- Australia

- /

- Metals and Mining

- /

- ASX:BHP

The Bull Case For BHP Group (ASX:BHP) Could Change Following New Production Guidance and South Flank Focus

Reviewed by Sasha Jovanovic

- BHP Group Limited recently announced quarterly production results, reporting 493,600 tonnes of copper and 64.1 million tonnes of iron ore for the period ending September 30, 2025, and issued guidance for fiscal 2026 targeting up to 2 million tonnes of copper and 269 million tonnes of iron ore.

- The company has also confirmed a shift in iron ore operations to focus on South Flank, following a US-Australia agreement that highlighted BHP's position in supplying essential minerals amid rising copper prices and industry demand.

- We'll examine how BHP's sharpened operational focus and role in critical minerals may reshape the company's investment outlook and risk profile.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

BHP Group Investment Narrative Recap

To own BHP Group stock, an investor needs to believe in the world’s long-term reliance on critical minerals like copper and iron ore and BHP’s ability to supply them efficiently. While the company’s latest quarterly results and operational shift toward South Flank reinforce its commitment to maintaining production guidance, they do not significantly alter the current primary catalyst: rising copper demand. The main risk, BHP’s exposure to iron ore pricing and Chinese demand, remains material and largely unchanged by this news. Among recent developments, BHP’s confirmation of unchanged 2026 iron ore guidance despite scaling back the Yandi mine is most relevant. This underlines management’s focus on operational efficiency and cost control in the face of market volatility, with the South Flank project at the center of sustaining volume targets. Investors watching for near-term growth catalysts will continue to track production reliability and cost discipline, especially in Western Australia. On the other hand, future stability could be challenged if demand in China shifts suddenly or iron ore competition intensifies, which investors should be aware of...

Read the full narrative on BHP Group (it's free!)

BHP Group is forecast to generate $49.6 billion in revenue and $10.0 billion in earnings by 2028. This outlook assumes a yearly revenue decline of 1.1% and a $1.0 billion increase in earnings from the current $9.0 billion.

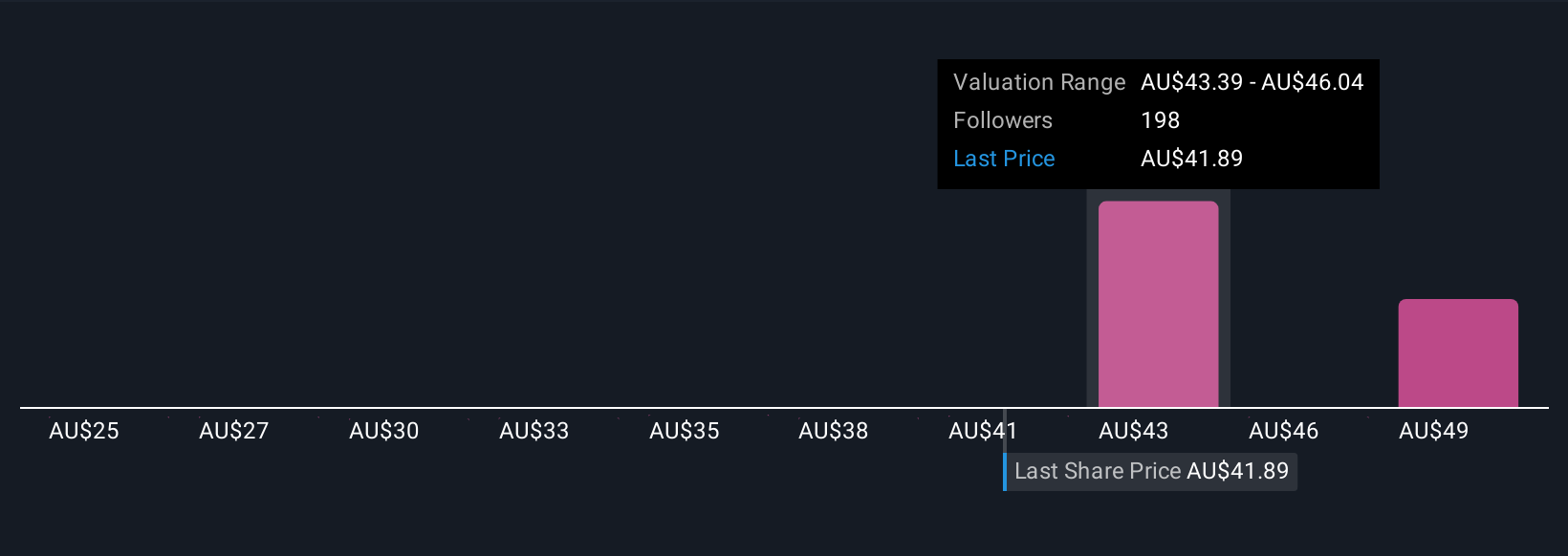

Uncover how BHP Group's forecasts yield a A$44.42 fair value, in line with its current price.

Exploring Other Perspectives

Nineteen fair value estimates from the Simply Wall St Community range from A$28.20 to A$51.13 per share. With current catalysts centered on global copper demand, this diversity highlights how opinions can differ widely on BHP’s outlook, see how your view stacks up.

Explore 19 other fair value estimates on BHP Group - why the stock might be worth as much as 18% more than the current price!

Build Your Own BHP Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BHP Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BHP Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BHP Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BHP Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BHP

BHP Group

Operates as a resources company in Australia, Europe, China, Japan, India, South Korea, rest of Asia, North America, South America, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives