- Australia

- /

- Metals and Mining

- /

- ASX:FEX

Fenix Resources (ASX:FEX): Evaluating Valuation Following New Performance Rights and Leadership Incentives

Reviewed by Kshitija Bhandaru

Fenix Resources (ASX:FEX) has caught investor attention this week after unveiling a significant round of performance rights grants, both to employees and key directors, following shareholder approval. These new allocations are designed to closely align management and staff with the company’s ongoing performance. This move sends a clear message about leadership’s focus on driving results in the increasingly competitive iron ore sector. For shareholders, such actions can be meaningful, as they do not only impact morale and engagement, but can also influence how the broader market assesses the company’s trajectory.

Looking more broadly, Fenix Resources has experienced considerable momentum over the past year. The stock is up nearly 88% in the past twelve months, with recent gains accelerating; returns are up 54% over the past month and 83% over the past three months. This price action comes in addition to the company’s multi-year performance, supported by higher reported revenue and net income figures. The combination of operational growth and evolving leadership incentives now sets a dynamic backdrop, creating new questions about what the market is pricing in for the future.

After a year of strong gains and a renewed focus from management, is Fenix Resources still undervalued, or are investors already betting on the next phase of its growth?

Most Popular Narrative: 69% Undervalued

The prevailing narrative views Fenix Resources as significantly undervalued, supported by ambitious growth forecasts and structural business shifts that could reshape its earnings profile in coming years.

Sustained demand for steel, underpinned by ongoing urbanization and infrastructure development in Asia and emerging markets, supports robust iron ore sales volumes and pricing for Fenix. This strengthens long-term revenue stability and cash flow generation. The company's focus on high-grade ore and potential participation in premium magnetite concentrate (via Athena/Byro magnetite project) positions it to capture higher pricing and benefit from global green steel initiatives, positively impacting revenue per tonne and profit margins.

Fenix’s valuation playbook hinges on transformative growth ambitions and a premium product shift. The consensus is not just calling for expansion, but a major leap in profitability and pricing power. Want the inside number that unlocks this high upside forecast? See the one projection that makes all the difference between today’s price and tomorrow’s potential.

Result: Fair Value of $1.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a heavy reliance on iron ore markets and the potential impact of rising industry costs could quickly undermine Fenix Resources' bullish outlook.

Find out about the key risks to this Fenix Resources narrative.Another View: Valuation from a Different Angle

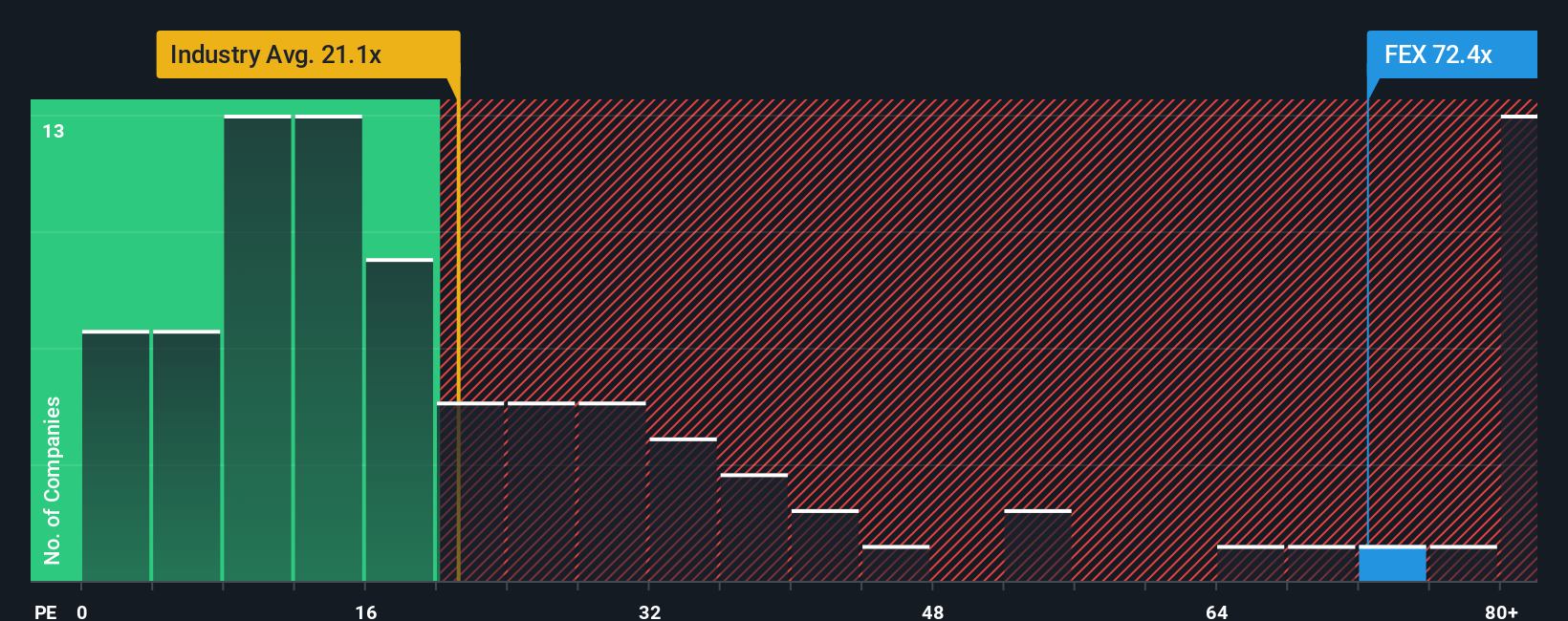

Looking at the company through the lens of earnings multiples, things appear less optimistic. Fenix Resources is trading at a much higher price-to-earnings ratio compared to the broader mining industry, which raises doubts about today’s “bargain” verdict. Could the market be overlooking hidden risks?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Fenix Resources to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Fenix Resources Narrative

If you see the story differently or like to draw your own conclusions, building a personalized analysis can take less than three minutes. Do it your way

A great starting point for your Fenix Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Opportunities?

Don’t let your research stop here. Give yourself an edge by targeting fresh sectors and up-and-coming stocks that could shape tomorrow’s market leaders.

- Tap into future-shaping technology by browsing AI penny stocks and spot companies advancing real-world artificial intelligence solutions.

- Secure your potential for steady income by checking out dividend stocks with yields > 3%, connecting you with firms offering robust dividend payouts above 3%.

- Get ahead of the curve in digital finance trends by reviewing cryptocurrency and blockchain stocks, highlighting stocks forging progress in blockchain and cryptocurrency innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FEX

Fenix Resources

Provides mining, logistics, and port services in Western Australia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives