- Australia

- /

- Construction

- /

- ASX:VBC

Bravura Solutions And 2 Other ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian stock market is showing modest gains, buoyed by a late Christmas rally in the U.S., with precious metals and the Australian dollar also enjoying strong performances. In this context, investors might find value in exploring penny stocks—an investment area often associated with smaller or newer companies that can offer growth potential at lower price points. Despite being considered somewhat outdated, these stocks can still present significant opportunities when backed by solid financials and sound fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.39 | A$116.07M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.50 | A$67.93M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.775 | A$48.26M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.87 | A$456.46M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.85 | A$3.5B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.22 | A$1.39B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.84 | A$120.18M | ✅ 4 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.48 | A$230.53M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.21 | A$124.98M | ✅ 4 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.45 | A$645.2M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 427 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Bravura Solutions (ASX:BVS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bravura Solutions Limited offers software solutions for the wealth management and transfer agency sectors across Australia, the United Kingdom, New Zealand, and other international markets, with a market cap of A$1.19 billion.

Operations: Bravura Solutions generates revenue from two main geographical segments: APAC with A$72.63 million and EMEA with A$186.07 million.

Market Cap: A$1.19B

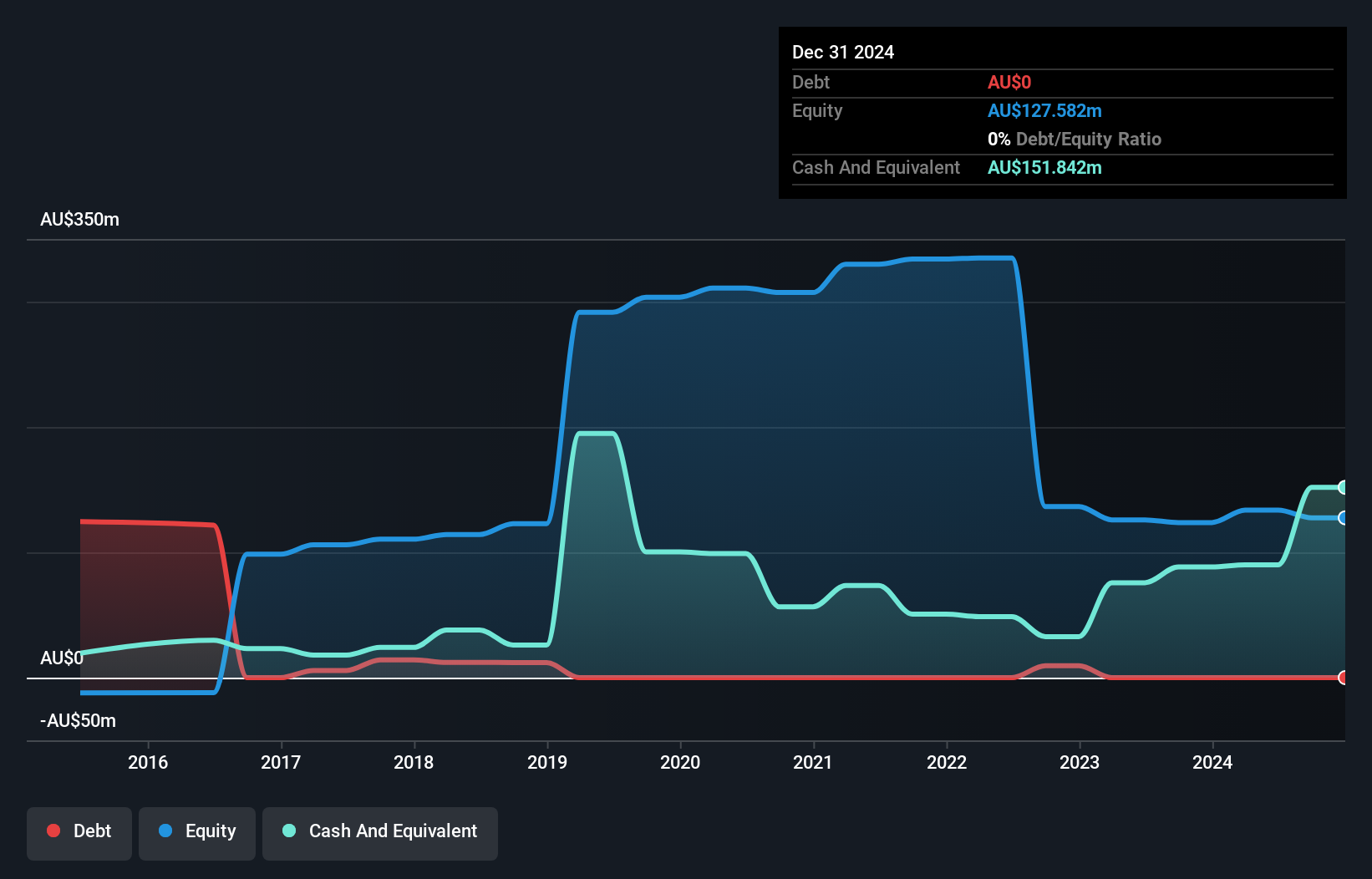

Bravura Solutions has shown significant financial resilience, with short-term assets of A$119.9 million surpassing both its long-term liabilities of A$15.2 million and short-term liabilities of A$71.0 million. The company is debt-free, which eliminates concerns about interest payments, and it boasts an outstanding return on equity at 79.3%. Recent earnings growth is remarkable at 745.7%, far outpacing the industry average, and current net profit margins have improved to 23.4% from last year's 3.5%. However, insider selling over the past quarter may warrant cautious observation despite trading below estimated fair value by 19.8%.

- Click here and access our complete financial health analysis report to understand the dynamics of Bravura Solutions.

- Understand Bravura Solutions' earnings outlook by examining our growth report.

Global Lithium Resources (ASX:GL1)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Global Lithium Resources Limited focuses on the evaluation, exploration, and development of lithium resources in Australia with a market cap of A$154.42 million.

Operations: Global Lithium Resources Limited has not reported any revenue segments.

Market Cap: A$154.42M

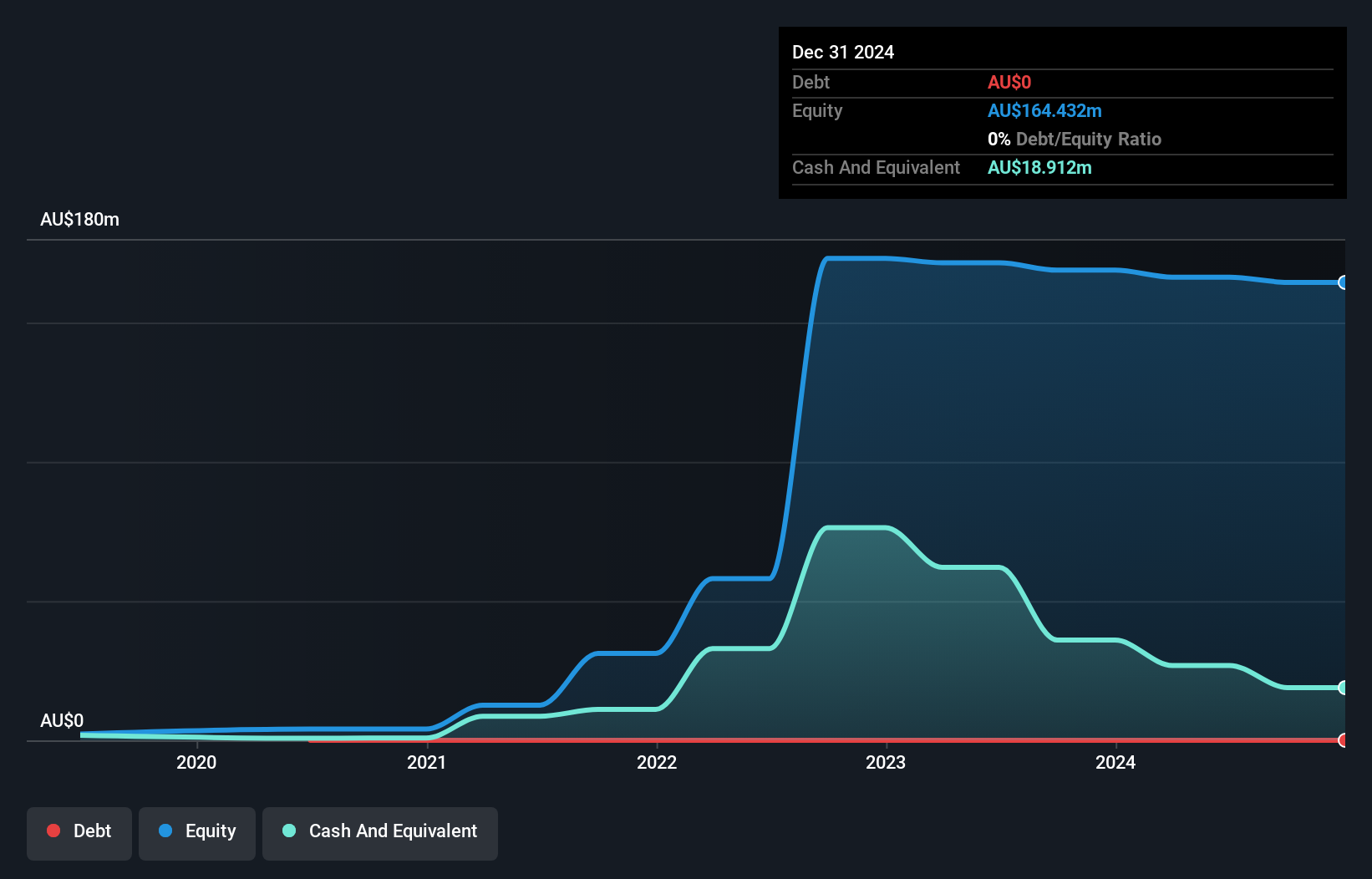

Global Lithium Resources Limited, with a market cap of A$154.42 million, is focused on lithium exploration and remains pre-revenue with earnings under US$1 million. Its short-term assets of A$16.6 million comfortably cover both short-term and long-term liabilities, suggesting financial stability despite being unprofitable. The company has no debt but faces challenges in achieving profitability over the next three years and has experienced increased losses over the past five years at an annual rate of 27.1%. Management tenure averages 2.2 years, indicating some experience, while the board is relatively new with an average tenure of 1.1 years.

- Click to explore a detailed breakdown of our findings in Global Lithium Resources' financial health report.

- Learn about Global Lithium Resources' future growth trajectory here.

Verbrec (ASX:VBC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Verbrec Limited offers engineering, asset management, training, mining technology software, and operations and maintenance services to the mining, energy, defense, and infrastructure sectors across Australia, New Zealand, Papua New Guinea, and the Pacific Islands with a market cap of A$64.28 million.

Operations: The company's revenue is derived from two main segments: Engineering, which generated A$77.86 million, and Training, which contributed A$7.76 million.

Market Cap: A$64.28M

Verbrec Limited, with a market cap of A$64.28 million, has shown profitability growth over the past five years but faced a recent earnings decline of 21.4%. The company’s short-term assets comfortably cover both its short-term and long-term liabilities, indicating solid financial management. Despite lower net profit margins compared to last year and a Return on Equity considered low at 15.7%, Verbrec's debt is well-covered by operating cash flow, and interest payments are adequately managed with EBIT coverage at 5.5x. Additionally, the company announced a share buyback program aimed at reducing administrative costs associated with small holdings.

- Get an in-depth perspective on Verbrec's performance by reading our balance sheet health report here.

- Examine Verbrec's earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Investigate our full lineup of 427 ASX Penny Stocks right here.

- Ready For A Different Approach? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VBC

Verbrec

Primarily provides engineering, asset management, training, mining technology software, and operations and maintenance services to mining, energy, defense, and infrastructure industries in Australia, New Zealand, Papua New Guinea, and the Pacific Islands.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion