- Australia

- /

- Healthtech

- /

- ASX:CGS

ASX Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

The Australian market experienced a relatively quiet day, with notable activity primarily in the energy sector due to geopolitical tensions affecting Brent Crude prices. In this context, penny stocks continue to capture investor interest as they offer unique opportunities for growth and value, particularly when backed by strong financials. Despite being considered a somewhat outdated term, penny stocks remain relevant for investors seeking promising under-the-radar companies that could provide significant long-term potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.735 | A$81.85M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.605 | A$115.47M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.76 | A$425.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.67 | A$441.56M | ✅ 5 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.10 | A$730.43M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.22 | A$746.28M | ✅ 4 ⚠️ 3 View Analysis > |

| Accent Group (ASX:AX1) | A$1.805 | A$1.09B | ✅ 4 ⚠️ 2 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.705 | A$223.61M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.27 | A$155.16M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.79 | A$144.17M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 1,006 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Cogstate (ASX:CGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cogstate Limited is a neuroscience technology company that focuses on creating, validating, and commercializing digital brain health assessments for academic and industry-sponsored research, with a market cap of A$239.67 million.

Operations: Cogstate's revenue is primarily derived from its Clinical Trials segment, which includes precision recruitment tools and research, generating $44.22 million, while the Healthcare segment, including sports-related activities, contributes $2.98 million.

Market Cap: A$239.67M

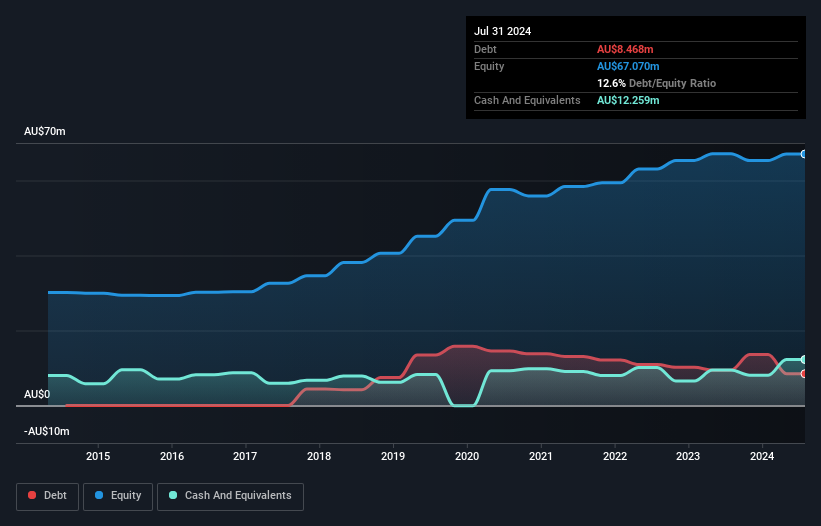

Cogstate Limited, with a market cap of A$239.67 million, demonstrates strong financial health and growth potential in the penny stock arena. The company has achieved consistent earnings growth, surpassing both its historical average and industry peers. With no debt on its balance sheet and short-term assets exceeding liabilities, Cogstate is well-positioned financially. Its management and board are seasoned, contributing to stable operations. Despite having a lower than ideal Return on Equity at 16.6%, Cogstate's earnings quality is high, supported by improved profit margins and shareholder stability without dilution over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of Cogstate.

- Explore Cogstate's analyst forecasts in our growth report.

Clover (ASX:CLV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Clover Corporation Limited produces, refines, and sells natural oils and encapsulated powders across various regions including Australia, New Zealand, Asia, Europe, the Middle East, and the Americas with a market cap of A$84.33 million.

Operations: The company generates revenue of A$72.49 million from its Nutritional Oil and Microencapsulated Powders segment.

Market Cap: A$84.33M

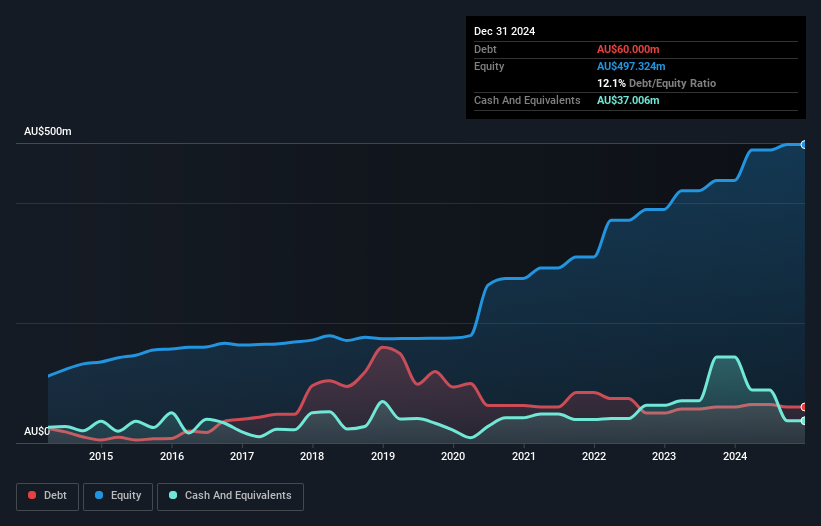

Clover Corporation Limited, with a market cap of A$84.33 million, shows financial resilience despite challenges in the penny stock sector. The company has demonstrated significant earnings growth over the past year, outpacing industry averages, and maintains strong liquidity with short-term assets surpassing both short- and long-term liabilities. Clover's debt management is robust, evidenced by a reduced debt-to-equity ratio and interest payments well-covered by EBIT. While its Return on Equity remains low at 6.7%, profit margins have improved significantly from last year. Recent dividend affirmations further indicate stable shareholder returns amidst market volatility.

- Jump into the full analysis health report here for a deeper understanding of Clover.

- Examine Clover's earnings growth report to understand how analysts expect it to perform.

Civmec (ASX:CVL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Civmec Limited is an investment holding company that offers construction and engineering services across the energy, resources, infrastructure, marine, and defense sectors in Australia, with a market cap of A$549.21 million.

Operations: The company generates revenue from three primary segments: Energy (A$38.78 million), Resources (A$864.53 million), and Infrastructure, Marine & Defence (A$140.68 million).

Market Cap: A$549.21M

Civmec Limited, with a market cap of A$549.21 million, has recently secured A$285 million in new contracts and extensions, enhancing its materials handling and maintenance divisions. Despite trading at 56.3% below its estimated fair value and showing a significant five-year earnings growth of 25.7% annually, Civmec faces challenges with negative operating cash flow impacting debt coverage. The company's short-term assets exceed both short- and long-term liabilities, indicating solid liquidity management. However, the dividend yield of 5.56% is not well covered by free cash flows, suggesting potential sustainability concerns amidst broader financial volatility in the sector.

- Get an in-depth perspective on Civmec's performance by reading our balance sheet health report here.

- Assess Civmec's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Click through to start exploring the rest of the 1,003 ASX Penny Stocks now.

- Ready For A Different Approach? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CGS

Cogstate

A neuroscience technology company, engages in the creation, validation, and commercialization of digital brain health assessments used in both academic and industry sponsored research.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives