There's No Escaping Clover Corporation Limited's (ASX:CLV) Muted Earnings Despite A 33% Share Price Rise

Despite an already strong run, Clover Corporation Limited (ASX:CLV) shares have been powering on, with a gain of 33% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 45% in the last year.

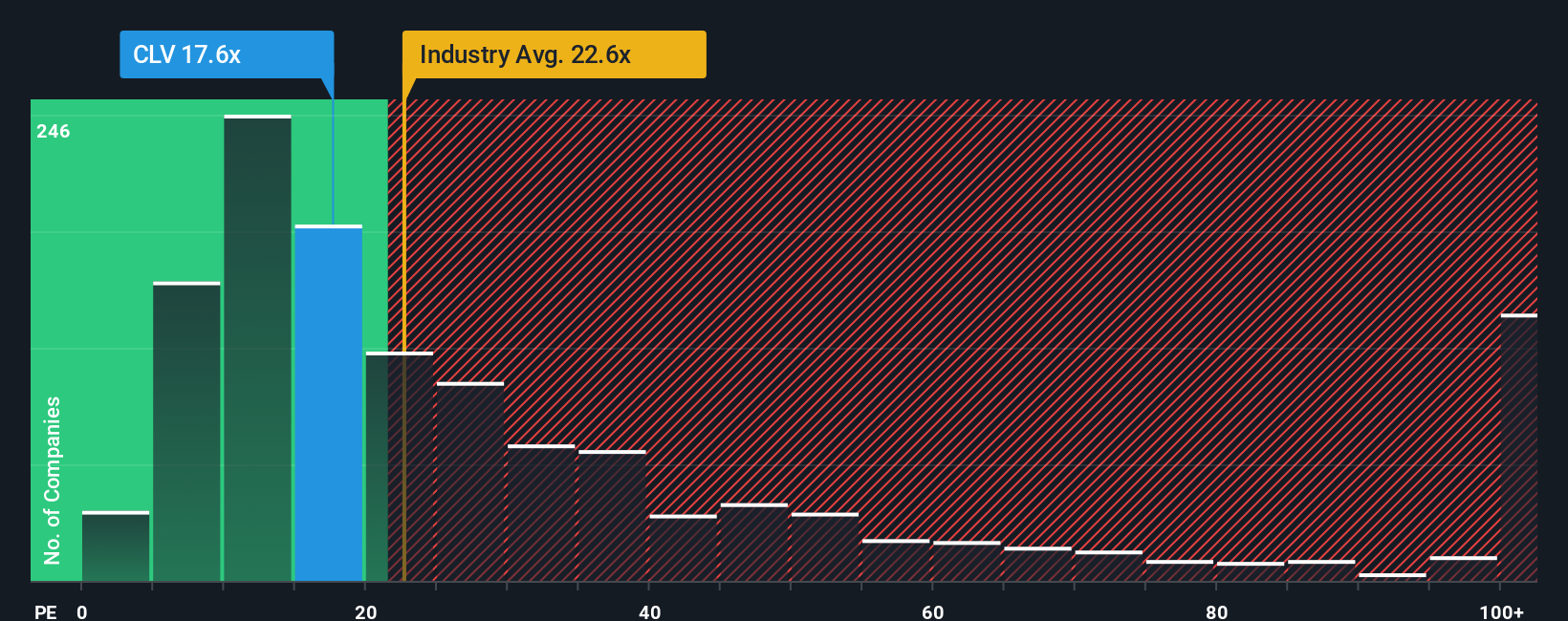

In spite of the firm bounce in price, given about half the companies in Australia have price-to-earnings ratios (or "P/E's") above 21x, you may still consider Clover as an attractive investment with its 17.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been advantageous for Clover as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Clover

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Clover's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 382%. Still, incredibly EPS has fallen 2.0% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 7.3% per year during the coming three years according to the two analysts following the company. With the market predicted to deliver 17% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Clover's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Clover's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Clover's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Clover.

Of course, you might also be able to find a better stock than Clover. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CLV

Clover

Engages in the production, refining, and sale of natural oils and encapsulated powders in Australia, New Zealand, Asia, Europe, the Middle East, and the Americas.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives