With the Australian market experiencing a slight dip as ASX 200 futures point to a -0.2% slide, investors are keeping an eye on global influences and local economic updates, such as the Reserve Bank's latest minutes. Penny stocks, though often seen as relics of past market trends, continue to offer intriguing opportunities for those willing to explore beyond established names. These stocks typically represent smaller or newer companies and can provide a unique blend of affordability and growth potential when supported by strong financial health.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.47 | A$116.52M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.375 | A$71.5M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.07 | A$473.34M | ✅ 4 ⚠️ 2 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$4.30 | A$354.08M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.93 | A$1.03B | ✅ 4 ⚠️ 2 View Analysis > |

| Bravura Solutions (ASX:BVS) | A$2.28 | A$1.02B | ✅ 3 ⚠️ 3 View Analysis > |

| Austin Engineering (ASX:ANG) | A$0.315 | A$195.47M | ✅ 4 ⚠️ 1 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.42 | A$134.18M | ✅ 3 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.86 | A$149.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Perenti (ASX:PRN) | A$2.21 | A$2.05B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 452 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Audinate Group (ASX:AD8)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Audinate Group Limited develops and sells digital audio visual networking solutions both in Australia and internationally, with a market cap of A$415.26 million.

Operations: The company generates revenue of A$62.07 million from its Contract Electronics Manufacturing Services segment.

Market Cap: A$415.26M

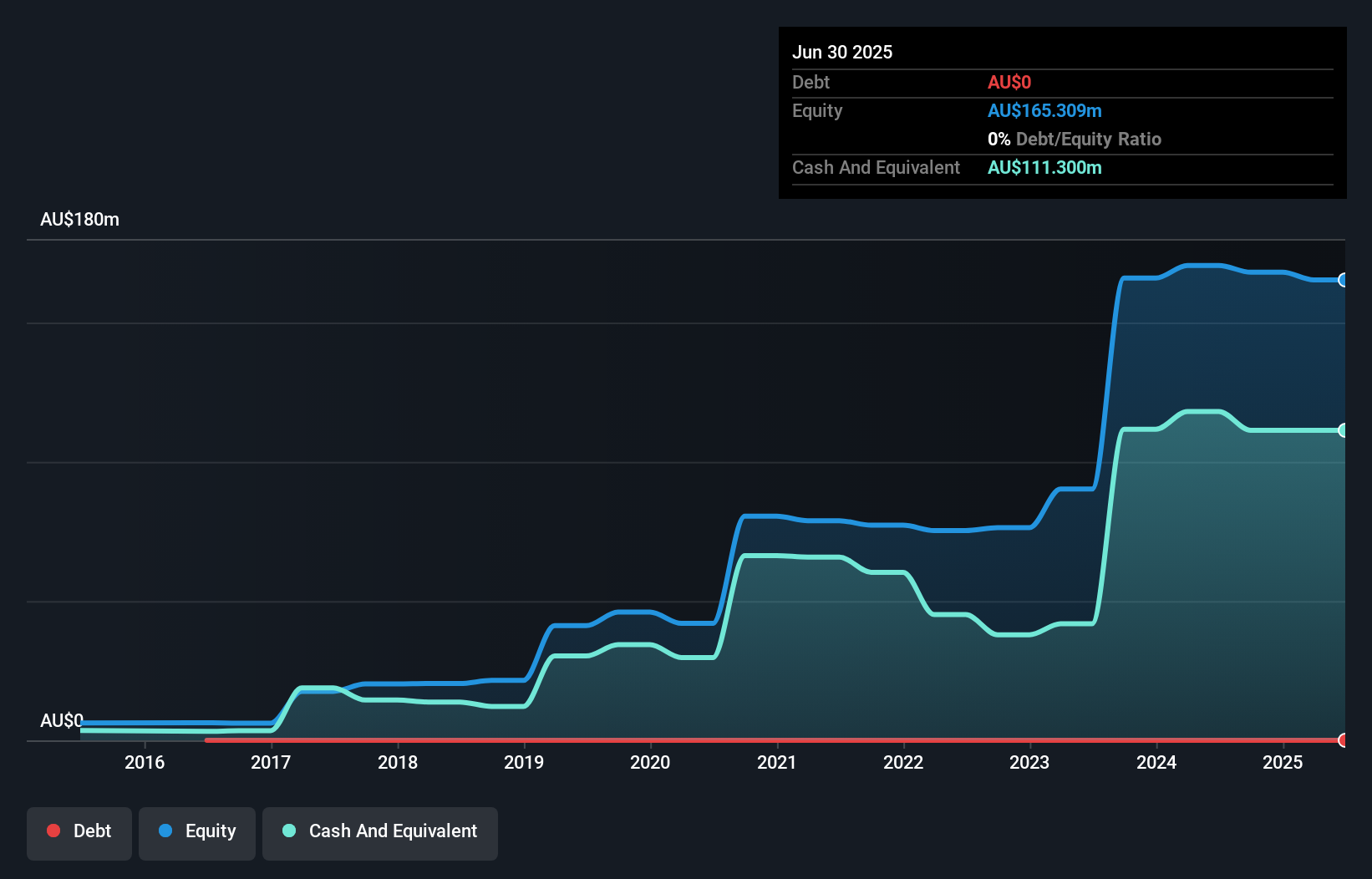

Audinate Group, with a market cap of A$415.26 million, is navigating challenges as its revenue dropped to A$62.07 million from A$91.48 million the previous year, resulting in a net loss of A$6.38 million. Despite being unprofitable and not expected to achieve profitability soon, Audinate remains debt-free and has reduced losses over the past five years at a significant rate. The company’s short-term assets comfortably cover both short- and long-term liabilities, indicating financial resilience amidst volatility concerns. Recent leadership changes may offer strategic continuity as Audinate transitions under new board chair Alison Ledger's guidance.

- Unlock comprehensive insights into our analysis of Audinate Group stock in this financial health report.

- Gain insights into Audinate Group's outlook and expected performance with our report on the company's earnings estimates.

Champion Iron (ASX:CIA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Champion Iron Limited focuses on the acquisition, exploration, development, and production of iron ore properties in Canada and has a market cap of A$2.36 billion.

Operations: The company generates revenue from the sale of iron ore concentrate, amounting to CA$1.53 billion.

Market Cap: A$2.36B

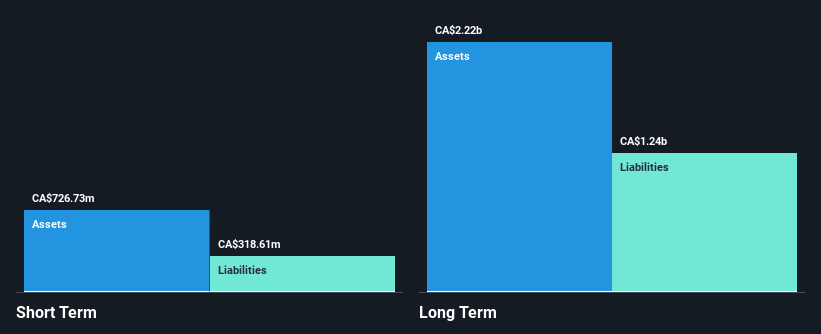

Champion Iron Limited, with a market cap of A$2.36 billion, reported a decline in Q1 2025 earnings to CA$23.78 million from CA$81.36 million the previous year due to lower sales and reduced profit margins. Despite these challenges, the company's net debt to equity ratio is satisfactory at 39.3%, and its debt is well covered by operating cash flow at 47.6%. However, short-term assets do not cover long-term liabilities (CA$1.3 billion), and dividend sustainability remains questionable as it isn't well-covered by earnings or free cash flows, reflecting potential risks for investors seeking stable returns in penny stocks.

- Jump into the full analysis health report here for a deeper understanding of Champion Iron.

- Understand Champion Iron's earnings outlook by examining our growth report.

Vita Life Sciences (ASX:VLS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vita Life Sciences Limited is a healthcare company that formulates, packages, distributes, and sells vitamins and supplements across several countries in Asia-Pacific including Australia, with a market cap of A$128.59 million.

Operations: Vita Life Sciences generates its revenue primarily from Australia (A$44.44 million), followed by Malaysia (A$25.66 million) and Singapore (A$7.57 million).

Market Cap: A$128.59M

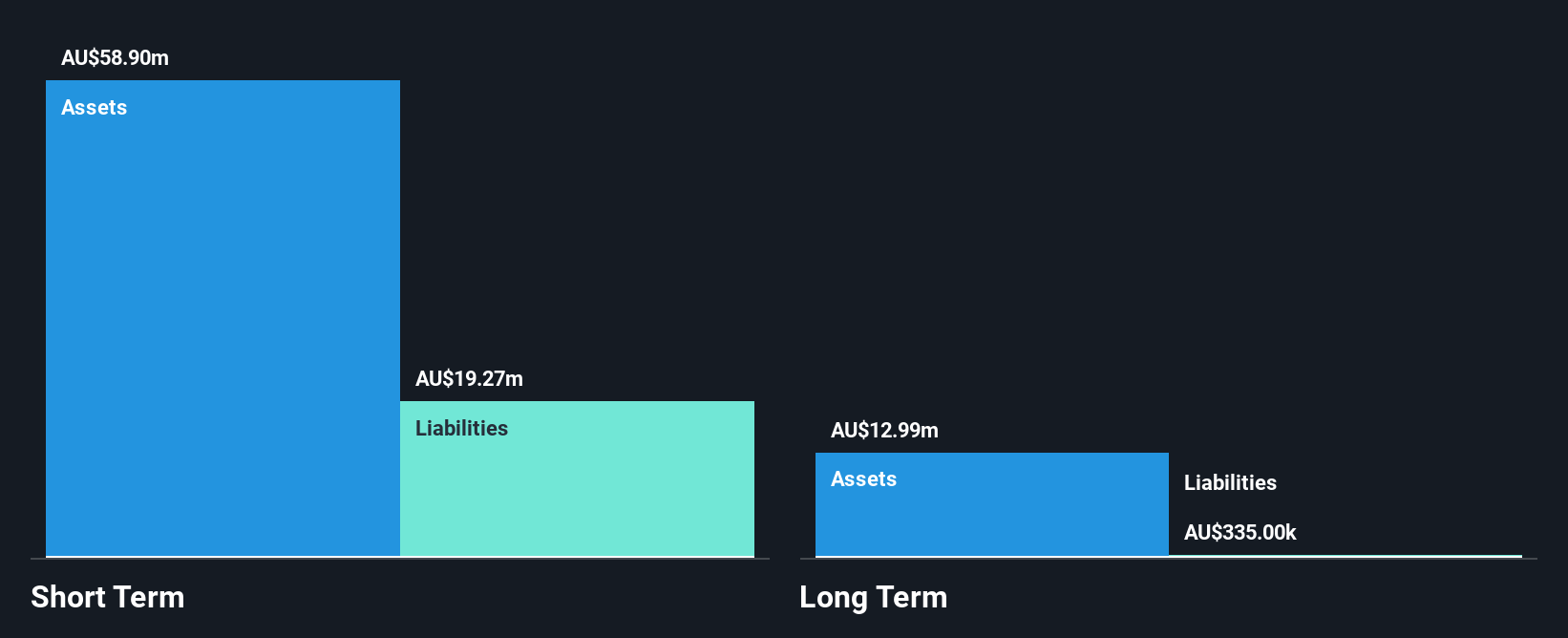

Vita Life Sciences Limited, with a market cap of A$128.59 million, recently reported half-year net income growth to A$4.84 million from A$4.31 million the previous year. The company is debt-free and has strong short-term asset coverage for both short-term (A$19.3M) and long-term liabilities (A$335K). Despite these strengths, its return on equity remains low at 16.8%, and profit margins have decreased to 11% from 12.4%. Although earnings quality is high, negative earnings growth over the past year raises concerns about future performance in the competitive healthcare sector.

- Click here to discover the nuances of Vita Life Sciences with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Vita Life Sciences' track record.

Next Steps

- Navigate through the entire inventory of 452 ASX Penny Stocks here.

- Ready To Venture Into Other Investment Styles? The end of cancer? These 26 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AD8

Audinate Group

Engages in develops and sells digital audio visual (AV) networking solutions Australia and internationally.

Adequate balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives