Richard Tacon has been the CEO of Bathurst Resources Limited (ASX:BRL) since 2015, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Bathurst Resources.

View our latest analysis for Bathurst Resources

How Does Total Compensation For Richard Tacon Compare With Other Companies In The Industry?

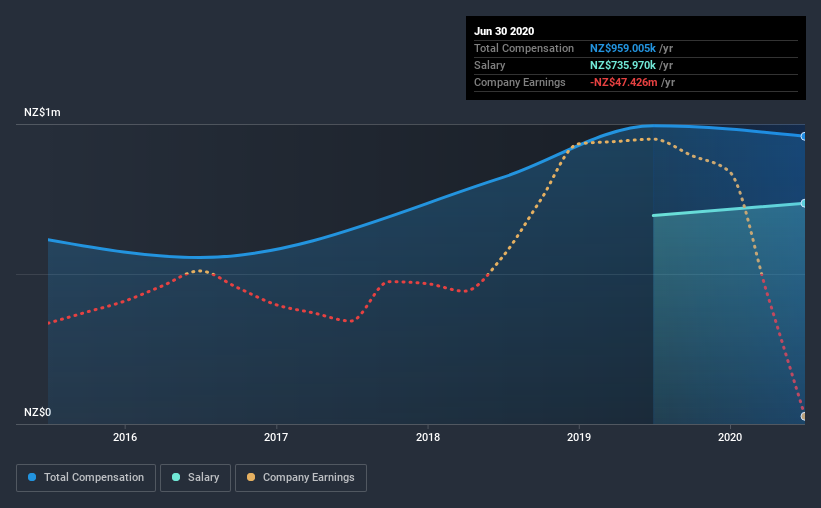

Our data indicates that Bathurst Resources Limited has a market capitalization of AU$64m, and total annual CEO compensation was reported as NZ$959k for the year to June 2020. We note that's a small decrease of 3.6% on last year. In particular, the salary of NZ$736.0k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below AU$272m, we found that the median total CEO compensation was NZ$327k. Accordingly, our analysis reveals that Bathurst Resources Limited pays Richard Tacon north of the industry median. What's more, Richard Tacon holds AU$640k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | NZ$736k | NZ$695k | 77% |

| Other | NZ$223k | NZ$299k | 23% |

| Total Compensation | NZ$959k | NZ$994k | 100% |

On an industry level, roughly 70% of total compensation represents salary and 30% is other remuneration. According to our research, Bathurst Resources has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Bathurst Resources Limited's Growth

Bathurst Resources Limited's earnings per share (EPS) grew 22% per year over the last three years. In the last year, its revenue is down 11%.

Shareholders would be glad to know that the company has improved itself over the last few years. While it would be good to see revenue growth, profits matter more in the end. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Bathurst Resources Limited Been A Good Investment?

With a three year total loss of 68% for the shareholders, Bathurst Resources Limited would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As previously discussed, Richard is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. However, we must not forget that the EPS growth has been very strong, but we cannot say the same about the uninspiring shareholder returns (over the last three years). Although we don't think the CEO pay is too high, considering negative investor returns, it is more generous than modest.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 2 warning signs (and 1 which is a bit unpleasant) in Bathurst Resources we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Bathurst Resources, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bathurst Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:BRL

Bathurst Resources

Engages in the exploration, development, and production of bituminous and coking coal in New Zealand and Canada.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion