We Think The Compensation For Clover Corporation Limited's (ASX:CLV) CEO Looks About Right

Despite Clover Corporation Limited's (ASX:CLV) share price growing positively in the past few years, the per-share earnings growth has not grown to investors' expectations, suggesting that there could be other factors at play driving the share price. Some of these issues will occupy shareholders' minds as the AGM rolls around on 18 November 2021. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

View our latest analysis for Clover

Comparing Clover Corporation Limited's CEO Compensation With the industry

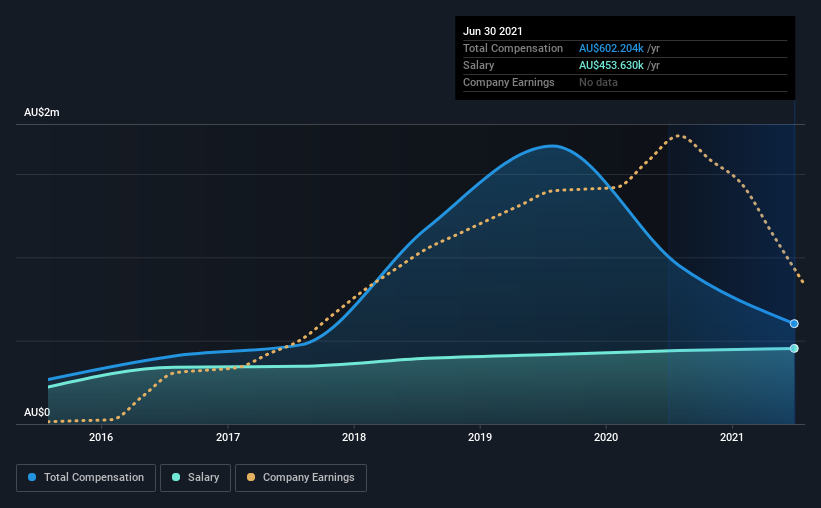

At the time of writing, our data shows that Clover Corporation Limited has a market capitalization of AU$273m, and reported total annual CEO compensation of AU$602k for the year to June 2021. Notably, that's a decrease of 37% over the year before. Notably, the salary which is AU$453.6k, represents most of the total compensation being paid.

For comparison, other companies in the same industry with market capitalizations ranging between AU$136m and AU$543m had a median total CEO compensation of AU$535k. From this we gather that Peter Davey is paid around the median for CEOs in the industry. Furthermore, Peter Davey directly owns AU$750k worth of shares in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | AU$454k | AU$441k | 75% |

| Other | AU$149k | AU$510k | 25% |

| Total Compensation | AU$602k | AU$952k | 100% |

Talking in terms of the industry, salary represented approximately 65% of total compensation out of all the companies we analyzed, while other remuneration made up 35% of the pie. Clover pays out 75% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Clover Corporation Limited's Growth

Over the last three years, Clover Corporation Limited has shrunk its earnings per share by 7.7% per year. In the last year, its revenue is down 31%.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Clover Corporation Limited Been A Good Investment?

With a total shareholder return of 21% over three years, Clover Corporation Limited shareholders would, in general, be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about whether these returns will continue. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Clover (free visualization of insider trades).

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:CLV

Clover

Engages in the production, refining, and sale of natural oils and encapsulated powders in Australia, New Zealand, Asia, Europe, the Middle East, and the Americas.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success