- Australia

- /

- Capital Markets

- /

- ASX:RPL

ASX Penny Stocks: Cogstate And 2 Promising Companies To Watch

Reviewed by Simply Wall St

The Australian market has experienced mixed sentiments recently, with optimism in sectors like lithium and gold despite some major stocks dragging down the indices. For investors willing to explore beyond the well-known names, penny stocks—often smaller or newer companies—continue to present intriguing opportunities. While the term might seem outdated, these stocks can offer significant potential when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.475 | A$136.13M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.85 | A$52.93M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.08 | A$473.37M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.63 | A$272.35M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| LaserBond (ASX:LBL) | A$0.51 | A$60.22M | ✅ 4 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.865 | A$413.84M | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.27 | A$1.39B | ✅ 3 ⚠️ 1 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.81 | A$260.15M | ✅ 3 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.34 | A$129.97M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 413 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Cogstate (ASX:CGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cogstate Limited is a neuroscience solutions company that focuses on the creation, validation, and commercialization of digital brain health assessments globally, with a market cap of A$501.14 million.

Operations: Cogstate generates revenue primarily from its Clinical Trials segment, which includes precision recruitment tools and research, contributing $50.58 million, while its Healthcare segment, including sports-related services, accounts for $2.51 million.

Market Cap: A$501.14M

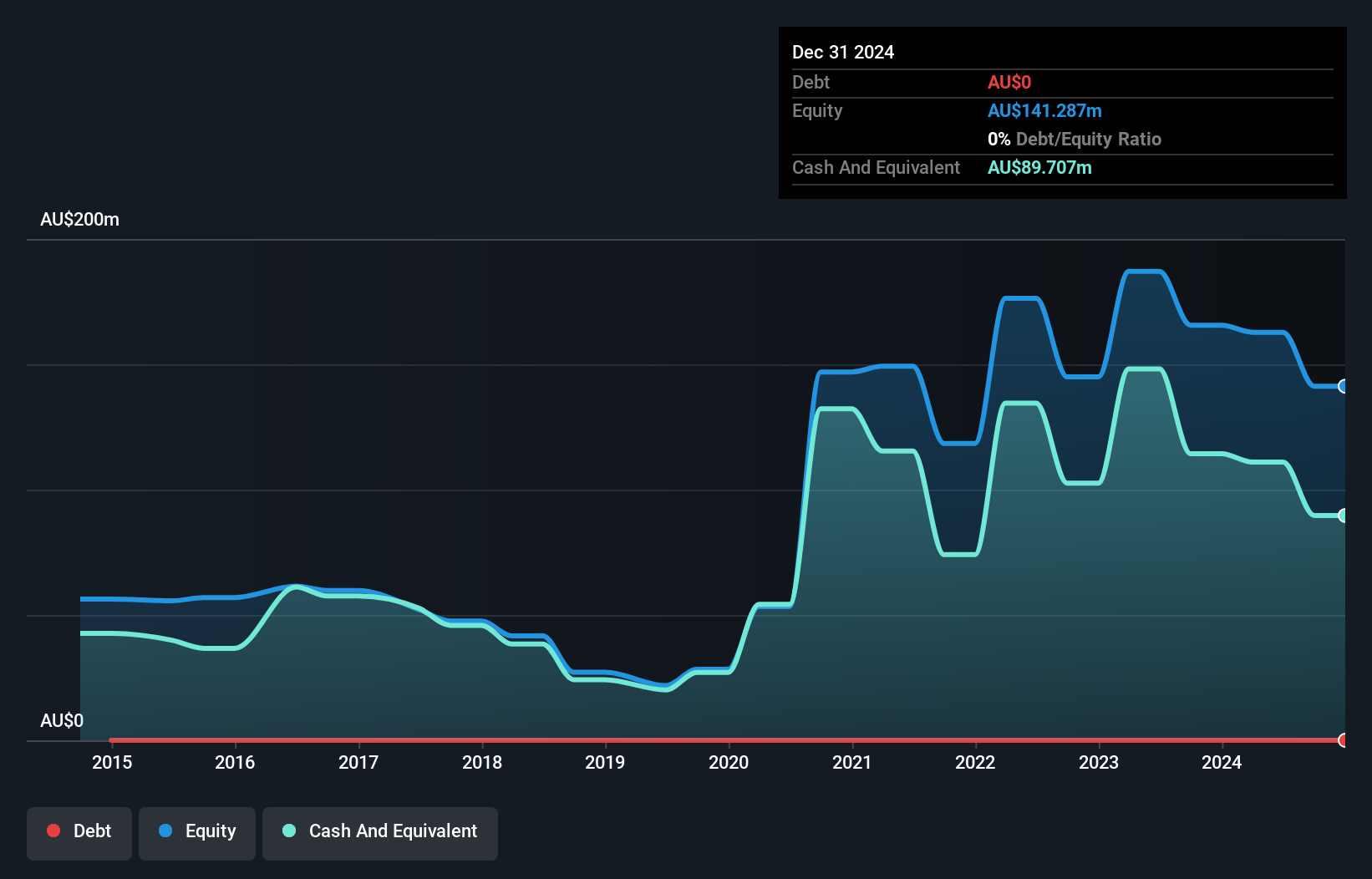

Cogstate Limited has demonstrated significant growth, with earnings increasing by 86.1% over the past year, surpassing the Healthcare Services industry average. The company is debt-free, with short-term assets exceeding both short and long-term liabilities, indicating strong financial health. Recent buybacks have reduced share dilution risk, while a stable management team supports operational consistency. Despite a high price-to-earnings ratio of 32.2x being below industry average, Cogstate's net profit margin improved to 19.1%. Recent earnings reports show increased revenue and net income year-over-year, reinforcing its position as an intriguing option within penny stocks in Australia.

- Get an in-depth perspective on Cogstate's performance by reading our balance sheet health report here.

- Gain insights into Cogstate's outlook and expected performance with our report on the company's earnings estimates.

Chalice Mining (ASX:CHN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chalice Mining Limited is a mineral exploration and evaluation company with a market capitalization of A$758.76 million.

Operations: Chalice Mining Limited does not have any reported revenue segments.

Market Cap: A$758.76M

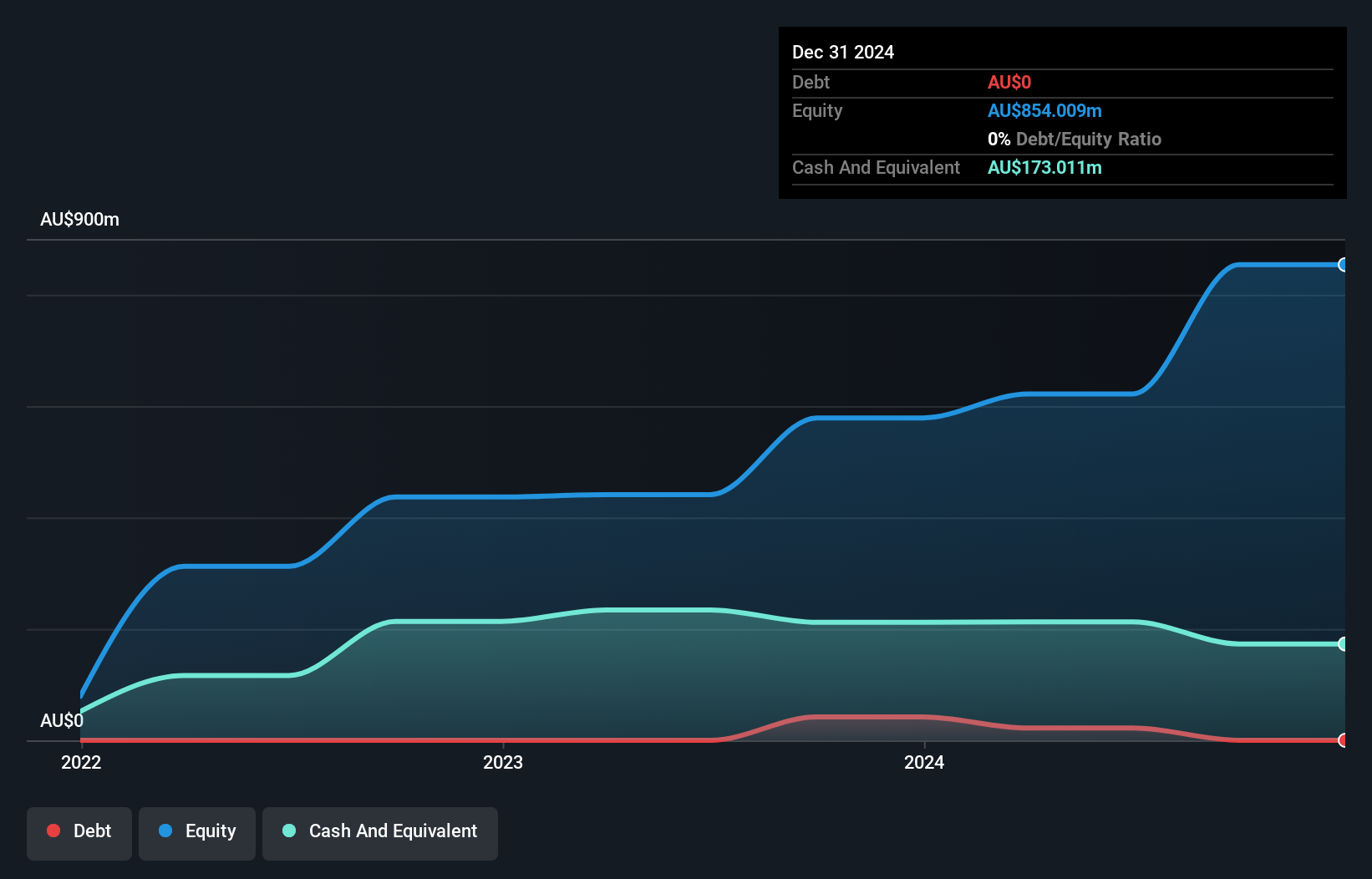

Chalice Mining Limited, with a market cap of A$758.76 million, remains pre-revenue and unprofitable but shows potential with a forecasted revenue growth of over 54% annually. The company reported a reduced net loss of A$24.21 million for the year ending June 2025, down from A$39.5 million previously. It benefits from being debt-free and having sufficient cash runway for over three years under current free cash flow conditions. Although its board is experienced, the management team is relatively new, which may impact strategic execution as it navigates the challenges typical for penny stocks in Australia’s mining sector.

- Jump into the full analysis health report here for a deeper understanding of Chalice Mining.

- Explore Chalice Mining's analyst forecasts in our growth report.

Regal Partners (ASX:RPL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market cap of A$1.06 billion.

Operations: The company generates revenue of A$245.45 million from its investment management services segment.

Market Cap: A$1.06B

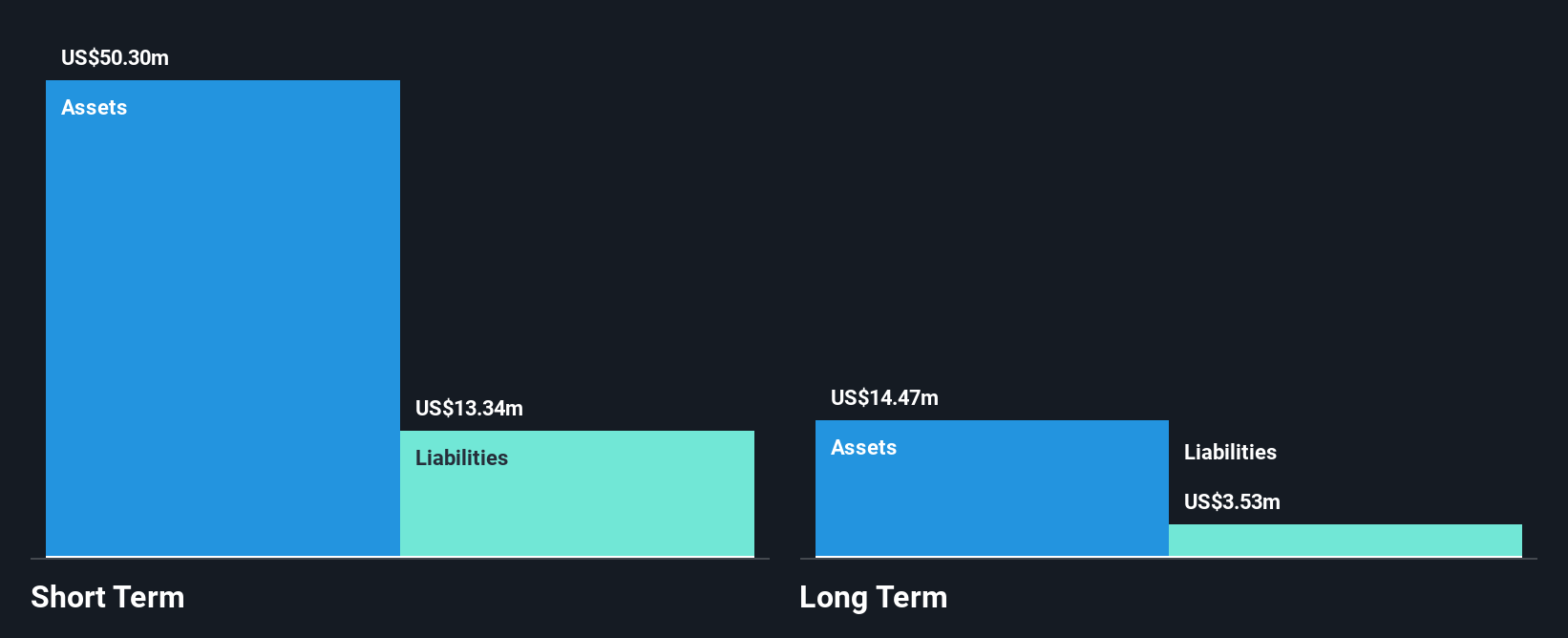

Regal Partners Limited, with a market cap of A$1.06 billion, has shown stable weekly volatility and maintains strong financial health by covering both short and long-term liabilities with its assets. Despite negative earnings growth over the past year and reduced profit margins from 28.1% to 17.2%, the company remains financially resilient with more cash than total debt and operating cash flow well covering its debt obligations. Recently added to the S&P/ASX 300 Index, Regal Partners offers a dividend yield of 5.56%, though it is not fully covered by earnings or free cash flows, indicating potential sustainability concerns for investors in penny stocks within Australia’s capital markets sector.

- Click to explore a detailed breakdown of our findings in Regal Partners' financial health report.

- Gain insights into Regal Partners' future direction by reviewing our growth report.

Turning Ideas Into Actions

- Embark on your investment journey to our 413 ASX Penny Stocks selection here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RPL

Good value with reasonable growth potential.

Market Insights

Community Narratives