- Australia

- /

- Metals and Mining

- /

- ASX:CRS

Companies Like Caprice Resources (ASX:CRS) Are In A Position To Invest In Growth

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So, the natural question for Caprice Resources (ASX:CRS) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business's cash, relative to its cash burn.

View our latest analysis for Caprice Resources

When Might Caprice Resources Run Out Of Money?

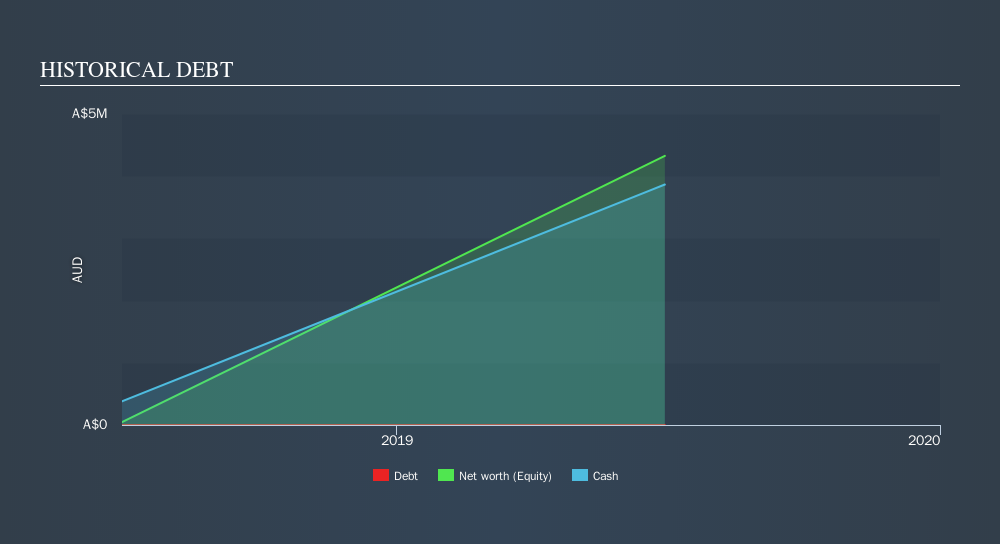

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In June 2019, Caprice Resources had AU$3.9m in cash, and was debt-free. Importantly, its cash burn was AU$601k over the trailing twelve months. That means it had a cash runway of about 6.4 years as of June 2019. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. You can see how its cash balance has changed over time in the image below.

How Is Caprice Resources's Cash Burn Changing Over Time?

Because Caprice Resources isn't currently generating revenue, we consider it an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Remarkably, it actually increased its cash burn by 2528% in the last year. We certainly hope for shareholders' sake that the money is well spent, because that kind of expenditure increase always makes us nervous. Caprice Resources makes us a little nervous due to its lack of substantial operating revenue. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

Can Caprice Resources Raise More Cash Easily?

While Caprice Resources does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash to drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Caprice Resources has a market capitalisation of AU$3.9m and burnt through AU$601k last year, which is 15% of the company's market value. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

Is Caprice Resources's Cash Burn A Worry?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Caprice Resources's cash runway was relatively promising. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. While it's important to consider hard data like the metrics discussed above, many investors would also be interested to note that Caprice Resources insiders have been trading shares in the company. Click here to find out if they have been buying or selling.

Of course Caprice Resources may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:CRS

Caprice Resources

Engages in the acquisition, exploration, and development of mineral resource projects in Australia.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion