- Australia

- /

- Metals and Mining

- /

- ASX:BHM

A Look at Broken Hill Mines (ASX:BHM) Valuation Following $25m Hartree Financing and Offtake Deal

Reviewed by Kshitija Bhandaru

Broken Hill Mines (ASX:BHM) has secured a US$25 million Offtake Financing Facility with Hartree Metals LLC to support growth at its Rasp and Pinnacles mines. The four-year arrangement includes Hartree buying 200,000 tons of silver-lead concentrate, which signals greater confidence in the company’s production capacity and access to global markets.

See our latest analysis for Broken Hill Mines.

While Broken Hill Mines’ announcement has turned heads, it comes as the share price has slowly edged higher this year, with a 0.94% year-to-date share price return. Momentum seems to be building, reflecting renewed optimism around future production and this strategic financing tie-up.

If you’re interested in discovering other companies with strong growth trends and notable insider backing, broaden your search with our fast growing stocks with high insider ownership.

With recent gains and a major strategic deal now in place, the question for investors is whether Broken Hill Mines is still undervalued or if the market has already priced in expectations for future growth.

Price-to-Earnings of 76.8x: Is it justified?

Broken Hill Mines is currently trading at a price-to-earnings ratio of 76.8x. This stands out when set against its last closing price of A$0.91 and raises major questions about whether the market is pricing in exceptional future growth or simply overestimating its prospects.

The price-to-earnings (P/E) multiple tells us how much investors are willing to pay for each dollar of earnings. In sectors like metals and mining, the P/E is often used to benchmark profit expectations since commodity cycles can create volatile earnings.

BHM’s P/E of 76.8x is not just high in absolute terms; it is significantly above both the Australian Metals and Mining industry average (22.1x) and its peer group (17x). This disparity suggests investors have extremely high profit growth expectations or could be overlooking financial risks revealed in the company’s recent performance. Without a clear track record of sustained, high-quality earnings, such a premium looks difficult to justify.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 76.8x (OVERVALUED)

However, persistent earnings volatility or weaker-than-expected mine production could challenge the bullish outlook and prompt investors to reassess the situation.

Find out about the key risks to this Broken Hill Mines narrative.

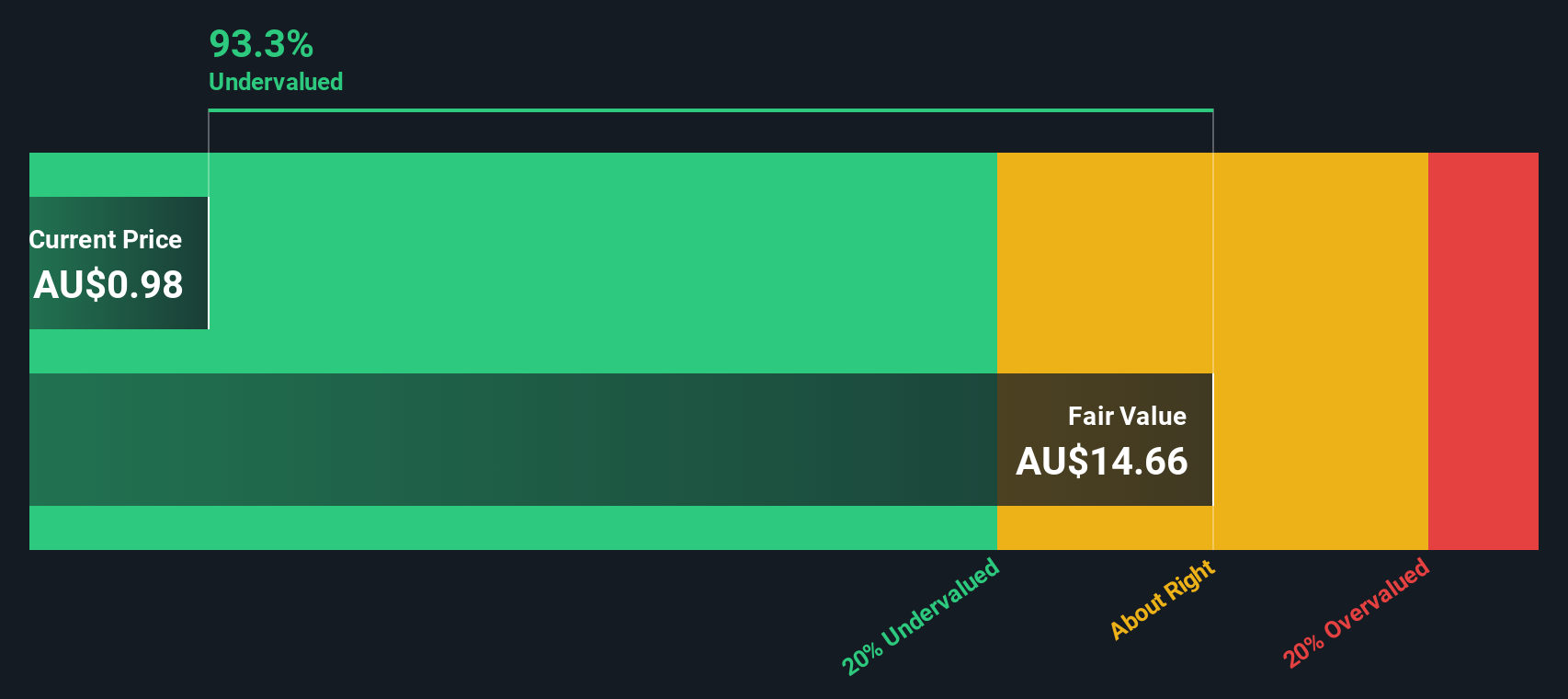

Another View: Deep Discount Using DCF

Yet, when using our DCF model from a different perspective, a starkly different picture emerges. Broken Hill Mines is trading nearly 94% below its estimated fair value of A$14.83, based on discounted cash flows. The market’s skepticism is clear: does this signal a hidden bargain, or are critical risks being ignored?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Broken Hill Mines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Broken Hill Mines Narrative

If you see things differently or want to uncover your own angle on the numbers, crafting your personal take is fast and straightforward. Do it your way.

A great starting point for your Broken Hill Mines research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know the best opportunities go fast. Instead of watching from the sidelines, get ahead by searching for your next winning stock using these powerful tools:

- Capitalize on growing income streams and uncover regular payouts by reviewing these 19 dividend stocks with yields > 3% with yields above 3%.

- Spot up-and-coming innovators shaking up the tech world by scanning these 24 AI penny stocks with real artificial intelligence breakthroughs.

- Secure value for your portfolio and target tomorrow’s winners among these 910 undervalued stocks based on cash flows highlighted for their strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broken Hill Mines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BHM

Broken Hill Mines

Engages in the exploration and mining activities in Australia.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026