- Australia

- /

- Metals and Mining

- /

- ASX:GGP

ASX Growth Stocks With High Insider Ownership To Watch

Reviewed by Simply Wall St

As the ASX200 navigates a mixed landscape with sectors like Real Estate and Discretionary pulling ahead while Materials lag, investors are keenly observing the broader market dynamics. In such an environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong management confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Image Resources (ASX:IMA) | 22.3% | 79.8% |

| Findi (ASX:FND) | 33.6% | 91.2% |

| Fenix Resources (ASX:FEX) | 21.1% | 54.7% |

| Emerald Resources (ASX:EMR) | 18.1% | 36% |

| Echo IQ (ASX:EIQ) | 18% | 51.4% |

| Cyclopharm (ASX:CYC) | 11.3% | 97.8% |

| BlinkLab (ASX:BB1) | 39.8% | 52.7% |

| Alfabs Australia (ASX:AAL) | 10.8% | 41.3% |

| Acrux (ASX:ACR) | 15.5% | 106.9% |

We're going to check out a few of the best picks from our screener tool.

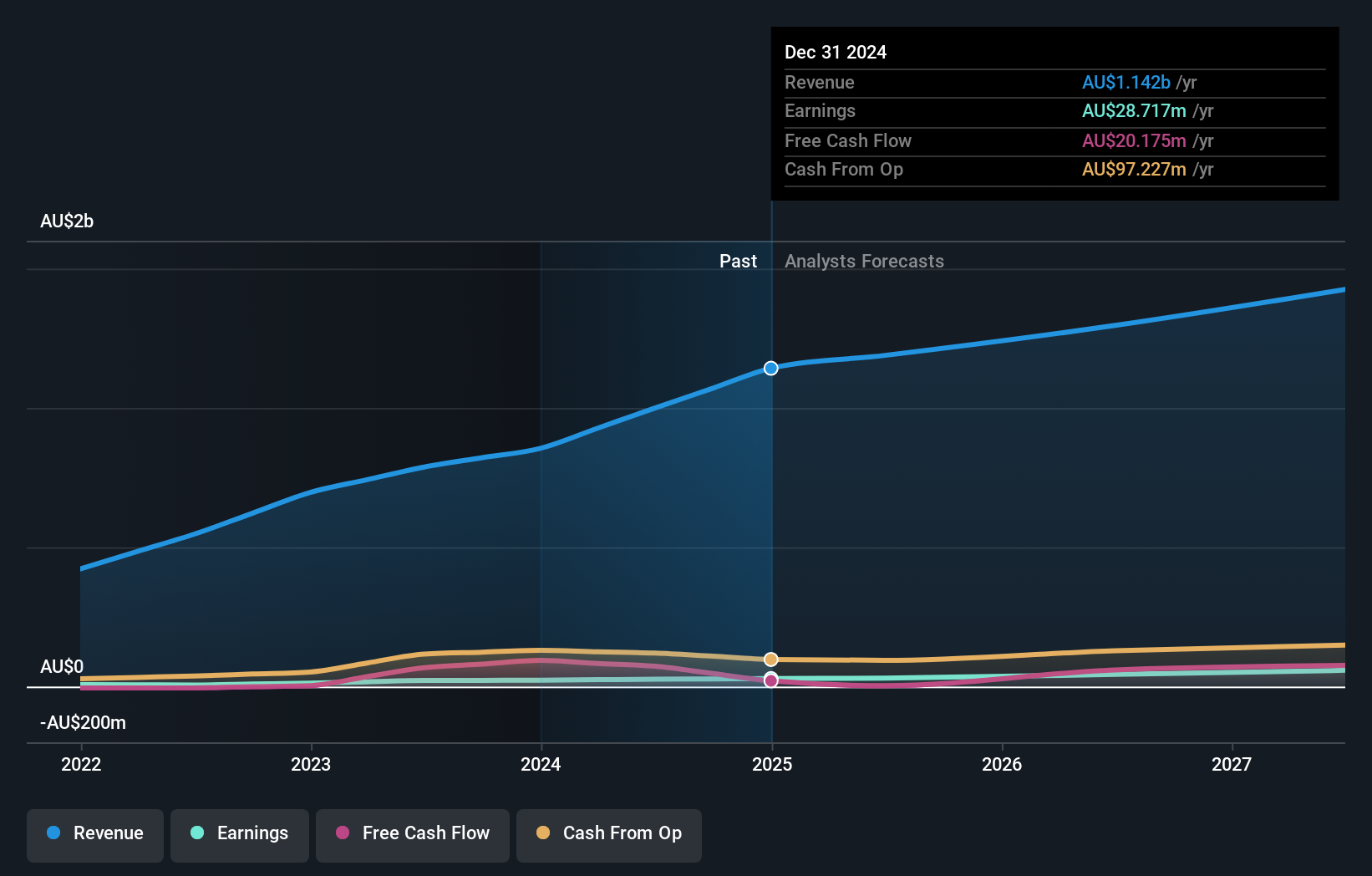

Aussie Broadband (ASX:ABB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aussie Broadband Limited offers telecommunications and technology services in Australia, with a market cap of A$1.29 billion.

Operations: The company's revenue segments include Business (A$102.99 million), Wholesale (A$143.55 million), Residential (A$628.51 million), and Enterprise and Government (A$93.51 million).

Insider Ownership: 11.2%

Aussie Broadband is experiencing significant growth, with earnings forecast to rise 24.21% annually, outpacing the Australian market's 11.2%. Despite trading at 69.3% below its estimated fair value, there has been notable insider selling recently. Revenue is expected to grow faster than the market at 8.3% per year but remains below high-growth benchmarks. The addition of Sarah Adam-Gedge as a non-executive director brings valuable expertise from leading large-scale technology firms across Asia-Pacific and Australia.

- Unlock comprehensive insights into our analysis of Aussie Broadband stock in this growth report.

- The analysis detailed in our Aussie Broadband valuation report hints at an inflated share price compared to its estimated value.

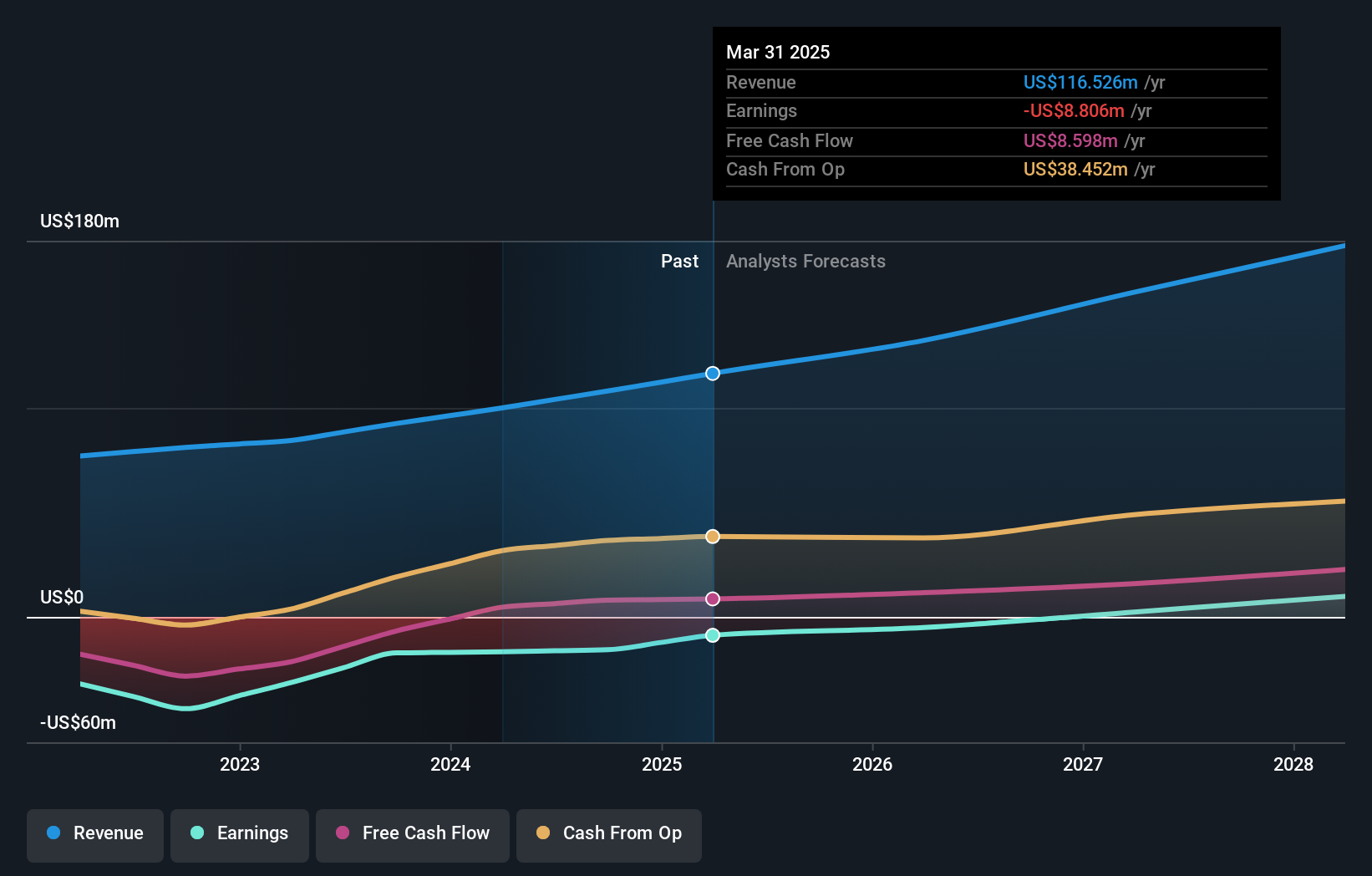

Catapult Sports (ASX:CAT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Catapult Sports Ltd is a sports science and analytics company that develops and supplies technologies to enhance athlete and team performance across Australia, Europe, the Middle East, Africa, the Asia Pacific, and the Americas, with a market cap of A$1.61 billion.

Operations: The company's revenue is derived from three primary segments: Tactics & Coaching ($36.66 million), Performance & Health ($63.47 million), and Media & Other ($16.40 million).

Insider Ownership: 15.5%

Catapult Sports, undergoing a name change from Catapult Group International Ltd, is projected to achieve significant earnings growth of 69.28% annually as it transitions to profitability over the next three years. Despite its revenue growth forecast of 13.8% per year being slower than high-growth benchmarks, it surpasses the Australian market average. Insider transactions have been mixed recently with substantial selling but no significant buying activity noted in the past three months.

- Click to explore a detailed breakdown of our findings in Catapult Sports' earnings growth report.

- The valuation report we've compiled suggests that Catapult Sports' current price could be inflated.

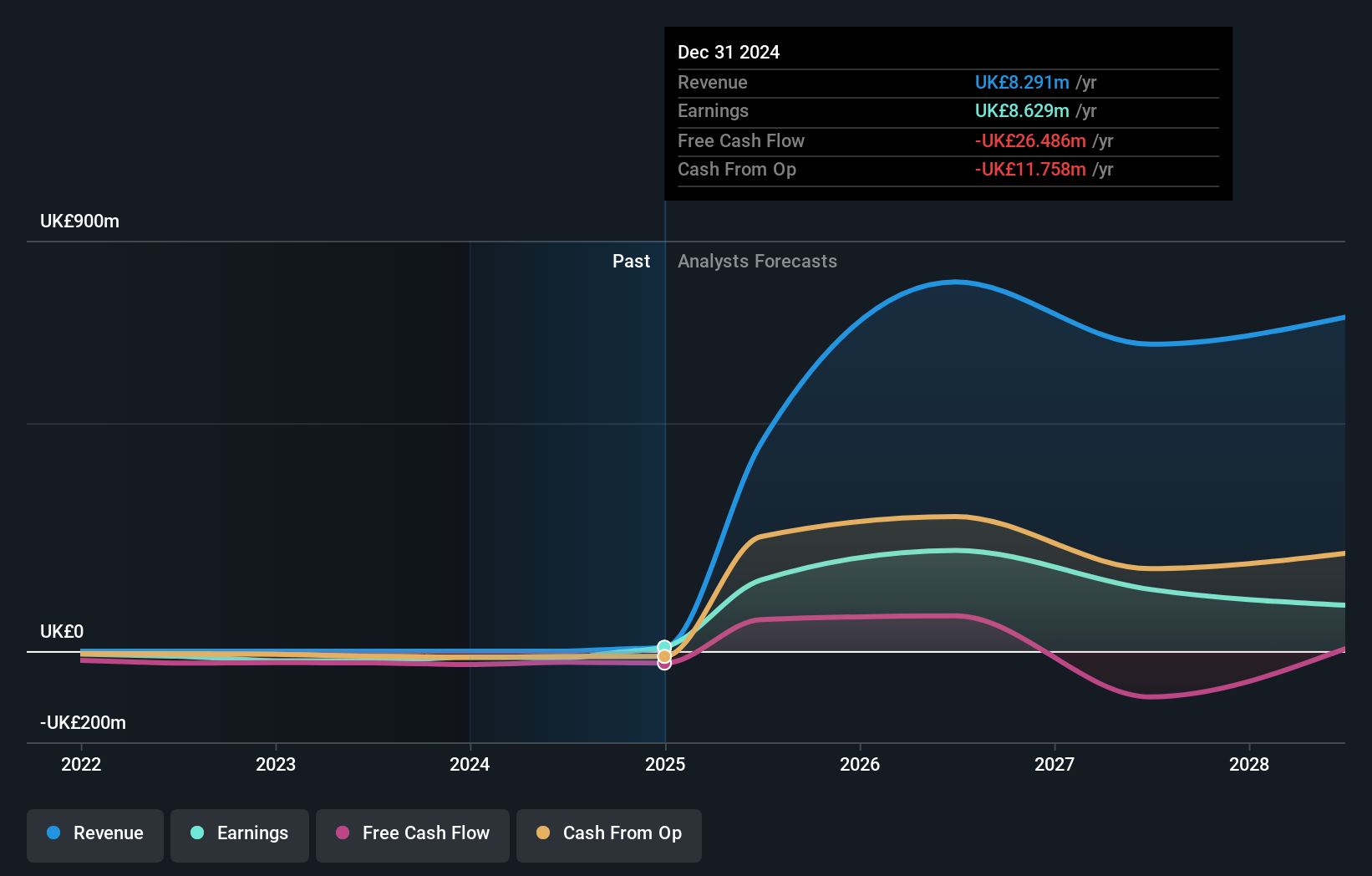

Greatland Resources (ASX:GGP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Greatland Resources Limited is a gold and copper mining company with a market cap of A$3.67 billion.

Operations: Greatland Resources Limited generates its revenue from gold and copper mining operations.

Insider Ownership: 14.2%

Greatland Resources anticipates robust earnings growth of 24.4% annually, outpacing the Australian market's average. The company's revenue is also expected to grow significantly at 24.2% per year, driven by its recent IPO raising A$504 million and planned gold production of 260-310 koz for fiscal 2026. Despite these positives, Greatland's return on equity is forecast to remain low at 15%. Recent changes include a stock split and new auditors from PwC following its ASX listing.

- Navigate through the intricacies of Greatland Resources with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Greatland Resources shares in the market.

Turning Ideas Into Actions

- Get an in-depth perspective on all 95 Fast Growing ASX Companies With High Insider Ownership by using our screener here.

- Contemplating Other Strategies? The end of cancer? These 26 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GGP

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives