- Australia

- /

- Metals and Mining

- /

- ASX:CIA

Champion Iron (ASX:CIA) Valuation in Focus Following Strong Q2 Earnings and Dividend Announcement

Reviewed by Simply Wall St

Champion Iron (ASX:CIA) just announced its second quarter earnings, revealing sharp growth in sales and net income from a year earlier, and declared a semi-annual dividend. This news has caught the attention of many investors.

See our latest analysis for Champion Iron.

Positive momentum is clearly building for Champion Iron, with the latest results and dividend likely sparking increased interest from investors. After sliding earlier in the year, the stock’s 14.7% jump over the past week and 31.4% share price return in the last 90 days point to growing confidence. The one-year total shareholder return still lags slightly at -2.7%.

If you’re keeping an eye out for other opportunities, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

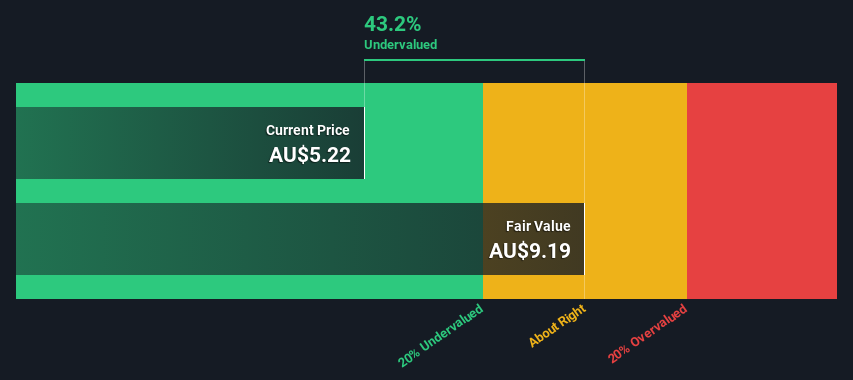

The question now is whether Champion Iron’s recent rally and upbeat earnings indicate that the stock is undervalued and offers a compelling entry point, or if the market has already taken the company’s growth prospects into account.

Most Popular Narrative: Fairly Valued

With Champion Iron’s fair value estimated at A$5.46 and the last close at A$5.53, the narrative points to a share price that is tightly aligned with fundamentals. The latest details shed light on the factors shaping this assessment.

The imminent commissioning of the Bloom Lake flotation plant, on track for completion by year end, will enable Champion Iron to produce higher grade 69% DR grade iron ore concentrate. This will allow the company to capture premium pricing tied to rising demand for decarbonized steel production and could positively impact both revenues and net margins.

Curious about whether one pivotal expansion project could dramatically shift Champion Iron’s earnings power? The real story is in the game-changing impact this milestone could have on profit margins and future contract negotiations. Discover what assumptions underpin this "fair value" and why the market isn’t pricing in blue-sky growth just yet.

Result: Fair Value of $5.46 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent operational challenges and exposure to commodity price swings could quickly dampen the outlook and put the strength of current market optimism to the test.

Find out about the key risks to this Champion Iron narrative.

Another View: Discounted Cash Flow Contrast

While the fair value narrative suggests Champion Iron is about fairly priced, our DCF model paints a much more bullish picture. Based on future expected cash flows, the SWS DCF model estimates a fair value of A$21.76, which is substantially above the current share price. Is the market underestimating long-term earnings potential, or is this too optimistic given recent risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Champion Iron Narrative

If you want to dive in and draw your own conclusions, the tools to build a personal narrative are right at your fingertips in just a few minutes. Do it your way

A great starting point for your Champion Iron research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More High-Impact Investment Ideas?

Uncover the next wave of promising stocks and gain an edge before others catch on. Broaden your strategy today, or risk missing out on tomorrow’s standout performers.

- Spot opportunities in digital assets by adding these 82 cryptocurrency and blockchain stocks to your radar for companies riding the blockchain and cryptocurrency revolution.

- Secure reliable income streams and see which companies are delivering consistent returns with these 18 dividend stocks with yields > 3% that boast attractive yields above 3%.

- Catch fast movers hidden in plain sight by launching your search with these 843 undervalued stocks based on cash flows based on compelling cash flow metrics and growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CIA

Champion Iron

Engages in the acquisition, exploration, development, and production of iron ore properties in Canada.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives