Stock Analysis

Further weakness as Hazer Group (ASX:HZR) drops 12% this week, taking three-year losses to 54%

Investing in stocks inevitably means buying into some companies that perform poorly. But long term Hazer Group Limited (ASX:HZR) shareholders have had a particularly rough ride in the last three year. So they might be feeling emotional about the 55% share price collapse, in that time. And over the last year the share price fell 38%, so we doubt many shareholders are delighted. Furthermore, it's down 19% in about a quarter. That's not much fun for holders.

After losing 12% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Hazer Group

Given that Hazer Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over three years, Hazer Group grew revenue at 3.5% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. It's likely this weak growth has contributed to an annualised return of 16% for the last three years. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term). After all, growing a business isn't easy, and the process will not always be smooth.

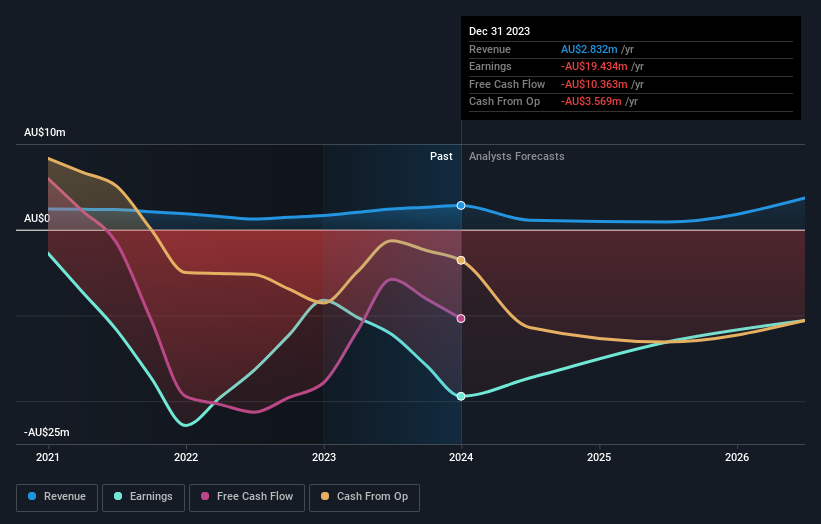

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. If you are thinking of buying or selling Hazer Group stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While the broader market gained around 13% in the last year, Hazer Group shareholders lost 36%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 9%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Hazer Group , and understanding them should be part of your investment process.

Hazer Group is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Hazer Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Hazer Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HZR

Hazer Group

Operates as a clean technology development company in Australia.

Flawless balance sheet with limited growth.