- Australia

- /

- Metals and Mining

- /

- ASX:BIS

Discover 3 ASX Penny Stocks With Market Caps Over A$100M

Reviewed by Simply Wall St

Australian shares are set to close out the first half of the trading year on a positive note, buoyed by Wall Street's momentum towards all-time highs and a revitalized IPO market. Amid this optimism, investors are turning their attention to penny stocks—a term that may seem outdated but continues to signify potential growth opportunities at lower price points. These smaller or newer companies can offer significant upside when they possess strong financials and fundamentals, making them an intriguing option for those looking beyond the larger market players.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.37 | A$106.04M | ✅ 3 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.30 | A$108.5M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.65 | A$123.97M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.85 | A$439.42M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.79 | A$473.29M | ✅ 4 ⚠️ 1 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$352.8M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$833.14M | ✅ 5 ⚠️ 3 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.72 | A$228.41M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.77 | A$178.89M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.775 | A$142.97M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 473 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Bisalloy Steel Group (ASX:BIS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bisalloy Steel Group Limited manufactures and sells quenched and tempered, high-tensile, and abrasion-resistant steel plates in Australia, Indonesia, Thailand, and internationally with a market cap of A$178.89 million.

Operations: The company generates revenue primarily from its operations in Australia, amounting to A$103.30 million.

Market Cap: A$178.89M

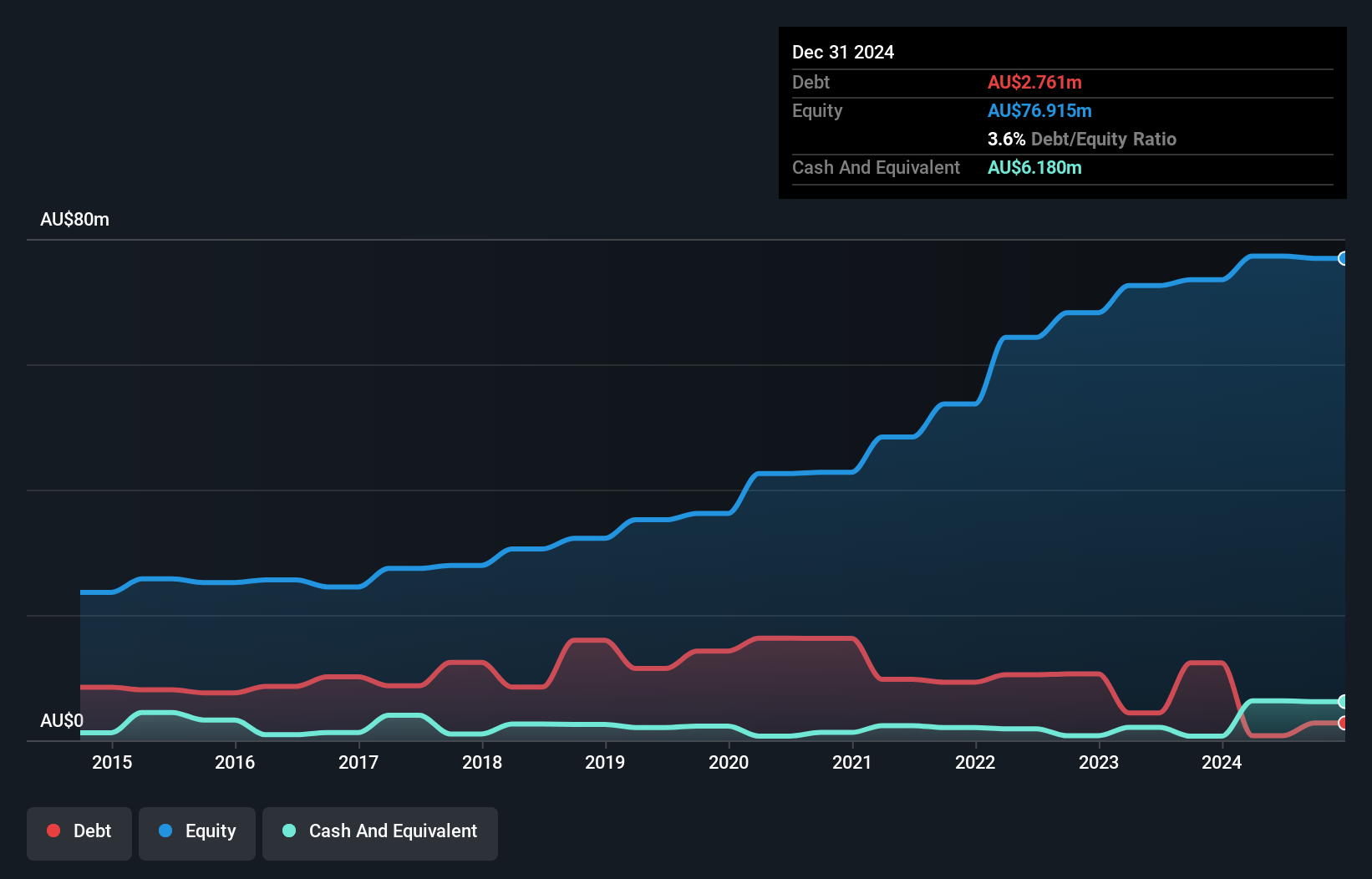

Bisalloy Steel Group, with a market cap of A$178.89 million, demonstrates financial stability and growth potential in the penny stock segment. Its short-term assets of A$88.7 million comfortably cover both short-term (A$44.6M) and long-term liabilities (A$7.1M), while having more cash than total debt enhances its financial health. The company's earnings have grown 19.3% annually over five years, supported by high-quality earnings and a robust return on equity of 21.7%. Despite a slightly slower recent growth rate of 14%, Bisalloy remains well-positioned with stable weekly volatility and no significant shareholder dilution recently observed.

- Jump into the full analysis health report here for a deeper understanding of Bisalloy Steel Group.

- Evaluate Bisalloy Steel Group's prospects by accessing our earnings growth report.

Botanix Pharmaceuticals (ASX:BOT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Botanix Pharmaceuticals Limited focuses on the research and development of dermatology and antimicrobial products in Australia and the United States, with a market cap of A$617.67 million.

Operations: The company generates revenue of A$2.07 million from its research and development activities in dermatology and antimicrobial products.

Market Cap: A$617.67M

Botanix Pharmaceuticals, with a market cap of A$617.67 million, is navigating the penny stock landscape with strategic financial maneuvers despite being pre-revenue. Recent capital influxes include a A$48 million loan facility from Kreos Capital and a completed A$40 million equity offering. These funds bolster its cash runway beyond previous estimates of 10 months, addressing short-term liabilities comfortably covered by assets worth A$67.8 million. However, the company remains unprofitable with increasing losses over five years and negative return on equity at -42.48%. Management changes indicate an evolving leadership team as it seeks to leverage dermatology and antimicrobial research advancements.

- Click here to discover the nuances of Botanix Pharmaceuticals with our detailed analytical financial health report.

- Explore Botanix Pharmaceuticals' analyst forecasts in our growth report.

Champion Iron (ASX:CIA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Champion Iron Limited is involved in the acquisition, exploration, development, and production of iron ore properties in Canada, with a market cap of A$2.28 billion.

Operations: The company generates revenue primarily from its Iron Ore Concentrate segment, totaling CA$1.61 billion.

Market Cap: A$2.28B

Champion Iron's recent performance reflects both opportunities and challenges within the penny stock sphere. The company reported CA$1.61 billion in revenue for the year ending March 2025, yet net income declined to CA$142.05 million from CA$234.19 million a year prior, with profit margins dropping to 8.8%. Despite a high net debt-to-equity ratio of 41.1%, its debt is well-covered by operating cash flow at 43%, and interest payments are adequately managed with an EBIT coverage of 11.7 times. While trading below estimated fair value, dividend sustainability remains questionable due to insufficient free cash flow coverage.

- Click here and access our complete financial health analysis report to understand the dynamics of Champion Iron.

- Gain insights into Champion Iron's outlook and expected performance with our report on the company's earnings estimates.

Make It Happen

- Dive into all 473 of the ASX Penny Stocks we have identified here.

- Curious About Other Options? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bisalloy Steel Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BIS

Bisalloy Steel Group

Engages in the manufacture and sale of quenched and tempered, high-tensile, and abrasion resistant steel plates in Australia, Indonesia, Thailand, and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives