- Australia

- /

- Metals and Mining

- /

- ASX:IGO

IGO (ASX:IGO) Valuation in Focus Following Strategic Board Overhaul and Incoming Chair Announcement

Reviewed by Simply Wall St

IGO (ASX:IGO) is shaking up its leadership, naming Dr. Vanessa Guthrie as Non-Executive Director and incoming Chair. This move marks a new chapter for the company as it looks to strengthen governance and chart its future in battery minerals.

See our latest analysis for IGO.

IGO’s leadership renewal comes as the company works to strengthen its position within the battery minerals space, following a tough stretch for shareholders. Although the share price sits at $4.99, the one-year total shareholder return is down 5.9%, and the picture over three years shows a steep 65.9% loss. However, modest year-to-date price gains could be an early sign of momentum returning as the new strategic direction takes shape.

If you’re on the lookout for what’s next in the broader market, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

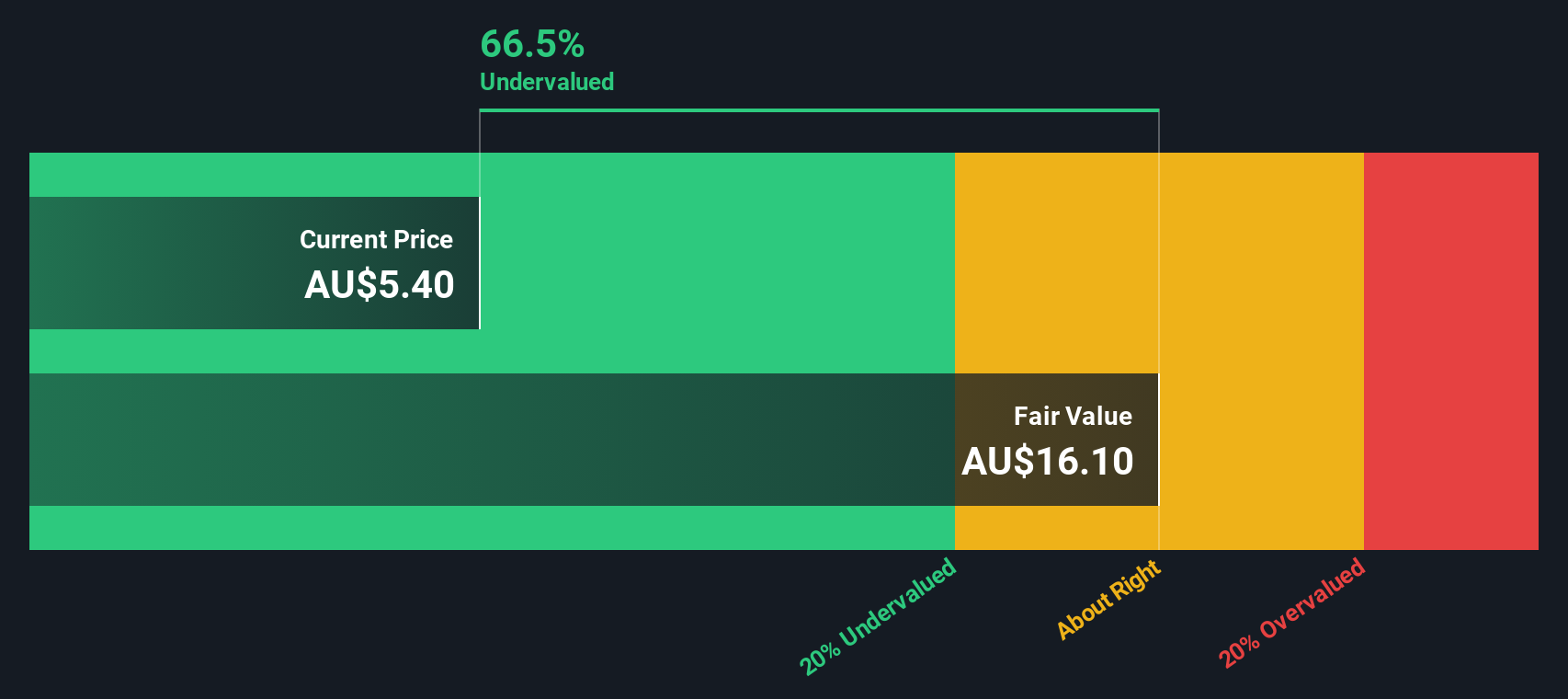

With the company trading well below previous highs despite a small rebound this year, investors are left to wonder if IGO shares are now undervalued or if the market has already priced in any growth ahead.

Price-to-Sales Ratio of 7.1x: Is it justified?

IGO trades at a price-to-sales ratio of 7.1x, which places it well above its peers and suggests a rich market valuation despite recent share price weakness.

The price-to-sales ratio measures the company's market value relative to its annual revenue and is often used for businesses where earnings are volatile or negative. For IGO, this metric reflects how much investors are willing to pay for each dollar of company sales.

While strong long-term prospects in battery minerals might help justify a premium, the current level shows that investors are pricing in an optimistic turnaround much faster than both industry norms and peer averages.

- Compared to the Australian Metals and Mining industry, which averages a much higher multiple (116.1x), IGO could appear attractive by industry standards. However, the estimated fair price-to-sales ratio is far lower at 0.2x, indicating a significant risk of overvaluation if the company's growth does not materialize as hoped.

Explore the SWS fair ratio for IGO

Result: Price-to-Sales of 7.1x (OVERVALUED)

However, ongoing revenue declines and negative net income growth remain significant risks. These factors could hinder any near-term recovery in IGO’s share valuation.

Find out about the key risks to this IGO narrative.

Another View: Our DCF Model Tells a Different Story

But what if we look beyond price-to-sales ratio? According to our SWS DCF model, IGO shares are actually trading about 52% below their estimated fair value of A$10.35. This approach values all future cash flows, not just current sales. This raises the question: is the market being too pessimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out IGO for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 861 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own IGO Narrative

If you have a different perspective or want to dig deeper into the data yourself, you can easily build your own story in just a few minutes. So why not Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding IGO.

Looking for more investment ideas?

Don’t wait around while opportunities pass by. Use the Simply Wall Street Screener to target specific trends and sectors that could fuel your next big win.

- Capture high yields by checking out these 17 dividend stocks with yields > 3% to find stable income and attractive returns well above market averages.

- Spot undervalued potential early by searching through these 861 undervalued stocks based on cash flows featuring companies built on solid cash flows and favorable valuations.

- Ride the wave of AI innovation with these 25 AI penny stocks highlighting standout names making breakthroughs in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IGO

IGO

IGO Limited, together with its subsidiaries, discovers, develops, and delivers battery minerals in Australia.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives