- Australia

- /

- Metals and Mining

- /

- ASX:PEX

Bio-Gene Technology And 2 Other ASX Penny Stocks To Watch For Growth

Reviewed by Simply Wall St

The Australian market has been showing positive momentum, with the ASX200 up 0.49% as investor sentiment is buoyed by expectations of an RBA rate cut. In such a climate, identifying stocks that combine affordability with growth potential can be particularly appealing to investors looking for opportunities beyond traditional sectors. Although the term 'penny stock' may seem outdated, these smaller or newer companies often hold promise when backed by solid financials, offering a chance for significant returns in today's dynamic market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.4M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.97 | A$320.75M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.52 | A$102.12M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.99 | A$247.9M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.92 | A$106.21M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.18 | A$337.66M | ★★★★☆☆ |

| Vita Life Sciences (ASX:VLS) | A$1.95 | A$108.49M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.315 | A$62.65M | ★★★★★☆ |

Click here to see the full list of 1,027 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Bio-Gene Technology (ASX:BGT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bio-Gene Technology Limited is an agtech development company focused on developing and commercializing naturally derived insecticide products in Australia and internationally, with a market cap of A$10.67 million.

Operations: The company's revenue segment is derived entirely from conducting research and development activities in the agricultural sector, amounting to A$0.01832 million.

Market Cap: A$10.67M

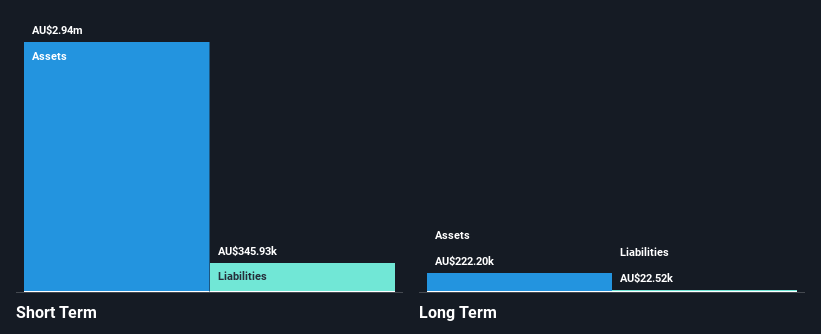

Bio-Gene Technology, with a market cap of A$10.67 million, is a pre-revenue company focused on developing insecticide products. Despite being debt-free and having short-term assets of A$2.9 million exceeding liabilities, the company faces financial challenges with less than a year of cash runway and increasing losses over five years at 9% annually. The company's share price has been highly volatile recently, and its management team lacks experience with an average tenure of 1.4 years. With no significant revenue streams yet, Bio-Gene's financial position remains precarious in the competitive agtech sector.

- Get an in-depth perspective on Bio-Gene Technology's performance by reading our balance sheet health report here.

- Gain insights into Bio-Gene Technology's past trends and performance with our report on the company's historical track record.

GreenX Metals (ASX:GRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GreenX Metals Limited focuses on the exploration and evaluation of mineral properties in Greenland, Poland, and Germany with a market cap of A$215.51 million.

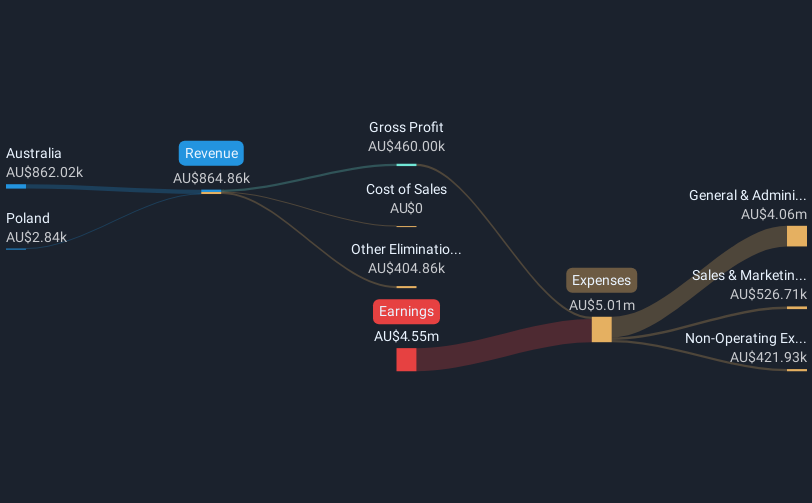

Operations: The company generates its revenue of A$0.46 million from mineral exploration activities.

Market Cap: A$215.51M

GreenX Metals, with a market cap of A$215.51 million, is a pre-revenue company focused on mineral exploration in Greenland, Poland, and Germany. Recent identification of high-grade antimony mineralisation at its Eleonore North project in Greenland aligns with global strategic interest due to China's export controls. The company is debt-free and has sufficient cash runway for over a year based on current free cash flow. Despite unprofitability and declining earnings over five years, GreenX's seasoned management and board provide stability as it explores the potential of antimony-gold systems amidst favorable market conditions.

- Click to explore a detailed breakdown of our findings in GreenX Metals' financial health report.

