- Australia

- /

- Metals and Mining

- /

- ASX:DRR

Does Deterra Royalties (ASX:DRR) Deserve A Spot On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Deterra Royalties (ASX:DRR). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Deterra Royalties

How Fast Is Deterra Royalties Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. Like a falcon taking flight, Deterra Royalties's EPS soared from AU$0.14 to AU$0.22, over the last year. That's a commendable gain of 58%.

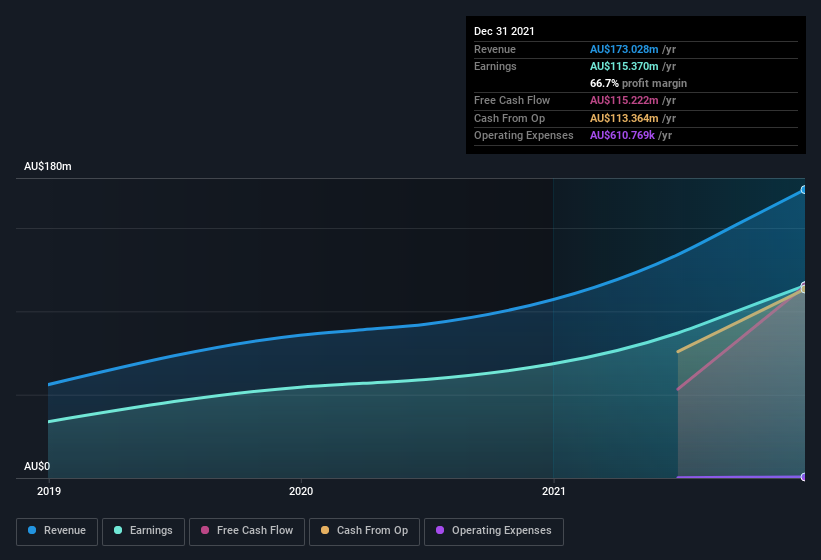

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note Deterra Royalties's EBIT margins were flat over the last year, revenue grew by a solid 53% to AU$173m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Deterra Royalties.

Are Deterra Royalties Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Deterra Royalties insiders spent AU$203k on stock, over the last year; in contrast, we didn't see any selling. That puts the company in a nice light, as it makes me think its leaders are feeling confident. It is also worth noting that it was Independent Non-Executive Chair Jennifer Seabrook who made the biggest single purchase, worth AU$97k, paying AU$3.90 per share.

It's reassuring that Deterra Royalties insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. I refer to the very reasonable level of CEO pay. For companies with market capitalizations between AU$1.4b and AU$4.4b, like Deterra Royalties, the median CEO pay is around AU$1.9m.

The Deterra Royalties CEO received AU$1.1m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Deterra Royalties Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Deterra Royalties's strong EPS growth. But wait, it gets better. We have seen insider buying and the executive pay seems on the modest side of things. The message I'd take from this quick rundown is that, yes, this stock is worth investigating further. What about risks? Every company has them, and we've spotted 2 warning signs for Deterra Royalties you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Deterra Royalties, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:DRR

Deterra Royalties

Operates as a royalty investment company in Australia, the United States, Mexico, Zambia, Peru, Canada, Mali, Kenya, Brazil, Cote D’Ivoire, and South Africa.

Good value average dividend payer.

Market Insights

Community Narratives