- Australia

- /

- Metals and Mining

- /

- ASX:EVN

Evolution Mining (ASX:EVN): Valuation Check After Strategic Lithium JV Expansion in Nevada

Evolution Mining (ASX:EVN) has just deepened its push into battery metals, lifting its stake to roughly 26% in the Nevada North Lithium joint venture and funding the next exploration phase in Nevada.

See our latest analysis for Evolution Mining.

The stronger position in Nevada North Lithium seems to be feeding into sentiment, with Evolution’s 90 day share price return of 28.89% and one year total shareholder return of 159.26% suggesting momentum is still building from a much longer upswing.

If this lithium move has you rethinking where growth might come from next, it could be worth scanning fast growing stocks with high insider ownership for other under the radar compounders.

Yet with the shares trading above consensus price targets after a huge run, investors now face a tougher question: Is Evolution still trading below its long term potential, or is the market already baking in years of growth?

Most Popular Narrative Narrative: 24.8% Overvalued

With Evolution Mining closing at A$12.76 against a narrative fair value near A$10.23, the most followed view sees expectations already running ahead of fundamentals.

The analysts have a consensus price target of A$7.222 for Evolution Mining based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$8.9, and the most bearish reporting a price target of just A$3.8.

Curious how modest revenue growth, rising margins and a punchy future earnings multiple can still point to downside from here? The narrative presents a detailed earnings bridge, layers in dilution, then discounts it all back at a precise required return. Want to see which assumptions carry the most weight in that A$10.23 fair value estimate?

Result: Fair Value of A$10.23 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained gold price strength and disciplined cost control could preserve Evolution’s margins, supporting earnings resilience and challenging the current overvaluation narrative.

Find out about the key risks to this Evolution Mining narrative.

Another Take on Valuation

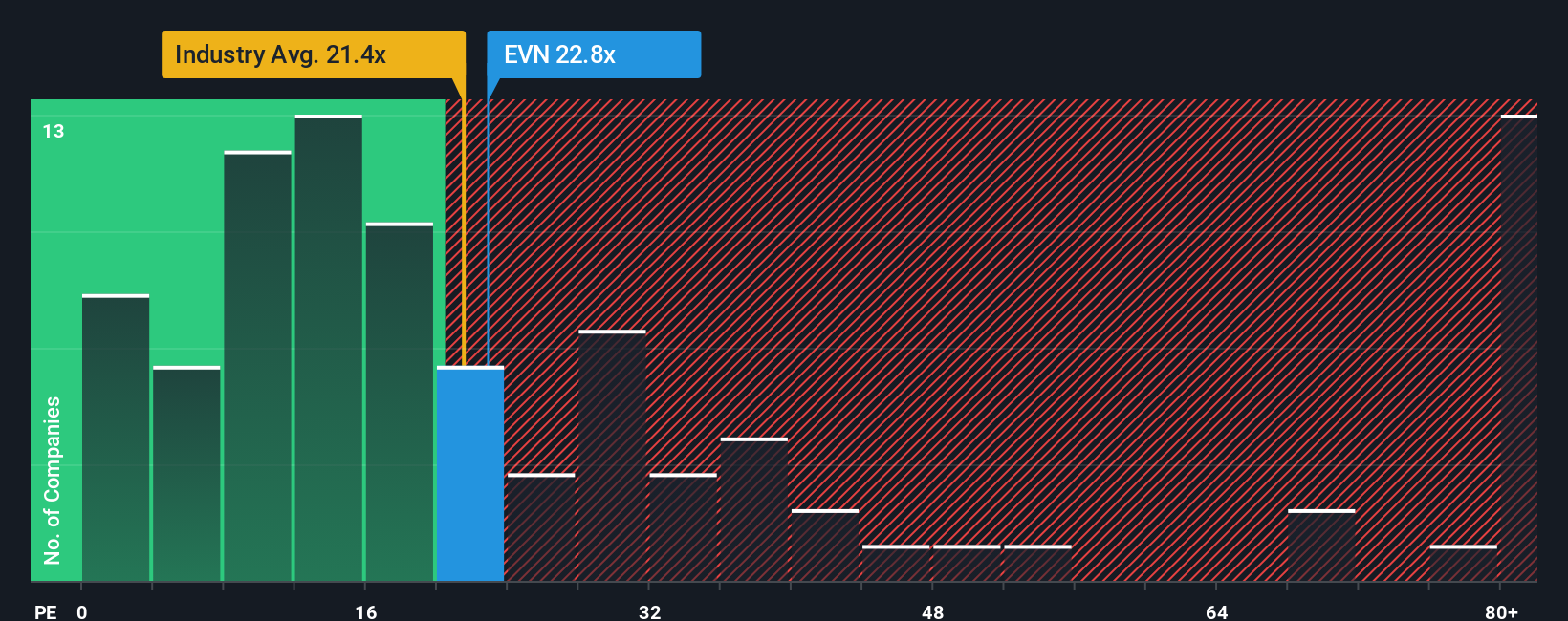

While the narrative fair value points to downside, our price to earnings work paints a milder picture. EVN trades at 28 times earnings versus an Australian metals and mining average of 21.9 times and a fair ratio of 23.6 times, implying a rich but not outrageous premium. Is that extra multiple headroom a warning sign, or simply the cost of owning a proven compounder?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Evolution Mining Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a full narrative in minutes using Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Evolution Mining.

Looking for more investment ideas?

Do not stop at just one opportunity. Let Simply Wall St’s screener surface more focused ideas so you do not miss the next big move.

- Capitalize on market mispricing by using these 904 undervalued stocks based on cash flows that may be trading well below their intrinsic value based on future cash flows.

- Ride powerful technological shifts by targeting these 25 AI penny stocks shaping automation, data intelligence and next generation software.

- Strengthen your long term income stream through these 12 dividend stocks with yields > 3% that combine reliable payouts with resilient fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evolution Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EVN

Evolution Mining

Engages in the exploration, mine development and operation, and sale of gold and gold-copper concentrates in Australia and Canada.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Okamoto Machine Tool Works focus on profitability

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Inotiv NAMs Test Center

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.