- Explore historical data to track GreenX Metals' performance over time in our past results report.

Peel Mining (ASX:PEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Peel Mining Limited is an Australian company focused on exploring economic mineral deposits, with a market cap of A$69.73 million.

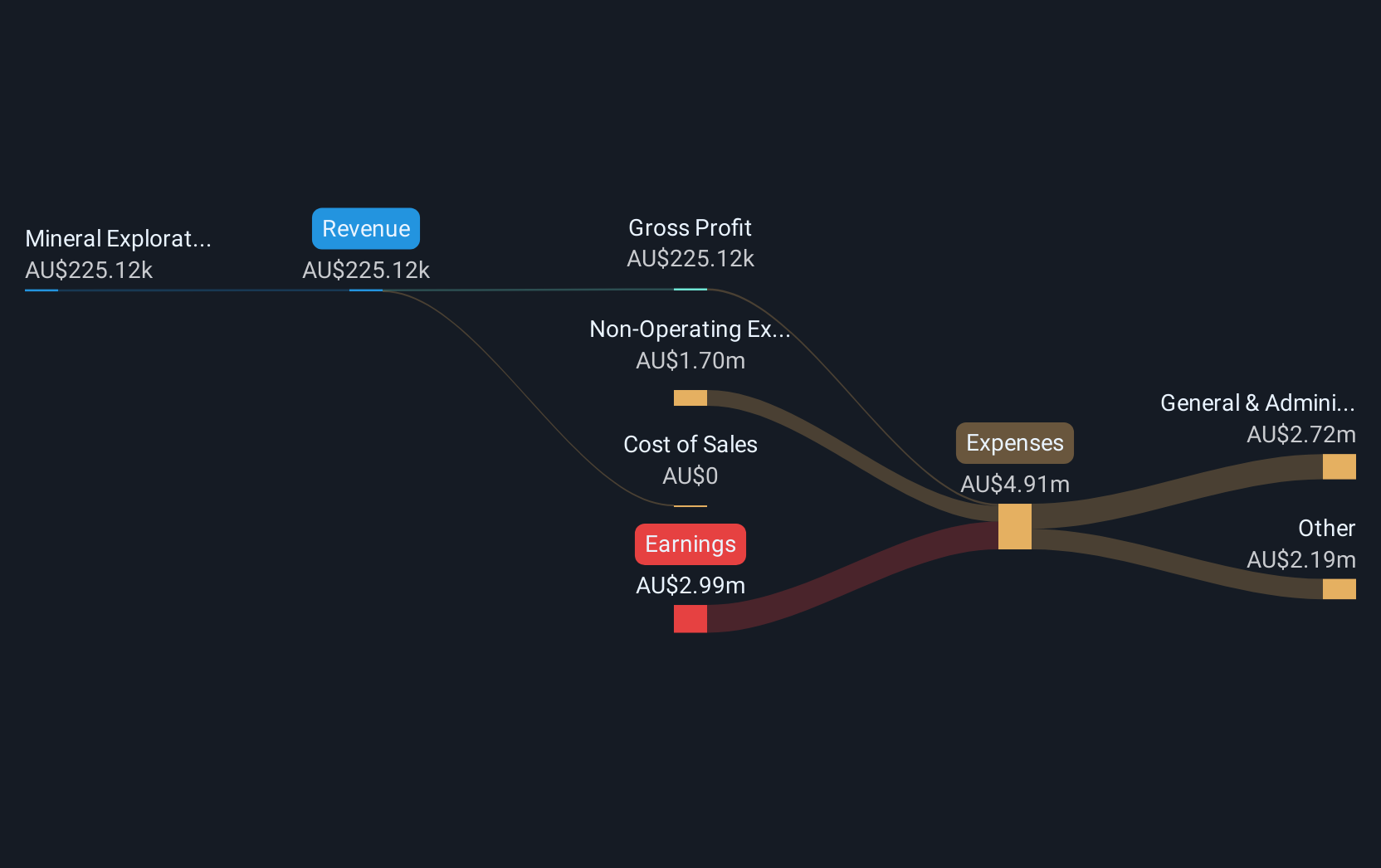

Operations: Peel Mining generates its revenue from the Mineral Exploration and Development segment, amounting to A$0.000416 million.

Market Cap: A$69.73M

Peel Mining, with a market cap of A$69.73 million, is pre-revenue and focuses on mineral exploration. The company has a sufficient cash runway for 2.4 years if free cash flow grows at historical rates and remains debt-free, which enhances financial stability. Although unprofitable with increasing losses over the past five years, its short-term assets significantly exceed both short- and long-term liabilities, indicating solid liquidity management. The management team averages 2.8 years in tenure, suggesting some level of experience in navigating the challenges associated with early-stage exploration companies like Peel Mining.

- Jump into the full analysis health report here for a deeper understanding of Peel Mining.

- Learn about Peel Mining's historical performance here.

Taking Advantage

- Access the full spectrum of 1,027 ASX Penny Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PEX

Peel Mining

Engages in the exploration for economic deposits of minerals in Australia.

Adequate balance sheet slight.

Market Insights

Community Narratives