- Australia

- /

- Specialized REITs

- /

- ASX:NSR

3 ASX Dividend Stocks To Consider With Up To 6.8% Yield

Reviewed by Simply Wall St

The Australian market has experienced a notable upswing, climbing 1.7% in the last week and rising 18% over the past year, with earnings projected to grow by 12% annually. In this context of robust market performance, dividend stocks that offer attractive yields can be appealing for investors looking to enhance their income streams while potentially benefiting from capital appreciation.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Fortescue (ASX:FMG) | 9.56% | ★★★★★☆ |

| Perenti (ASX:PRN) | 7.51% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.84% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.32% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.28% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.47% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.56% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.40% | ★★★★★☆ |

| GrainCorp (ASX:GNC) | 6.02% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.37% | ★★★★★☆ |

Click here to see the full list of 40 stocks from our Top ASX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

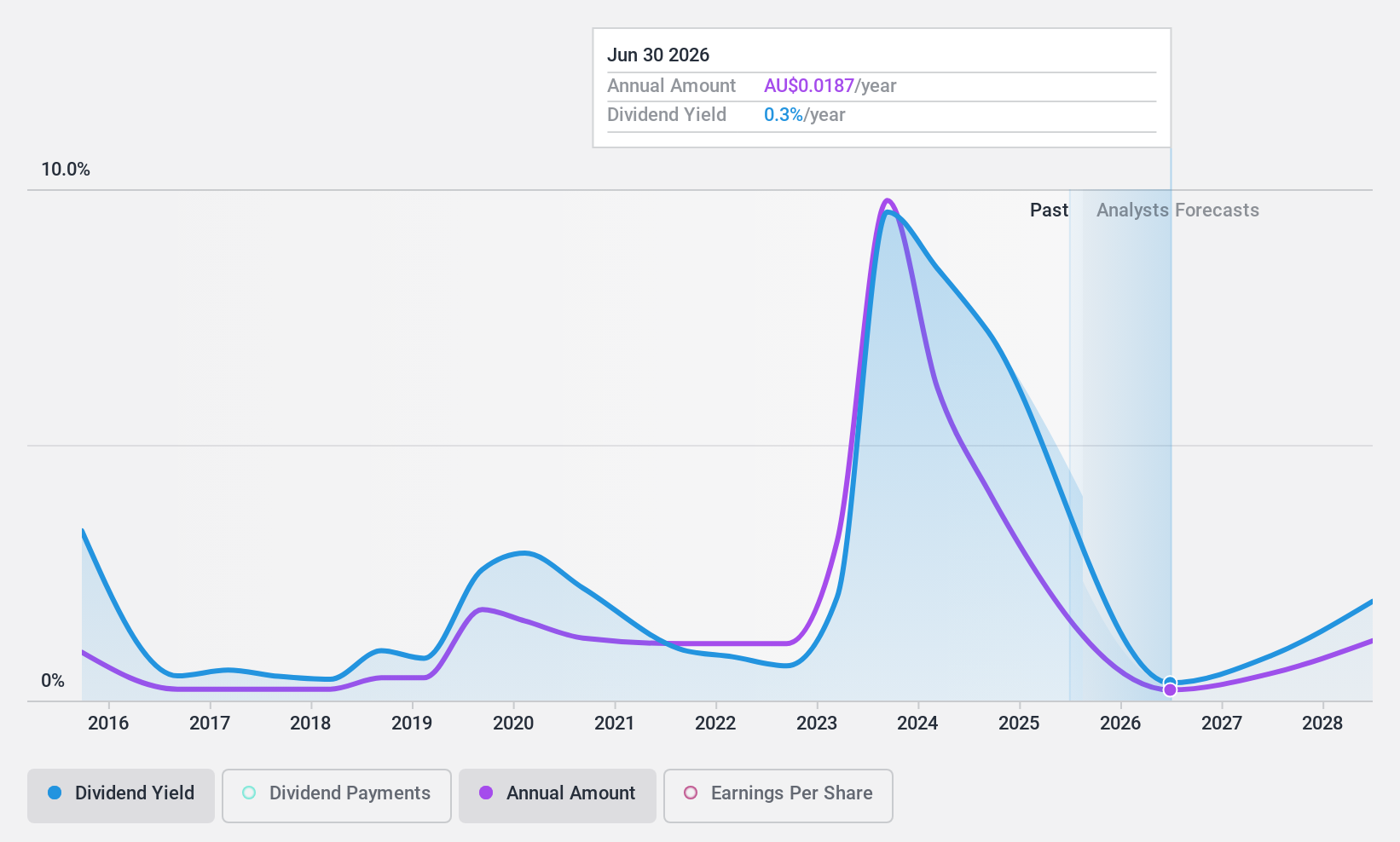

IGO (ASX:IGO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IGO Limited is an Australian exploration and mining company that focuses on discovering, developing, and operating assets for metals essential to clean energy, with a market cap of A$4.09 billion.

Operations: IGO Limited generates revenue primarily from its Nova Operation at A$539.10 million, followed by the Forrestania Operation at A$234.80 million, and the Cosmos Project contributing A$48.80 million, with additional income from interest revenue amounting to A$18.10 million.

Dividend Yield: 6.8%

IGO Limited's dividend profile presents challenges, with a high payout ratio of 10008.1% indicating dividends are not well covered by earnings, though cash flows provide some support with a lower cash payout ratio of 41.6%. Despite recent dividend decreases to A$0.26 and fluctuating payments over the past decade, IGO maintains a competitive yield at 6.84%, ranking in the top quartile in Australia. Recent M&A discussions suggest strategic shifts that could impact future dividend stability and growth prospects.

- Unlock comprehensive insights into our analysis of IGO stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of IGO shares in the market.

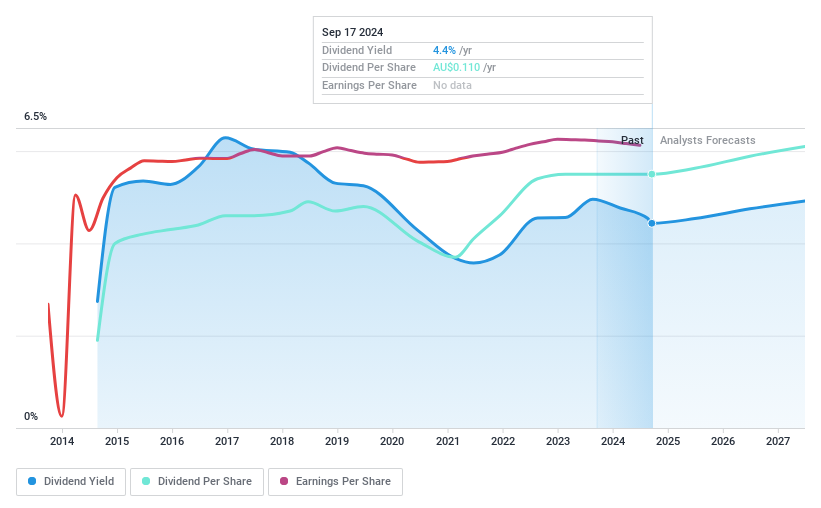

National Storage REIT (ASX:NSR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Storage REIT is the largest self-storage provider in Australia and New Zealand, operating over 225 centers to serve more than 90,000 residential and commercial customers, with a market cap of A$3.45 billion.

Operations: National Storage REIT generates revenue primarily from the operation and management of its storage centers, amounting to A$354.69 million.

Dividend Yield: 4.4%

National Storage REIT offers a stable dividend profile with consistent payments over the past decade, supported by earnings and cash flows, reflected in payout ratios of 55.5% and 83%, respectively. Despite a lower yield of 4.4% compared to top payers, its dividends remain reliable. Recent financials show increased revenue at A$355.37 million but decreased net income to A$28.93 million for FY2024, alongside an affirmed distribution of 5.5 cents per security for June 2024.

- Take a closer look at National Storage REIT's potential here in our dividend report.

- Our expertly prepared valuation report National Storage REIT implies its share price may be too high.

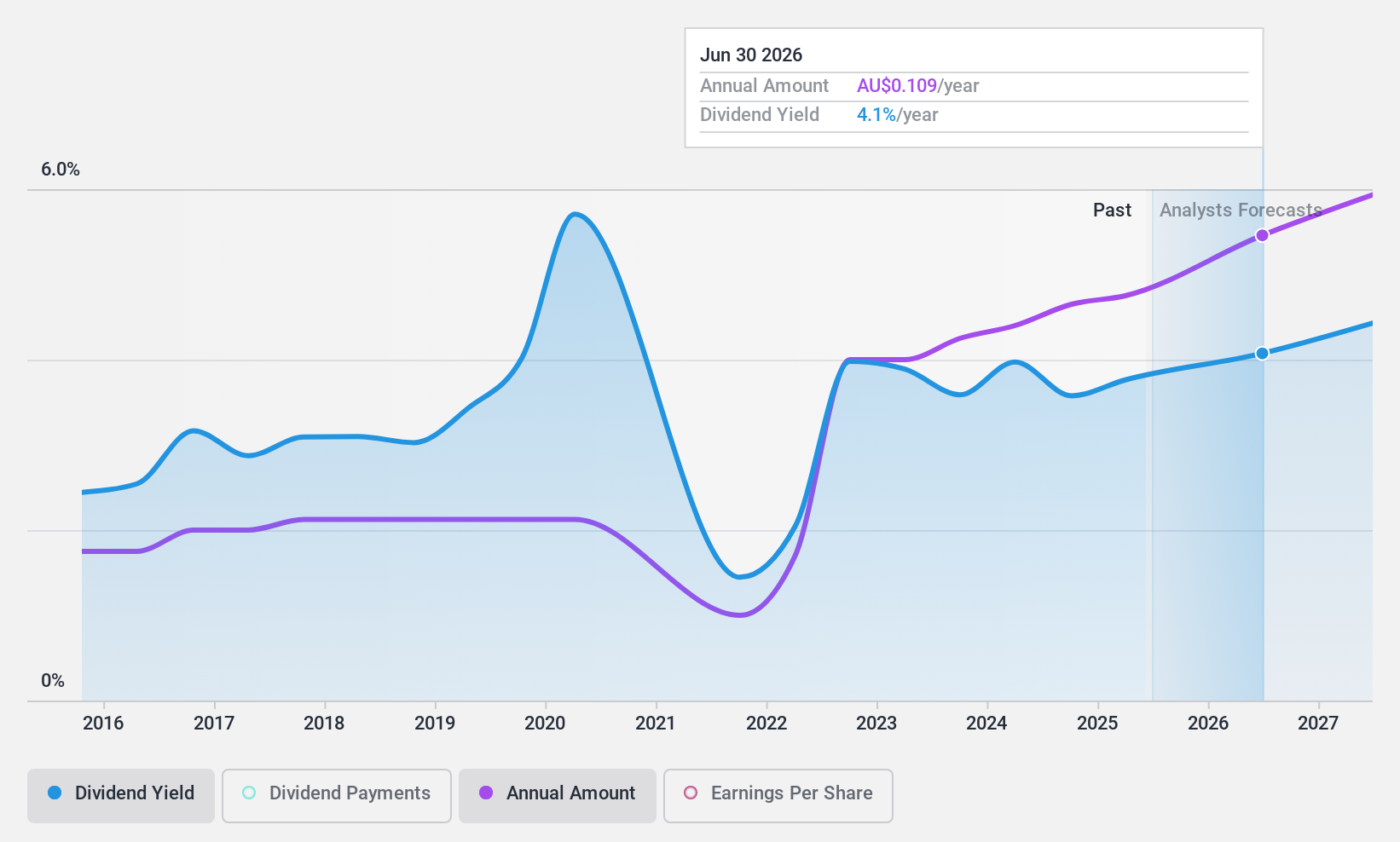

Ridley (ASX:RIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ridley Corporation Limited, with a market cap of A$814.66 million, operates in Australia providing animal nutrition solutions through its subsidiaries.

Operations: Ridley Corporation Limited generates revenue from its Bulk Stockfeeds segment with A$886.59 million and its Packaged/Ingredients segment with A$376.31 million.

Dividend Yield: 3.6%

Ridley Corporation's dividend sustainability is supported by a payout ratio of 71.7% and a cash payout ratio of 41.3%, indicating coverage by both earnings and cash flows. However, its dividends have been volatile over the past decade, with current yields (3.65%) below top-tier Australian payers. Recent developments include a share buyback program worth A$20 million to enhance shareholder value and an increased dividend distribution of A$0.0465 per share for October 2024 payments.

- Click here and access our complete dividend analysis report to understand the dynamics of Ridley.

- The valuation report we've compiled suggests that Ridley's current price could be quite moderate.

Summing It All Up

- Take a closer look at our Top ASX Dividend Stocks list of 40 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Storage REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NSR

National Storage REIT

National Storage is the largest self-storage provider in Australia and New Zealand, with over 225 centres providing tailored storage solutions to over 90,000 residential and commercial customers.

Established dividend payer with reasonable growth potential.