- Australia

- /

- Specialty Stores

- /

- ASX:JYC

Global Lithium Resources And 2 Other ASX Penny Stocks To Consider

Reviewed by Simply Wall St

As the Australian market braces for the Reserve Bank of Australia's latest rate decision, investors are keeping a close eye on potential shifts in economic policy. Amidst these broader market dynamics, penny stocks remain an intriguing investment area, offering affordability and growth potential through smaller or newer companies. Despite being considered an outdated term by some, penny stocks continue to hold relevance as they can provide opportunities for significant returns when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.03 | A$330.52M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.70 | A$94.04M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.595 | A$781.68M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.86 | A$237.13M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$2.04 | A$114.72M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.32 | A$112.7M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.90 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,046 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Global Lithium Resources (ASX:GL1)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Global Lithium Resources Limited focuses on the evaluation, exploration, and development of lithium resources in Australia with a market cap of A$58.63 million.

Operations: Global Lithium Resources Limited does not report any revenue segments.

Market Cap: A$58.63M

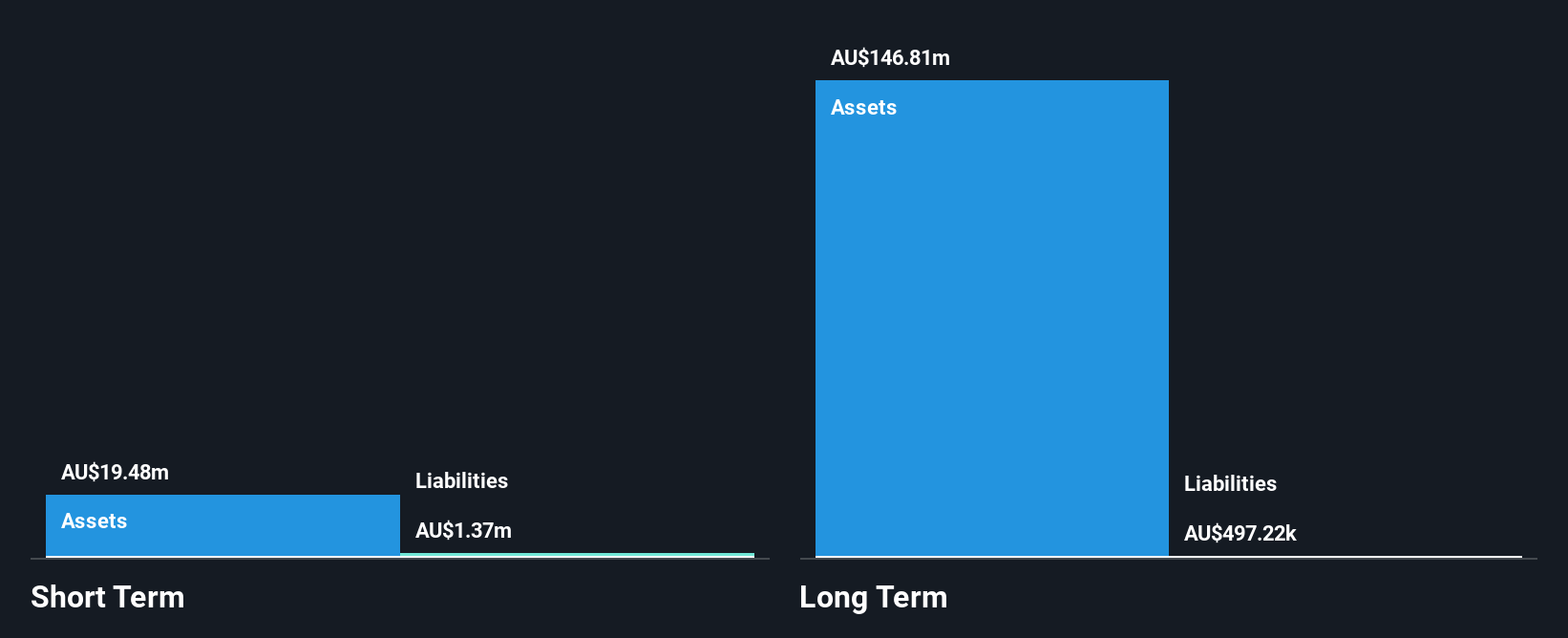

Global Lithium Resources Limited is navigating a challenging pre-revenue phase, with recent reported earnings of A$2.45 million and a net loss of A$4.37 million for the year ending June 2024. Despite having no debt and short-term assets exceeding liabilities, the company faces high volatility and an inexperienced management team with an average tenure of 1.2 years. Recent executive changes include Matthew Allen's transition to Non-Executive Director and Kevin Hart providing CFO services following role redundancies. The company is focusing on targeted exploration activities while managing financial constraints through board restructuring and expenditure reductions.

- Click to explore a detailed breakdown of our findings in Global Lithium Resources' financial health report.

- Assess Global Lithium Resources' future earnings estimates with our detailed growth reports.

Joyce (ASX:JYC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Joyce Corporation Ltd (ASX:JYC) is an Australian company that retails kitchen and wardrobe products, with a market cap of A$144.89 million.

Operations: Joyce generates revenue through its Retail Bedding - Franchise Operation (A$5.89 million), Retail Bedding Stores - Company-owned (A$17.26 million), and Retail Kitchen and Wardrobe Showrooms (A$121.30 million).

