- Australia

- /

- Metals and Mining

- /

- ASX:DVP

ASX Growth Companies With High Insider Ownership To Watch In November 2025

Reviewed by Simply Wall St

Amidst the current market volatility and geopolitical uncertainties, Australia's stock market has been experiencing fluctuations, with inflation concerns and sector-specific performances shaping investor sentiment. In this environment, identifying growth companies with high insider ownership can be an attractive strategy as it often indicates strong confidence from those closest to the business, potentially aligning well with investors seeking stability and potential long-term value.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 12.6% | 90.7% |

| Titomic (ASX:TTT) | 11.2% | 74.9% |

| Polymetals Resources (ASX:POL) | 37.7% | 108% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| IRIS Metals (ASX:IR1) | 21.6% | 144.4% |

| Elsight (ASX:ELS) | 17.4% | 77% |

| Echo IQ (ASX:EIQ) | 19.1% | 49.9% |

| BlinkLab (ASX:BB1) | 35.4% | 101.4% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

We're going to check out a few of the best picks from our screener tool.

Alpha HPA (ASX:A4N)

Simply Wall St Growth Rating: ★★★★★★

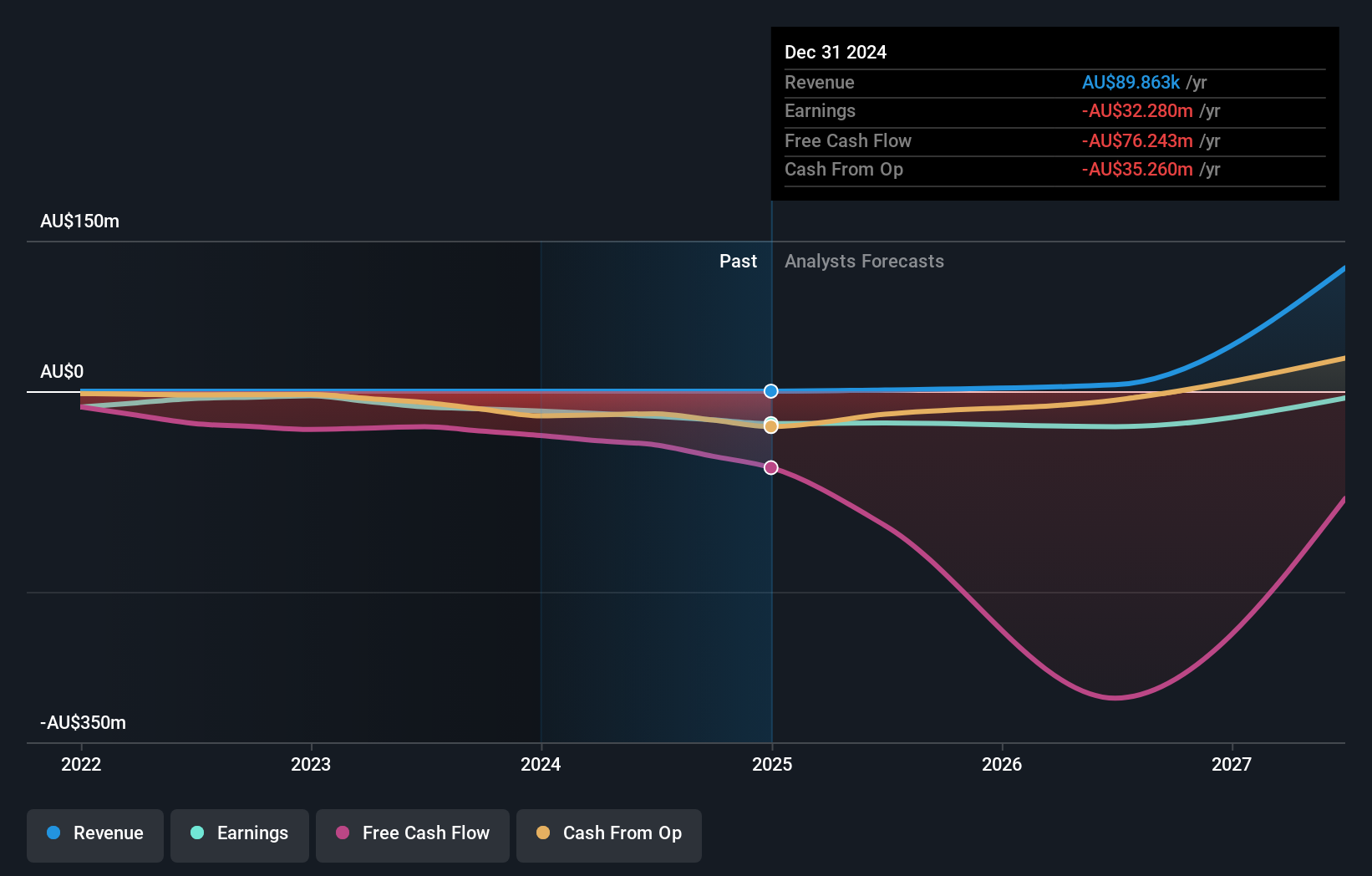

Overview: Alpha HPA Limited is a specialty materials and technology company engaged in the HPA First and Alpha Sapphire projects in Queensland, with a market cap of A$852.95 million.

Operations: The company's revenue segments include the HPA First Project generating A$0.26 million and the Alpha Sapphire Project contributing A$0.06 million.

Insider Ownership: 10.5%

Earnings Growth Forecast: 86.8% p.a.

Alpha HPA demonstrates potential as a growth company with high insider ownership in Australia. Recent earnings indicate significant revenue growth, from A$0.044 million to A$0.317 million, despite a net loss increase to A$32.56 million. The company is trading well below its estimated fair value and is expected to achieve profitability within three years, with substantial revenue and earnings growth forecasts outpacing the market average, although it faces cash runway constraints under one year.

- Click here to discover the nuances of Alpha HPA with our detailed analytical future growth report.

- According our valuation report, there's an indication that Alpha HPA's share price might be on the expensive side.

Artrya (ASX:AYA)

Simply Wall St Growth Rating: ★★★★★☆

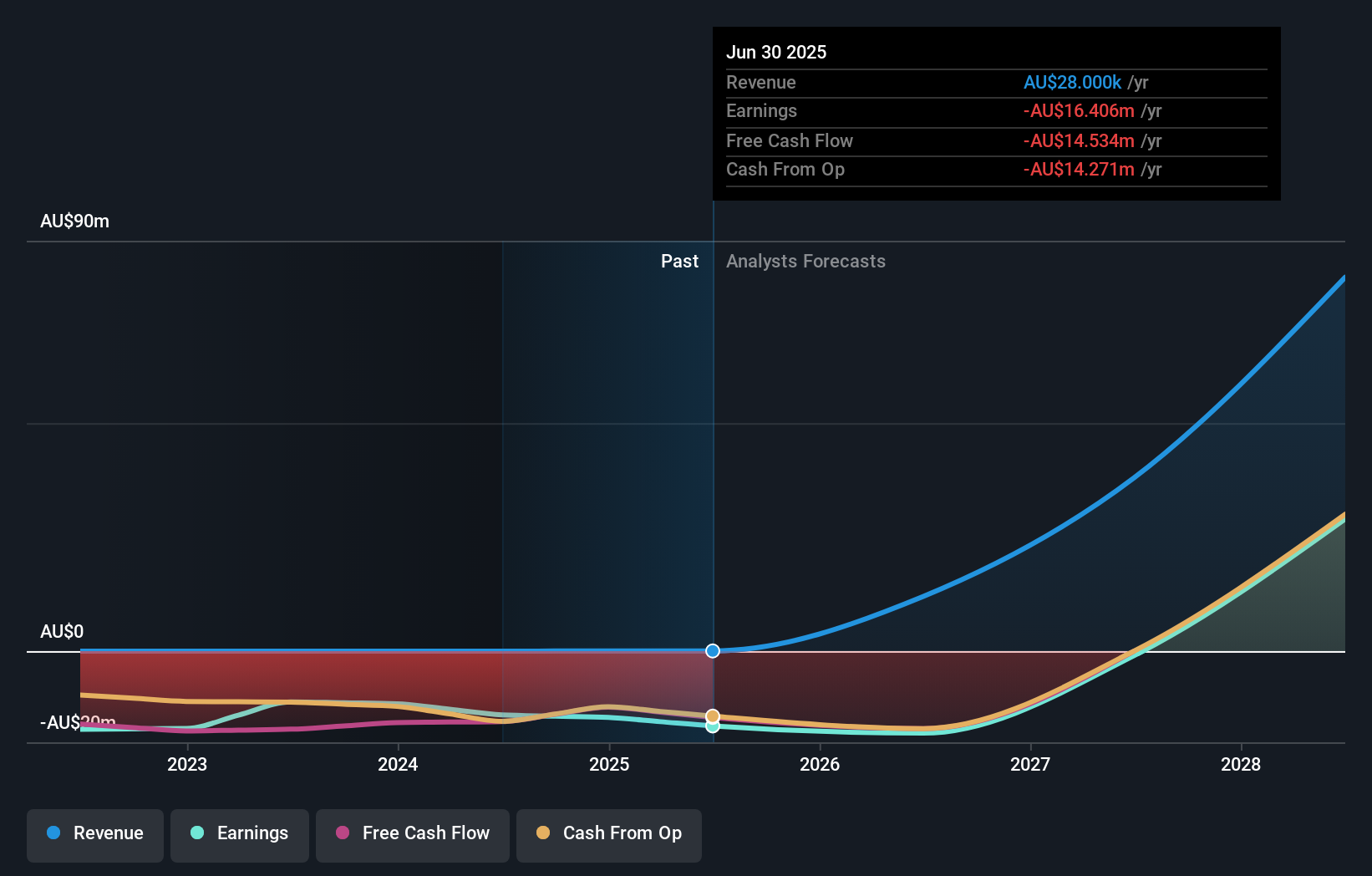

Overview: Artrya Limited is a medical technology company focused on developing and commercializing an artificial intelligence platform for detecting, diagnosing, and addressing coronary artery disease in Australia, with a market cap of A$497.67 million.

Operations: The company's revenue segment primarily consists of the development of AI-driven CCTA image analysis technology, generating A$0.03 million.

Insider Ownership: 14.0%

Earnings Growth Forecast: 61.5% p.a.

Artrya is positioned as a growth company with high insider ownership in Australia. Despite reporting minimal revenue of A$0.028 million and a net loss of A$16.41 million for the year ended June 2025, the company's revenue is forecast to grow significantly faster than the market at 49.6% per year. The recent FDA clearance for its Salix® Coronary Plaque module marks a pivotal expansion in the U.S., enhancing potential revenue streams through fee-per-scan assessments priced at US$950 each.

- Navigate through the intricacies of Artrya with our comprehensive analyst estimates report here.

- The analysis detailed in our Artrya valuation report hints at an inflated share price compared to its estimated value.

Develop Global (ASX:DVP)

Simply Wall St Growth Rating: ★★★★★☆

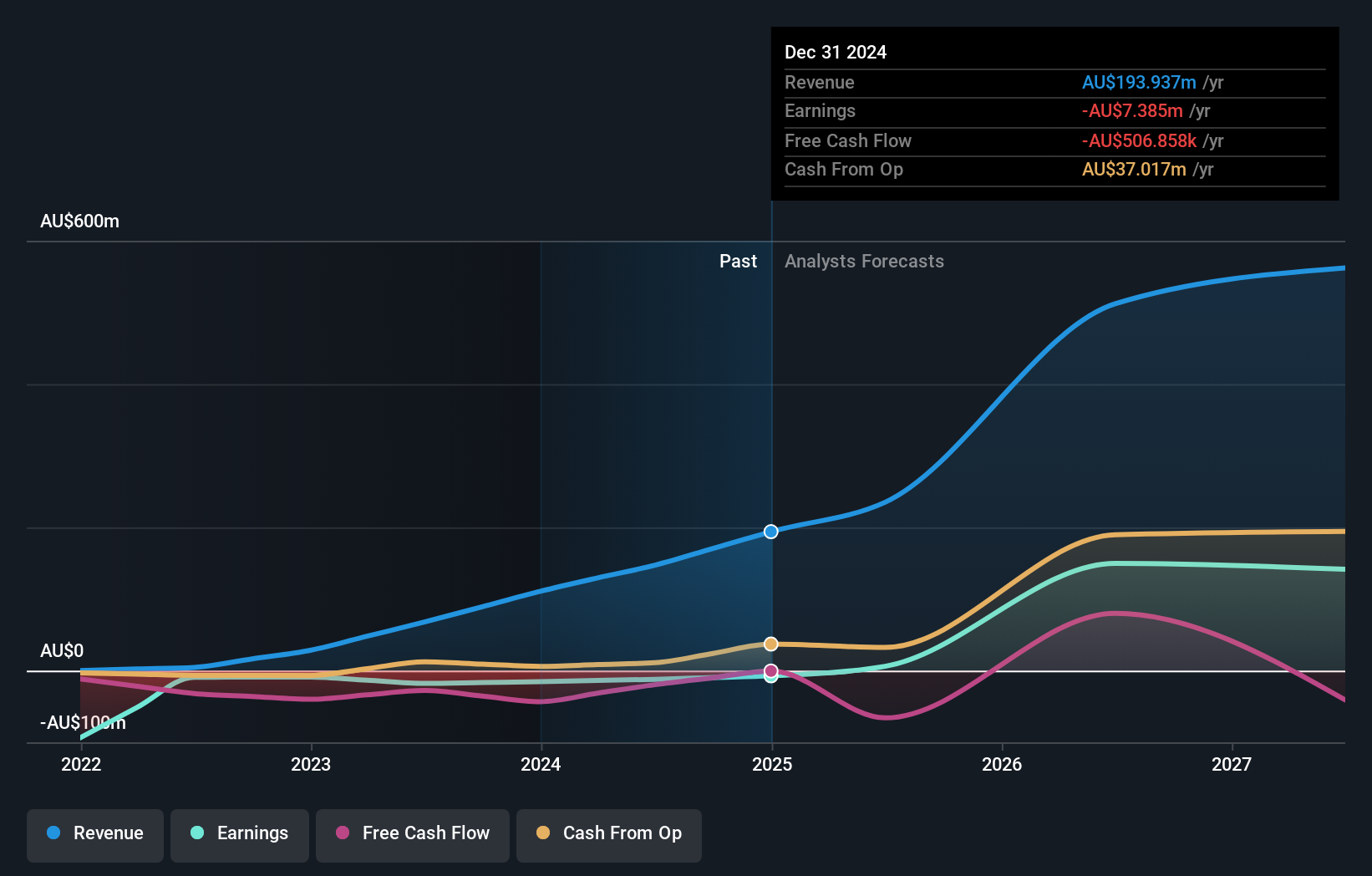

Overview: Develop Global Limited, with a market cap of A$1.08 billion, is involved in the exploration and development of mineral resource properties in Australia.

Operations: The company's revenue is primarily derived from Mining Services, contributing A$240.65 million, with an additional A$14.63 million coming from Mining and Exploration activities.

Insider Ownership: 20.2%

Earnings Growth Forecast: 32.7% p.a.

Develop Global is experiencing substantial growth, with forecasted revenue expansion at 36.8% annually, outpacing the Australian market. Despite past shareholder dilution, its earnings are expected to increase significantly by 32.7% per year over the next three years. Recent strategic appointments aim to bolster its accelerated growth strategy, including Duncan Bradford as a Nonexecutive Director and Nathan Stoitis as General Manager of Processing and Metallurgy, enhancing operational expertise and leadership depth in mining operations.

- Unlock comprehensive insights into our analysis of Develop Global stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Develop Global shares in the market.

Next Steps

- Investigate our full lineup of 107 Fast Growing ASX Companies With High Insider Ownership right here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DVP

Develop Global

Engages in the exploration and development of mineral resource properties in Australia.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives