3 ASX Penny Stocks With Market Caps Under A$600M To Consider

Reviewed by Simply Wall St

The Australian market saw a modest uptick, with the ASX200 closing up 0.14% at 8,447 points, as investors await cues from the U.S. markets. For those looking beyond established giants, penny stocks—though an older term—remain relevant for their potential to offer surprising value and growth opportunities. In this article, we explore three such stocks that stand out for their financial strength and resilience in today's market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$146.79M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$64.47M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.03 | A$333.78M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.54 | A$334.88M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.76 | A$101.23M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.41 | A$116.78M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.75 | A$231.32M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.65 | A$828.23M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$2.03 | A$113.04M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.87 | A$479.51M | ★★★★☆☆ |

Click here to see the full list of 1,044 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Australian Ethical Investment (ASX:AEF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$569.55 million.

Operations: The company generates revenue primarily through its Funds Management segment, which reported A$100.49 million.

Market Cap: A$569.55M

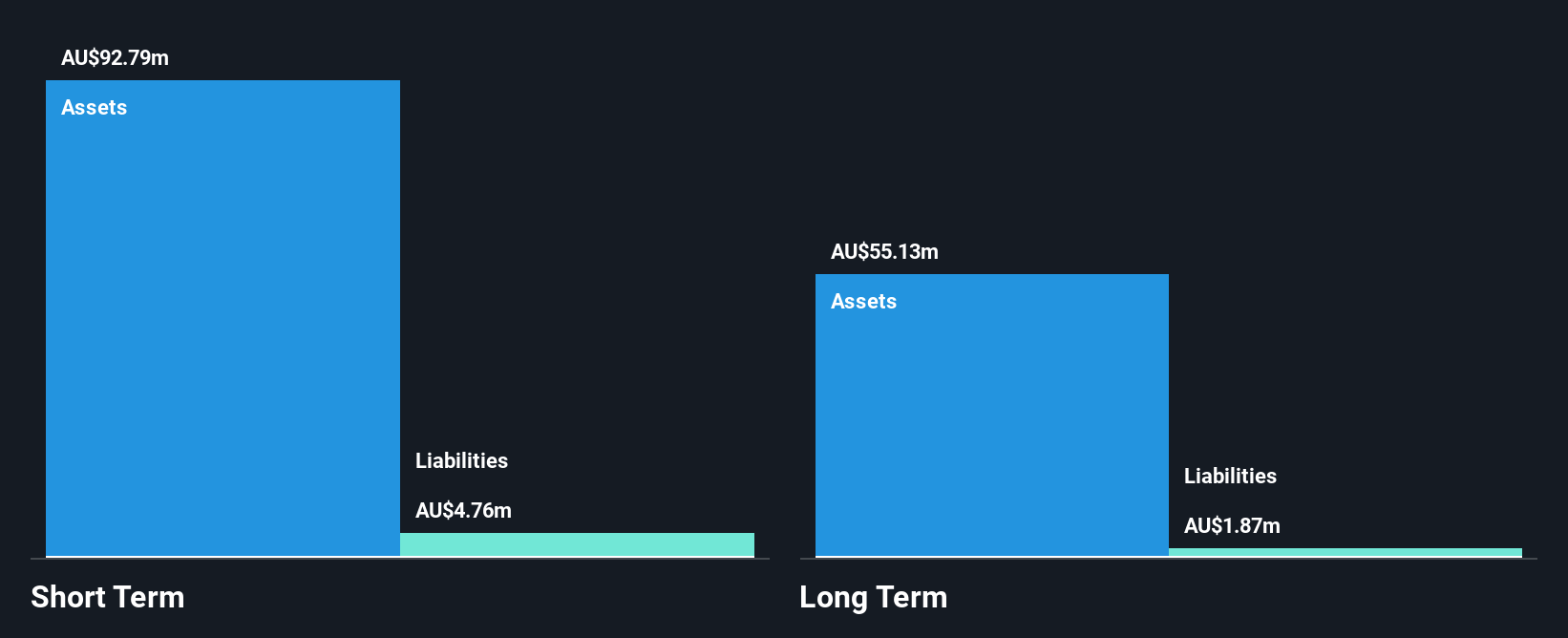

Australian Ethical Investment Ltd, with a market cap of A$569.55 million, has demonstrated significant earnings growth of 75.3% over the past year, outpacing the Capital Markets industry average. The company benefits from an experienced board and management team and maintains a high Return on Equity at 38.3%. Despite a large one-off loss impacting recent financial results, it remains debt-free with strong profit margins improving to 11.5%. Short-term assets comfortably cover both short- and long-term liabilities, suggesting solid financial health without shareholder dilution in the past year.

- Navigate through the intricacies of Australian Ethical Investment with our comprehensive balance sheet health report here.

- Gain insights into Australian Ethical Investment's historical outcomes by reviewing our past performance report.

Chalice Mining (ASX:CHN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chalice Mining Limited is a mineral exploration and evaluation company with a market capitalization of A$531.02 million.

Operations: Chalice Mining Limited has not reported any revenue segments.

Market Cap: A$531.02M

Chalice Mining Limited, with a market cap of A$531.02 million, is currently pre-revenue and unprofitable. Despite this, the company maintains a strong financial position with no debt and short-term assets of A$115.2 million covering both its short- and long-term liabilities. The management team and board are experienced, averaging over three years in tenure. While its return on equity remains negative at -24.26%, Chalice has not diluted shareholders recently and boasts a stable weekly volatility of 11%. The company also has sufficient cash runway for more than three years if current free cash flow trends continue.

- Take a closer look at Chalice Mining's potential here in our financial health report.

- Review our growth performance report to gain insights into Chalice Mining's future.

K&S (ASX:KSC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: K&S Corporation Limited operates in the transportation and logistics, warehousing, and fuel distribution sectors across Australia and New Zealand with a market cap of A$481.71 million.

Operations: The company's revenue is primarily derived from Australian Transport at A$582.80 million, Fuel at A$230.79 million, and New Zealand Transport at A$72.93 million.

Market Cap: A$481.71M

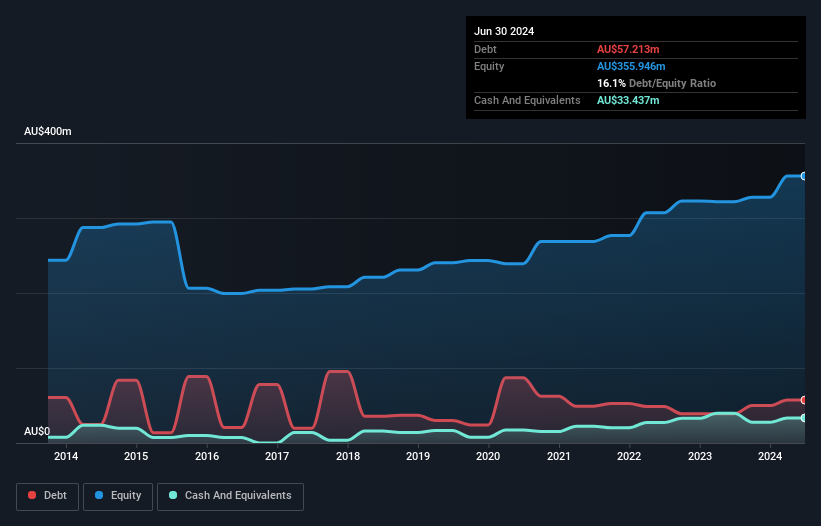

K&S Corporation Limited, with a market cap of A$481.71 million, operates in the transport and logistics sector and has demonstrated a solid financial performance. The company's earnings grew by 9.1% over the past year, outpacing the industry decline of 7%. Its debt is well covered by operating cash flow at 115%, while interest payments are comfortably managed with EBIT coverage of 10.2 times. Despite trading below estimated fair value by 11.3%, its dividend yield of 4.89% isn't fully supported by free cash flows. The management team and board are experienced, averaging over eight years in tenure, contributing to stable operations without significant shareholder dilution recently.

- Dive into the specifics of K&S here with our thorough balance sheet health report.

- Assess K&S' previous results with our detailed historical performance reports.

Key Takeaways

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 1,041 more companies for you to explore.Click here to unveil our expertly curated list of 1,044 ASX Penny Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if K&S might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KSC

K&S

Engages in the transportation and logistics, warehousing and fuel distribution businesses in Australia and New Zealand.

Proven track record with adequate balance sheet.