- Australia

- /

- Metals and Mining

- /

- ASX:BSL

A Look at BlueScope Steel (ASX:BSL) Valuation After Earnings Forecast Disappoints and Costs Rise

Reviewed by Simply Wall St

BlueScope Steel (ASX:BSL) shares dropped after management told investors to expect first-half underlying earnings near the lower end of earlier guidance. The company cited increased costs and softer pricing in its key markets.

See our latest analysis for BlueScope Steel.

Despite today’s sharp move, BlueScope Steel’s 1-day share price return of 2.3% only partially offsets recent volatility, as the stock still remains down over the past three months. Looking long-term, total shareholder returns of 10.9% for the past year and 48% over five years underscore its resilience, even through industry headwinds and recent leadership changes. Momentum has faded slightly from earlier this year, but many investors will be watching to see if the next earnings update revives optimism around the company’s growth and sustainability strategy.

If the steel sector’s twists and turns have you thinking big picture, it might be time to broaden your search and discover fast growing stocks with high insider ownership

With BlueScope shares now trading close to a 10% discount to average analyst price targets, the key question is whether recent weakness creates a genuine buying window or if the market is already factoring in growth challenges ahead.

Most Popular Narrative: 9% Undervalued

BlueScope Steel’s most widely followed valuation narrative suggests the shares are trading below consensus fair value, with the latest close at A$22.61 versus an estimated A$24.83 fair value. Here is why some market-watchers see a supportive outlook at current levels.

The increasing transition toward renewable energy, requiring extensive steel inputs for wind, solar, and grid infrastructure, presents growth opportunities for BlueScope. Their large landbank, active engagement with energy operators (for example, battery storage lease at Glenbrook), and stated intent to secure new project supply agreements are likely to provide incremental and recurring revenue streams.

What is the real driver of this upbeat valuation? The narrative hinges on game-changing growth in new markets and ambitious margin expansion, all layered onto a forecast for sharply rising profits. Wondering what bold bets and surprising forecasts fuel this optimism? Get the full story inside the complete narrative.

Result: Fair Value of $24.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising energy costs in Australia and persistent underperformance in BlueScope’s U.S. operations remain critical risks that could undermine the positive outlook.

Find out about the key risks to this BlueScope Steel narrative.

Another View: Market Multiples Tell a Different Story

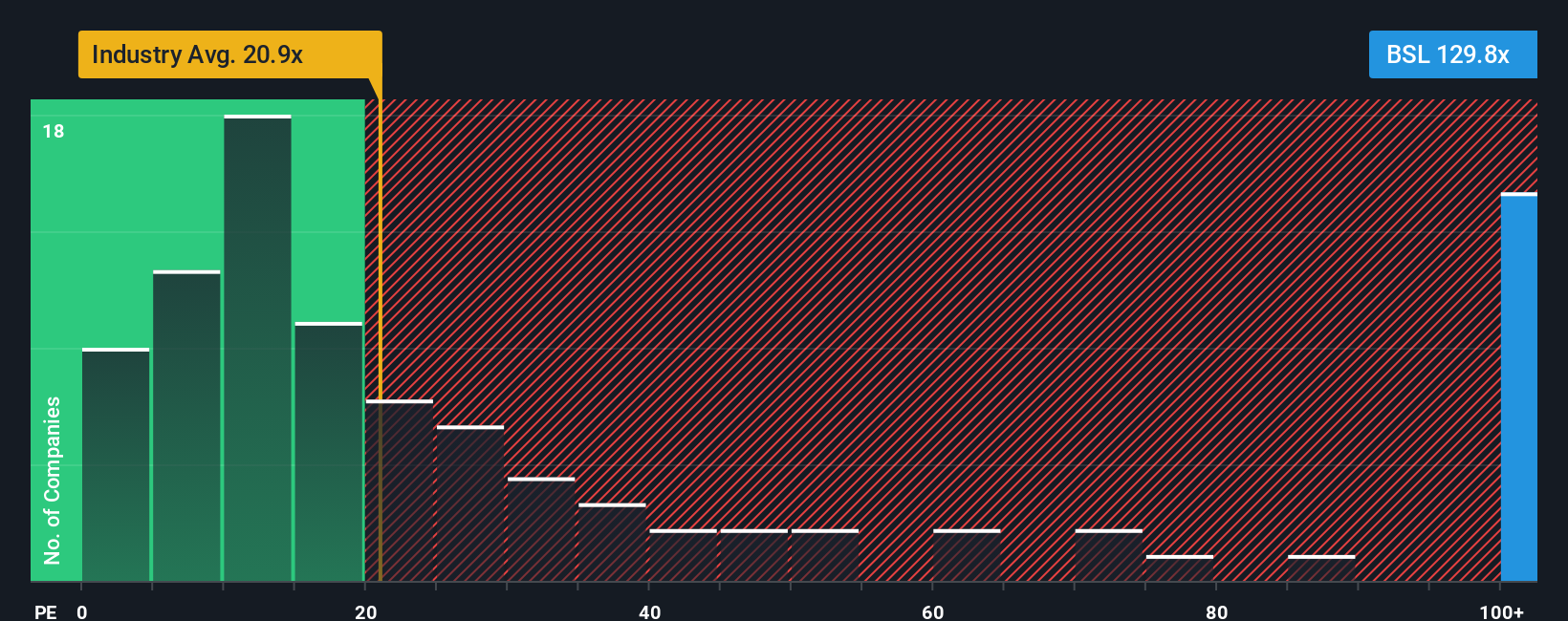

Taking a look at standard valuation multiples, BlueScope Steel trades at a hefty 133.6 times earnings, which is much higher than the Australian Metals and Mining industry average of 20.3x and its fair ratio of 27.9x. This gap suggests the market is attaching a premium and raises questions about future valuation risk if high expectations do not materialize. Are investors betting too much on a turnaround, or is the long-term upside still underappreciated?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BlueScope Steel Narrative

If the story so far does not fit your perspective, or if you would rather dive into the data and shape your own outlook, you can easily create a custom analysis in under three minutes. Do it your way

A great starting point for your BlueScope Steel research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Standout Investment Ideas?

Keep your edge in today’s market by tapping into three timely themes. Act now so you do not miss tomorrow’s high-potential opportunities!

- Uncover the income advantage with these 18 dividend stocks with yields > 3%, featuring stocks offering yields above 3% for robust passive returns.

- Embrace the future of medicine by seeking out progress in artificial intelligence with these 31 healthcare AI stocks, connecting you to companies redefining healthcare innovation.

- Capitalize on rapidly growing digital finance by tracking these 81 cryptocurrency and blockchain stocks. Blockchain and cryptocurrency stocks are rewriting the rules for investors worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlueScope Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BSL

BlueScope Steel

Engages in the production and marketing of metal-coated and painted steel building products in Australia, New Zealand, Asia, and North America.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives