As Australian markets react to the escalating China-U.S. trade tensions, opening lower and reflecting global economic uncertainties, investors are increasingly exploring diverse opportunities. Penny stocks, although a somewhat outdated term, still represent an intriguing investment area for those seeking potential growth in smaller or newer companies. In this article, we explore three penny stocks that combine financial strength with promising prospects, offering investors a chance to discover under-the-radar firms with long-term potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.575 | A$122.87M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$2.11 | A$155.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.755 | A$993.33M | ✅ 4 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.38 | A$65.1M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.24 | A$346.06M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.57 | A$109.85M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.05 | A$144.72M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.89 | A$633.9M | ✅ 5 ⚠️ 3 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.63 | A$430.76M | ✅ 4 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.34 | A$39.89M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 980 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Cadoux (ASX:CCM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cadoux Limited is involved in the exploration, evaluation, and development of mineral properties across Australia and Southeast Asia, with a market cap of A$19.47 million.

Operations: Cadoux Limited has not reported any revenue segments.

Market Cap: A$19.47M

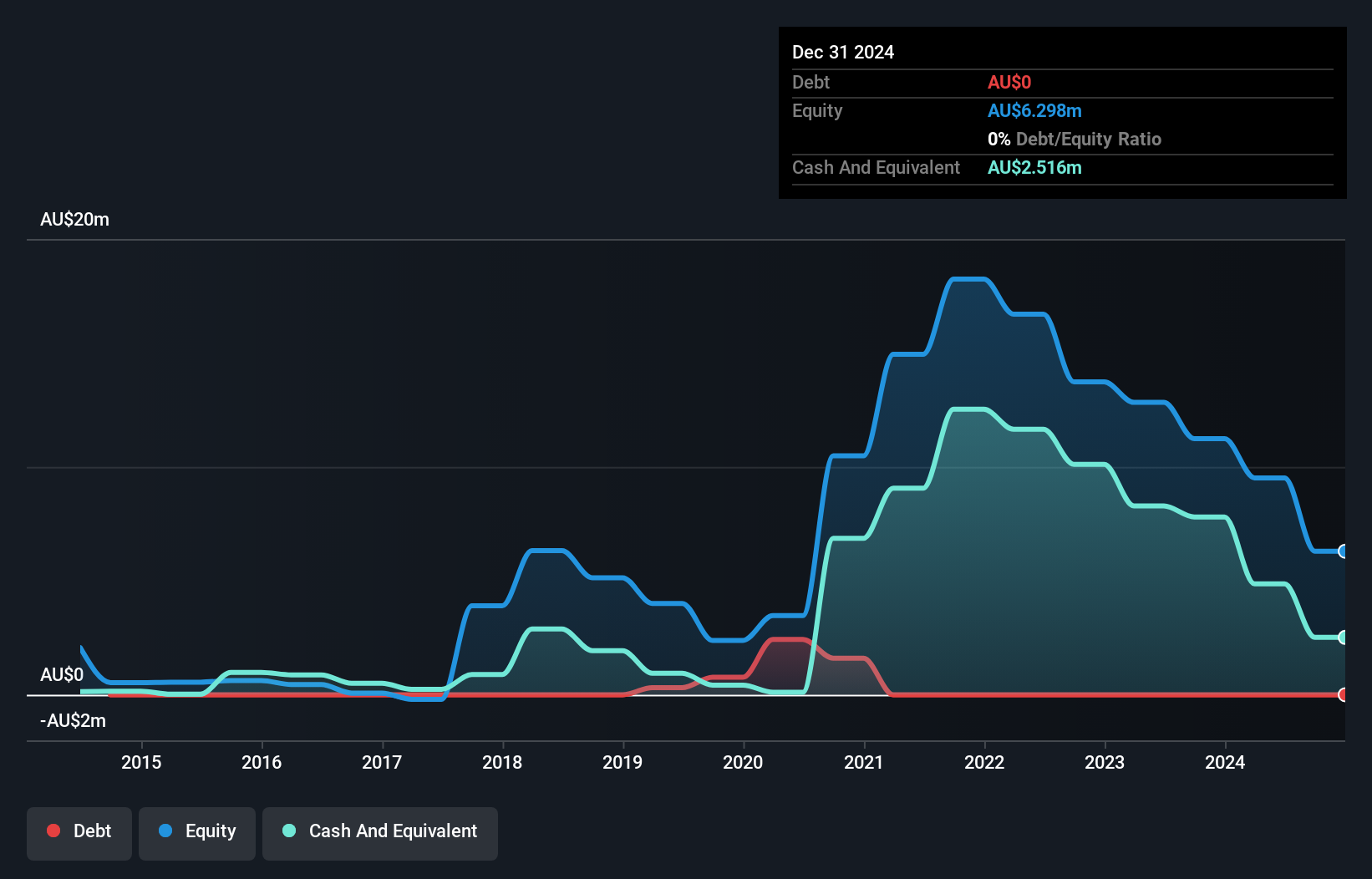

Cadoux Limited, with a market cap of A$19.47 million, operates as a pre-revenue company focused on mineral exploration and development. Despite being debt-free and having short-term assets of A$3.2 million exceeding its liabilities, Cadoux faces financial challenges with less than one year of cash runway based on current free cash flow trends. The company's earnings have declined by 10% annually over the past five years, culminating in a net loss of A$3.49 million for the recent half-year period ending December 2024. Management is seasoned with an average tenure of 14.2 years, providing stability amid these financial hurdles.

- Jump into the full analysis health report here for a deeper understanding of Cadoux.

- Explore historical data to track Cadoux's performance over time in our past results report.

Galileo Mining (ASX:GAL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Galileo Mining Ltd is involved in the exploration of mineral deposits in Western Australia and has a market cap of A$25.69 million.

Operations: Galileo Mining Ltd does not report any revenue segments.

Market Cap: A$25.69M

Galileo Mining Ltd, with a market cap of A$25.69 million, is a pre-revenue company focused on mineral exploration in Western Australia. Recent assay results from its Norseman project indicate promising palladium and platinum anomalies, extending known strike lengths. The company is debt-free, with short-term assets of A$11.5 million comfortably covering liabilities of A$388.7K. Despite becoming profitable this year due to significant one-off gains, its return on equity remains low at 7.4%. The board's average tenure of 6.3 years suggests experienced governance amid the company's volatile share price movements over recent months.

- Navigate through the intricacies of Galileo Mining with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Galileo Mining's track record.

Hazer Group (ASX:HZR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hazer Group Limited is an Australian clean technology development company with a market cap of A$69.08 million.

Operations: The company generates revenue from the research and development of novel graphite-and-hydrogen-production technology, amounting to A$4.06 million.

Market Cap: A$69.08M

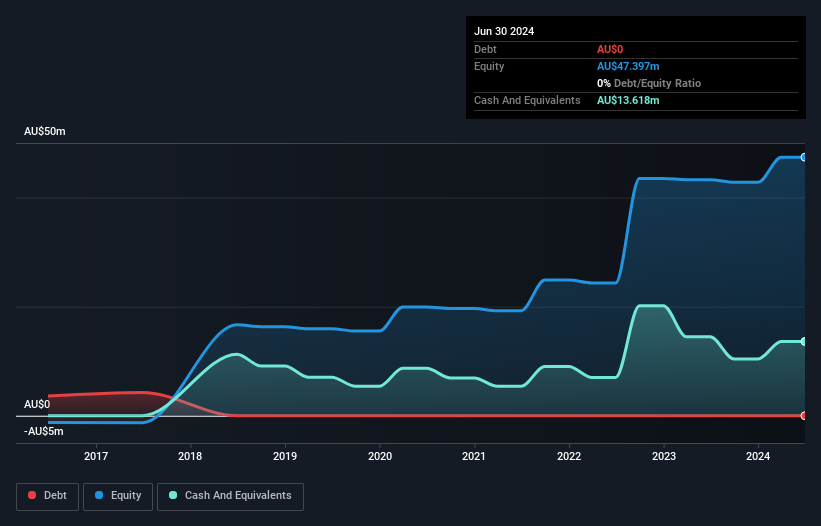

Hazer Group Limited, with a market cap of A$69.08 million, is a clean technology company focusing on graphite and hydrogen production. Despite generating A$4.06 million in revenue, it remains pre-revenue due to the lack of significant income streams. The company is debt-free and has short-term assets of A$12.5 million exceeding liabilities, yet faces challenges with less than a year of cash runway if cash flow trends persist. Recent earnings show improved revenue and reduced net losses compared to last year, but Hazer continues to be unprofitable with declining earnings over five years at 23.2% annually.

- Unlock comprehensive insights into our analysis of Hazer Group stock in this financial health report.

- Gain insights into Hazer Group's past trends and performance with our report on the company's historical track record.

Where To Now?

- Take a closer look at our ASX Penny Stocks list of 980 companies by clicking here.

- Interested In Other Possibilities? The latest GPUs need a type of rare earth metal called Neodymium and there are only 20 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hazer Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HZR

Hazer Group

Operates as a clean technology development company in Australia.

Flawless balance sheet low.

Market Insights

Community Narratives