- Australia

- /

- Metals and Mining

- /

- ASX:GTE

Great Western Exploration (ASX:GTE) Shareholders Received A Total Return Of Negative 45% In The Last Three Years

Great Western Exploration Limited (ASX:GTE) shareholders should be happy to see the share price up 19% in the last month. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 78% in the last three years, falling well short of the market return.

View our latest analysis for Great Western Exploration

Great Western Exploration recorded just AU$18,471 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that Great Western Exploration will find or develop a valuable new mine before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. There was already a significant chance that they would need more money for business development, and indeed they recently put themselves at the mercy of capital markets and raised equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some Great Western Exploration investors have already had a taste of the bitterness stocks like this can leave in the mouth.

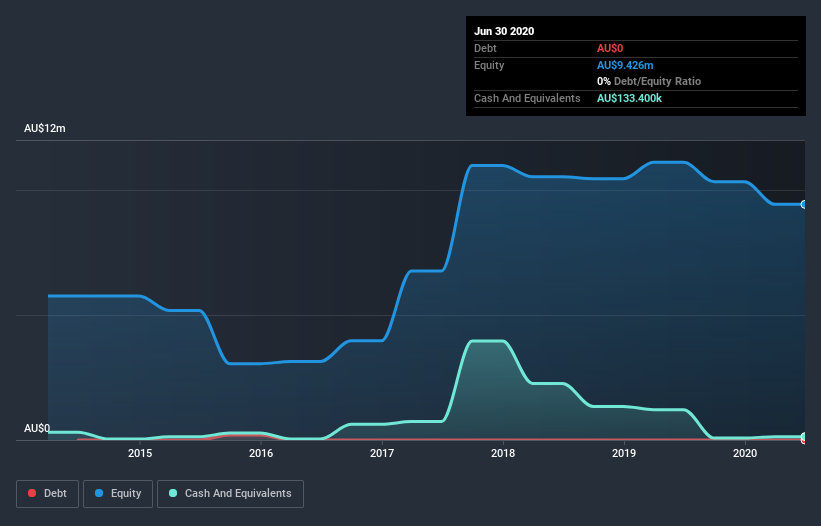

Great Western Exploration had liabilities exceeding cash when it last reported, according to our data. That made it extremely high risk, in our view. But with the share price diving 21% per year, over 3 years , it's probably fair to say that some shareholders no longer believe the company will succeed or they are worried about dilution with the recent cash injection. You can see in the image below, how Great Western Exploration's cash levels have changed over time (click to see the values).

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. What if insiders are ditching the stock hand over fist? It would bother me, that's for sure. It only takes a moment for you to check whether we have identified any insider sales recently.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Great Western Exploration's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that Great Western Exploration's TSR, at -45% is higher than its share price return of -78%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

We're pleased to report that Great Western Exploration shareholders have received a total shareholder return of 249% over one year. Notably the five-year annualised TSR loss of 5% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Great Western Exploration (2 are a bit unpleasant) that you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

When trading Great Western Exploration or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:GTE

Great Western Exploration

Engages in the exploration of mineral properties in Australia.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026