- Australia

- /

- Oil and Gas

- /

- ASX:OEL

Discover ASX Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

The ASX200 has experienced a modest rise, with the IT sector leading gains and Health Care lagging behind. In this context, penny stocks—though an older term—still represent an intriguing investment area for those seeking opportunities in smaller or emerging companies. By focusing on firms with solid financials and growth potential, investors can uncover promising prospects among these lesser-known stocks.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.05 | A$333.78M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.54 | A$334.88M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.83 | A$101.23M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.79 | A$231.32M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.69 | A$828.23M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$2.01 | A$113.04M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.30 | A$110.99M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.86 | A$479.51M | ★★★★☆☆ |

Click here to see the full list of 1,044 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Cogstate (ASX:CGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cogstate Limited is a neuroscience technology company focused on developing and commercializing digital brain health assessments for academic and industry-sponsored research, with a market cap of A$172.34 million.

Operations: The company's revenue is derived from two main segments: Healthcare (including Sport) generating $3.99 million and Clinical Trials (including Precision Recruitment Tool & Research) contributing $39.44 million.

Market Cap: A$172.34M

Cogstate Limited, with a market cap of A$172.34 million, has shown strong financial health and growth potential within the penny stock category. The company’s revenue is primarily driven by its Clinical Trials segment, contributing A$39.44 million, and it has demonstrated significant earnings growth of 52.8% over the past year. Cogstate's recent partnership with Medidata aims to enhance clinical trial efficiency for CNS diseases, potentially boosting its market position. Additionally, a share repurchase program reflects confidence in its valuation while maintaining stable debt levels covered by cash flow and short-term assets exceeding liabilities.

- Navigate through the intricacies of Cogstate with our comprehensive balance sheet health report here.

- Gain insights into Cogstate's future direction by reviewing our growth report.

Otto Energy (ASX:OEL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Otto Energy Limited is an oil and gas exploration, production, and sales company operating in North America with a market capitalization of A$57.54 million.

Operations: The company generates revenue primarily from its Oil & Gas - Exploration & Production segment, amounting to $20.37 million.

Market Cap: A$57.54M

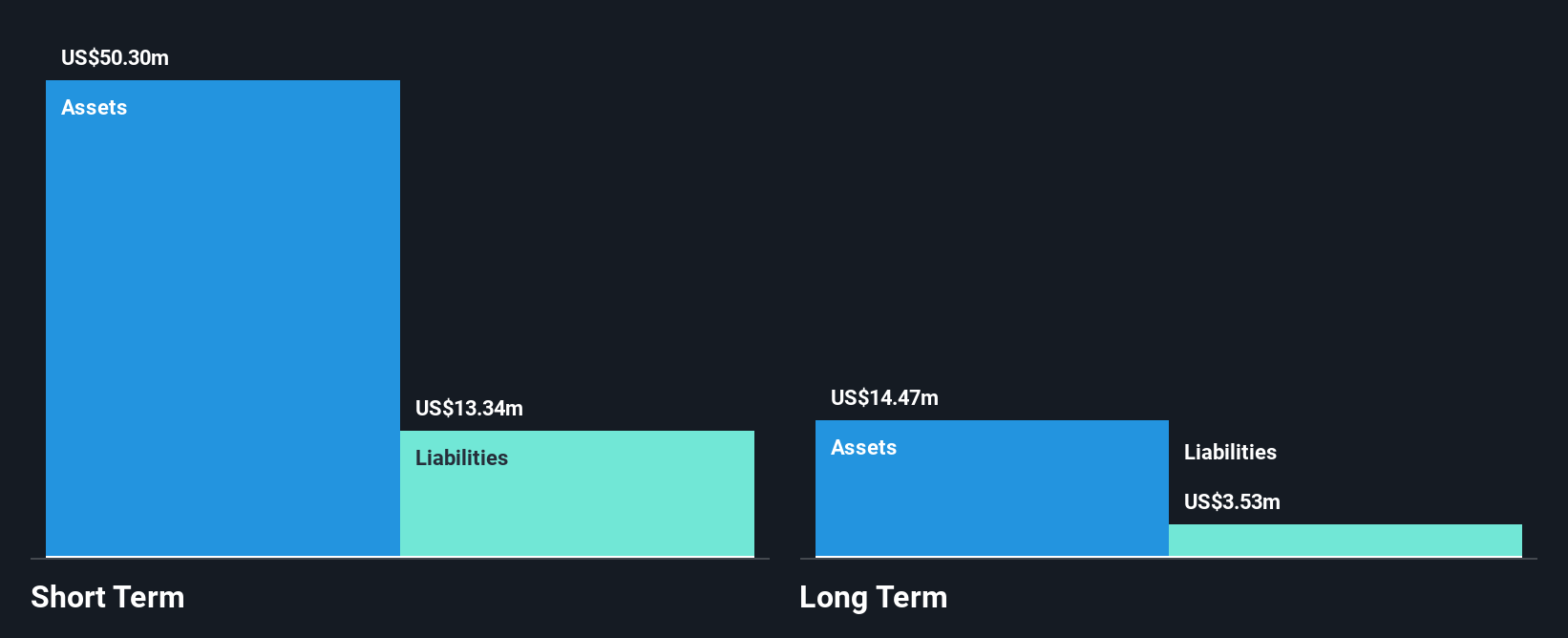

Otto Energy Limited, with a market cap of A$57.54 million, operates in oil and gas exploration and production. Despite being unprofitable, the company has managed to reduce its losses by 14.1% annually over five years and maintains a positive cash flow with a runway exceeding three years. Otto's short-term assets of US$43.1 million comfortably cover both short-term (US$2 million) and long-term liabilities (US$6.1 million). Recent leadership changes include the appointment of Justin Clyne as an Independent Non-Executive Director, potentially strengthening governance amid stable yet high weekly volatility compared to most Australian stocks.

- Unlock comprehensive insights into our analysis of Otto Energy stock in this financial health report.

- Review our historical performance report to gain insights into Otto Energy's track record.

Pro-Pac Packaging (ASX:PPG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pro-Pac Packaging Limited, along with its subsidiaries, manufactures and distributes flexible and industrial packaging products in Australia and New Zealand, with a market cap of A$7.63 million.

Operations: The company's revenue is derived from two main segments: Flexibles, contributing A$230.47 million, and Specialty, accounting for A$65.11 million.

Market Cap: A$7.63M

Pro-Pac Packaging Limited, with a market cap of A$7.63 million, operates in the packaging sector and faces significant challenges as it remains unprofitable. Despite reducing its debt to equity ratio from 77.5% to 26.6% over five years and maintaining satisfactory net debt levels at 21.9%, the company has less than a year of cash runway based on current free cash flow trends. Its short-term assets (A$127 million) exceed both short-term (A$114 million) and long-term liabilities (A$42.2 million). Recent board changes include Rupert Harrington's retirement, highlighting potential shifts in governance strategy amidst high share price volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Pro-Pac Packaging.

- Understand Pro-Pac Packaging's track record by examining our performance history report.

Taking Advantage

- Take a closer look at our ASX Penny Stocks list of 1,044 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:OEL

Otto Energy

Operates as an oil and gas exploration, production, and sales company in North America.

Flawless balance sheet and good value.