Market Cap: A$144.89M

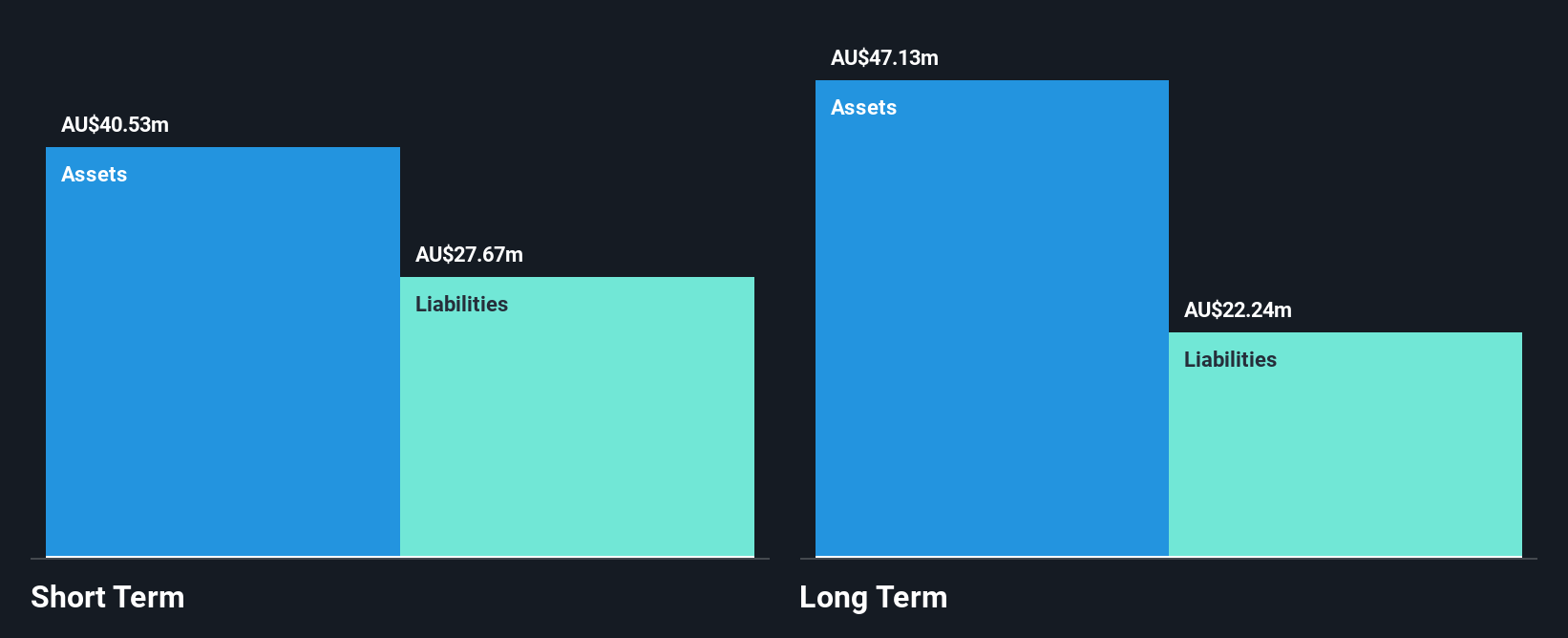

Joyce Corporation Ltd, with a market cap of A$144.89 million, demonstrates strong financial health as it operates debt-free and maintains high-quality earnings. The company has shown consistent profit growth, with earnings increasing by 11.7% over the past year and outperforming the Specialty Retail industry average. Joyce's short-term assets significantly exceed both its short- and long-term liabilities, ensuring robust liquidity. However, shareholders experienced dilution in the past year despite an outstanding Return on Equity of 45.2%. Recent board changes include the retirement of long-serving Non-Executive Director Dan Smetana after four decades at Joyce.

- Jump into the full analysis health report here for a deeper understanding of Joyce.

- Understand Joyce's track record by examining our performance history report.

Paradigm Biopharmaceuticals (ASX:PAR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Paradigm Biopharmaceuticals Limited focuses on the research and development of therapeutic products for human use in Australia, with a market cap of A$202.67 million.

Operations: Paradigm Biopharmaceuticals Limited has not reported any revenue segments.

Market Cap: A$202.67M

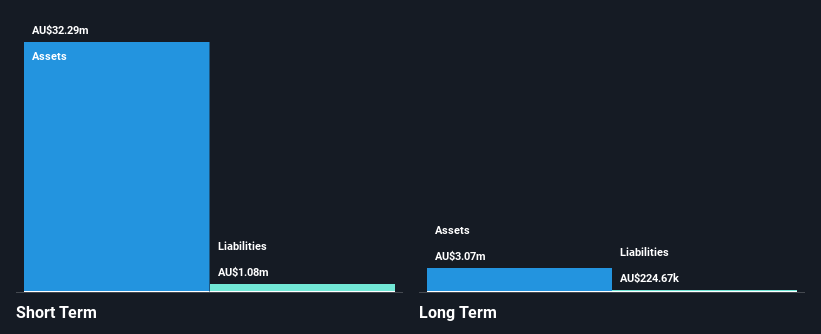

Paradigm Biopharmaceuticals, with a market cap of A$202.67 million, is pre-revenue and currently unprofitable, facing an expected earnings decline of 13.2% annually over the next three years. Despite this, the company maintains a strong financial position with no debt and short-term assets exceeding liabilities by A$20.9 million. Recent strategic shifts include Dr. Donna Skerrett stepping down from her board role to focus on Paradigm's pivotal Phase 3 clinical trial for its therapeutic products, which is progressing towards FDA submission and intended patient enrolment in early 2025 across multiple sites in Australia and the U.S.

- Dive into the specifics of Paradigm Biopharmaceuticals here with our thorough balance sheet health report.

- Gain insights into Paradigm Biopharmaceuticals' outlook and expected performance with our report on the company's earnings estimates.

Make It Happen

- Click through to start exploring the rest of the 1,043 ASX Penny Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:JYC

Joyce

Joyce Corporation Ltd retails kitchen and wardrobe products in Australia.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion