- Australia

- /

- Metals and Mining

- /

- ASX:FMG

Will Fortescue's (ASX:FMG) New Myall Joint Venture Exploration Redefine Its Growth Narrative?

Reviewed by Sasha Jovanovic

- Magmatic Resources announced that drilling has commenced at its Myall farm-in and joint venture project in New South Wales, following FMG Resources' (a Fortescue subsidiary) commitment of an A$3.5 million work program budget for exploration during the 2025-2026 financial year.

- This move underscores Fortescue's ongoing pursuit of advanced mineral opportunities and highlights the company's use of joint ventures to expand its exploration footprint.

- We'll now examine how Fortescue's new exploration commitment in NSW could shift its investment narrative and future project prospects.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Fortescue Investment Narrative Recap

Fortescue shareholders generally need to believe in the company's ability to balance iron ore expansion with green transition investments, while managing volatile earnings and exposure to Chinese demand. The recent NSW exploration news, while highlighting Fortescue's commitment to expanding resources, does not appear to materially impact the most immediate catalysts or chief business risks such as declining earnings forecasts and reliance on iron ore pricing.

Among recent announcements, Fortescue’s October debt financing update, where the company increased its tender offer for USD 750 million in outstanding notes, stands out in relation to current financial catalysts. This action supports liquidity and adds flexibility in funding ongoing exploration programs like the Myall joint venture, though it comes amidst ongoing earnings pressures and elevated capital needs.

In contrast, even as Fortescue expands exploration, investors should also consider how shifts in global iron ore demand...

Read the full narrative on Fortescue (it's free!)

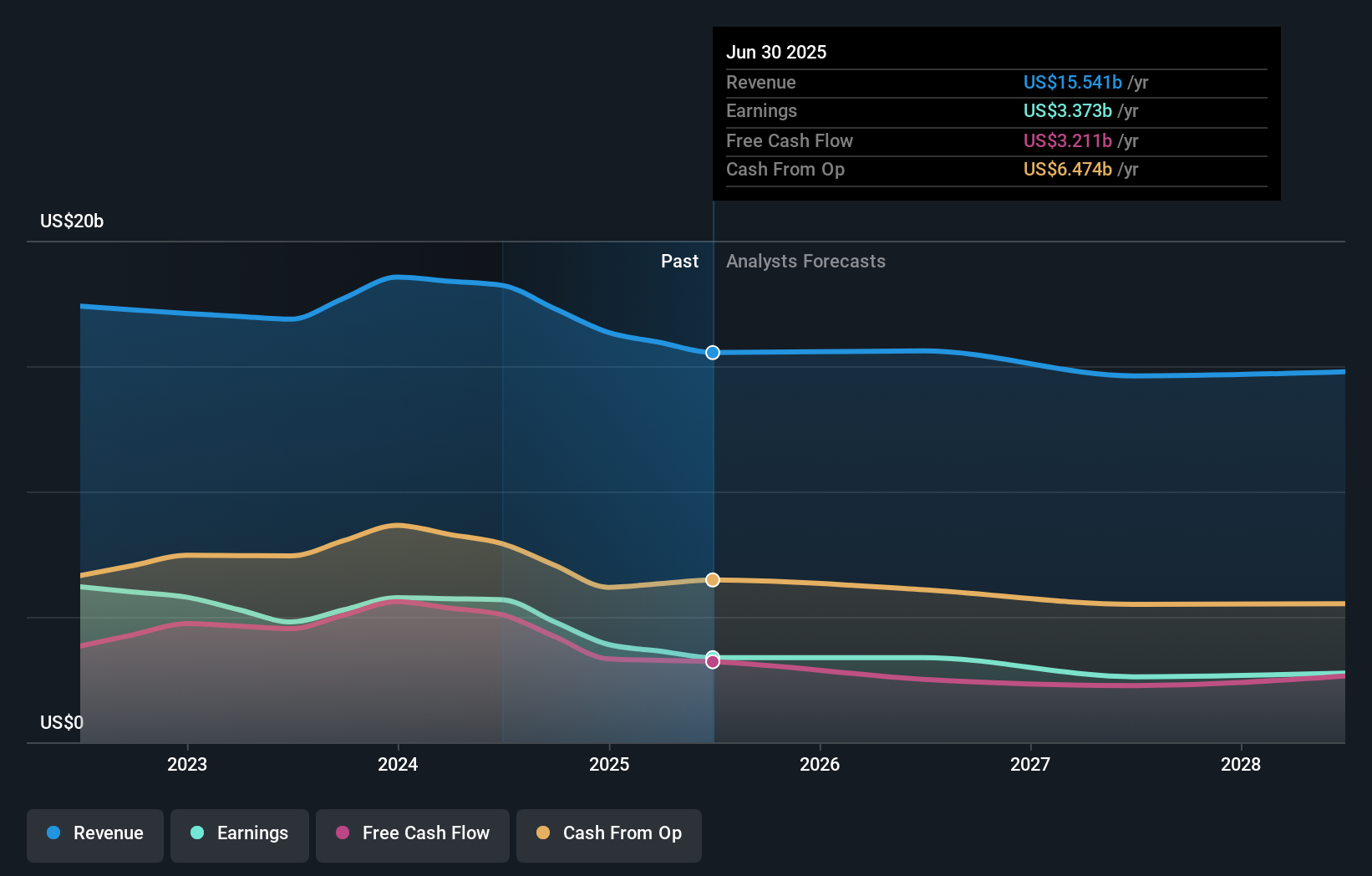

Fortescue's narrative projects $14.4 billion revenue and $2.4 billion earnings by 2028. This requires a 2.4% annual revenue decline and a decrease of $1.0 billion in earnings from $3.4 billion today.

Uncover how Fortescue's forecasts yield a A$18.93 fair value, a 6% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members place Fortescue’s fair value between A$18.93 and A$27.76, with 11 distinct estimates showing wide divergence. With many still focused on iron ore demand as a catalyst, it’s clear opinions differ greatly, consider reviewing several perspectives before forming your own view.

Explore 11 other fair value estimates on Fortescue - why the stock might be worth as much as 38% more than the current price!

Build Your Own Fortescue Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortescue research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Fortescue research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortescue's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FMG

Fortescue

Engages in the exploration, development, production, processing, and sale of iron ore in Australia, China, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives