- Australia

- /

- Metals and Mining

- /

- ASX:IMD

Imdex (ASX:IMD) Reports 19% Net Income Rise For FY Ending June 2025

Reviewed by Simply Wall St

Imdex (ASX:IMD) recently reported a 19% increase in net income for the fiscal year ending June 30, 2025, alongside a dividend decrease. This financial juxtaposition coincided with an 18.64% rise in the company's share price over the last quarter. Despite the reduction in dividends, the substantial earnings growth likely supported investor sentiment favorably, balancing the market's broader trends, which experienced an overall climb. Additionally, macroeconomic factors such as expected rate cuts reflected positively on the market's performance, providing a backdrop against which Imdex's stock flourished.

Buy, Hold or Sell Imdex? View our complete analysis and fair value estimate and you decide.

The recent financial performance of Imdex, reporting a 19% rise in net income despite a dividend reduction, indicates underlying strength supported by investor sentiment in the context of macroeconomic influences such as rate cut expectations. Over a five-year span, the company achieved a total shareholder return of over 162.13%, reinforcing its solid long-term position amidst sector expansions driven by critical mineral demand and digital mining adoption. Over the past year, Imdex's stock performance exceeded the Australian Market's 10.9% return, highlighting its relative strength amid broader industry gains.

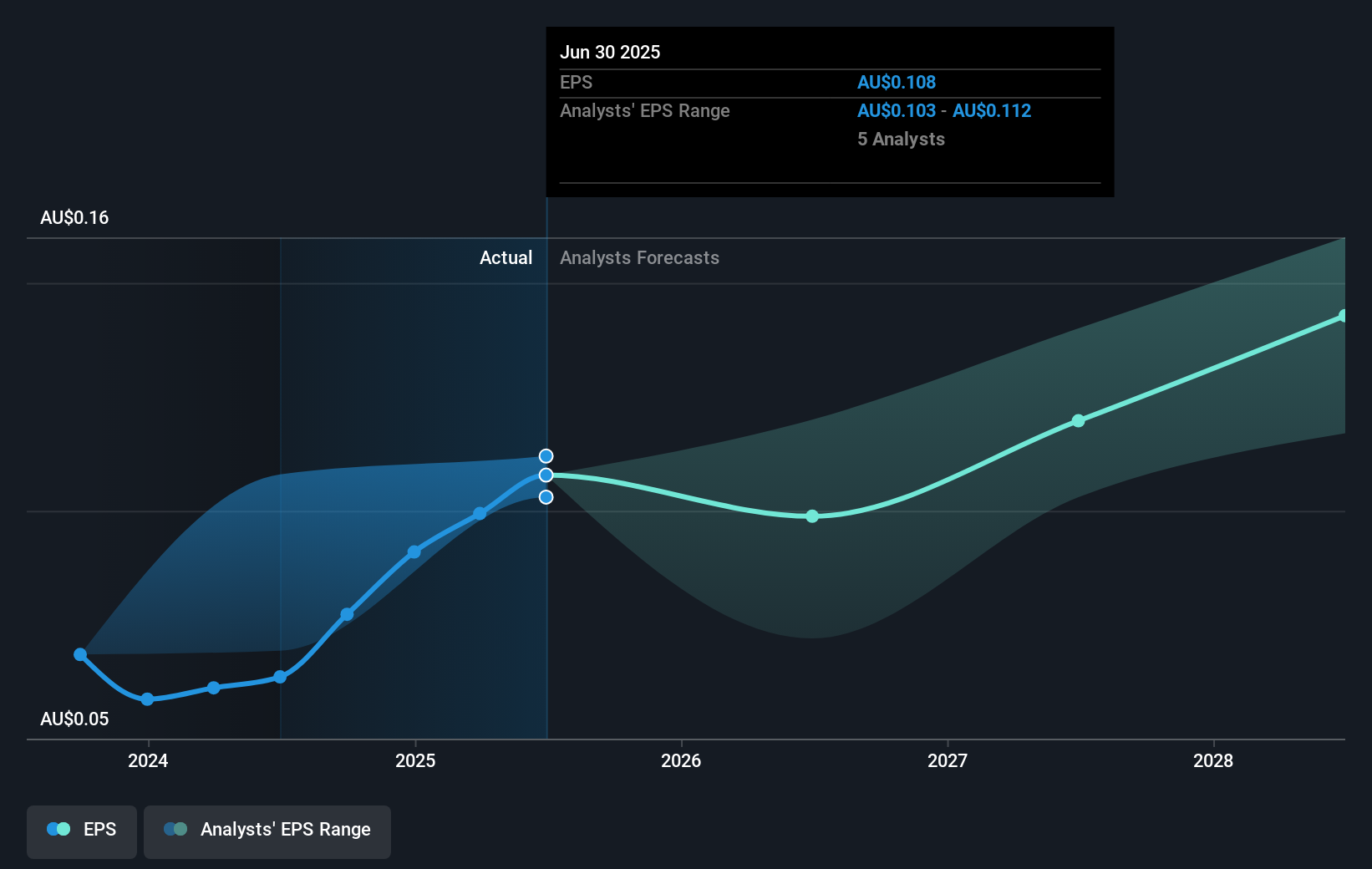

Imdex's robust earnings growth has potential implications for future revenue and earnings forecasts, as the company leverages technological innovations and market expansion. However, its reliance on cyclical exploration budgets and geopolitical risks presents challenges. With the current share price at A$3.31 and a consensus price target of A$3.42, this reflects modest market confidence. Analysts suggest that for Imdex to meet this target, it requires sustained growth and margin expansion, aligning with their forecasts. Stakeholders should consider these factors in relation to Imdex's strategic positioning and growth trajectory.

Examine Imdex's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IMD

Imdex

A mining-tech company, provides drilling products, rock knowledge sensors, and data and analytics for the minerals industry in the Asia-Pacific, the Middle East, Africa, Europe, and the Americas.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives