusting.

If you’re wondering what other names could offer fresh opportunities right now, consider expanding your search and discover fast growing stocks with high insider ownership.

With recent volatility and boardroom turnover, the spotlight is now on valuation. Is James Hardie trading at a discount that presents a buying opportunity, or are markets already factoring in all future growth?

Most Popular Narrative: 10.4% Undervalued

Compared to the last close price of A$32.83, the narrative consensus places James Hardie Industries’ fair value notably higher at A$36.63. This suggests upside potential if analyst assumptions play out. This segment breaks down a driving viewpoint behind that number.

The recent acquisition and integration of AZEK has more than doubled James Hardie's addressable market and expanded its product offering into high-growth outdoor living categories. This sets the stage for sustained top-line acceleration and double-digit revenue growth across North America over the coming years.

Curious what bold projections justify this price jump? The narrative focuses on aggressive growth, product innovation, and a target profit profile that rivals top sector leaders. See which high-stakes assumptions drive this valuation and why analysts think the company could outperform the market’s expectations.

Result: Fair Value of $36.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent market weakness and integration risks from the AZEK acquisition could present challenges to James Hardie’s ability to deliver on these bullish forecasts.

Find out about the key risks to this James Hardie Industries narrative.

Another View: What Do Price Ratios Say?

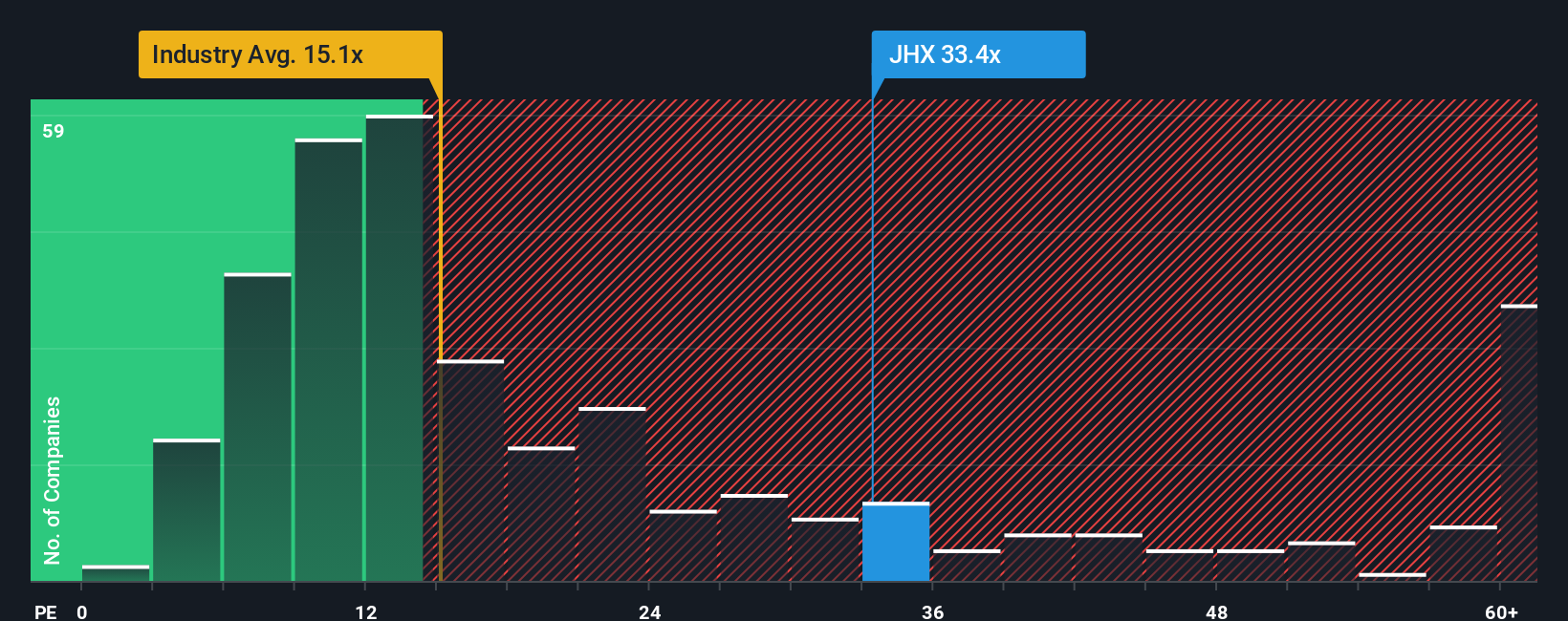

Looking from a price-to-earnings angle, James Hardie trades at 37.7x earnings. That's a premium to both the industry average of 15.5x and its fair ratio of 32.7x, but still below peer averages of 45.5x. This gap suggests added valuation risk if growth expectations are not met. Could sentiment or risk appetite be shifting behind the scenes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own James Hardie Industries Narrative

If you see the story differently or want to run your own numbers, you can easily build your own narrative in just a few minutes. Do it your way.

A great starting point for your James Hardie Industries research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means always spotting fresh trends ahead of the crowd. Expand your watchlist with high-quality picks that fit your strategy and risk appetite.

- Capitalize on fast-growing artificial intelligence by targeting companies making waves in this sector through these 26 AI penny stocks.

- Enhance your portfolio’s resilience and income with solid opportunities among these 21 dividend stocks with yields > 3%, which are currently offering attractive yields.

- Take the lead in fintech by zeroing in on game-changing innovation with these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:JHX

James Hardie Industries

Engages in the manufacture and sale of fiber cement, fiber gypsum, and cement bonded boards in the United States, Australia, Europe, and New Zealand.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives